First Class Tips About Bad Debts In Trial Balance

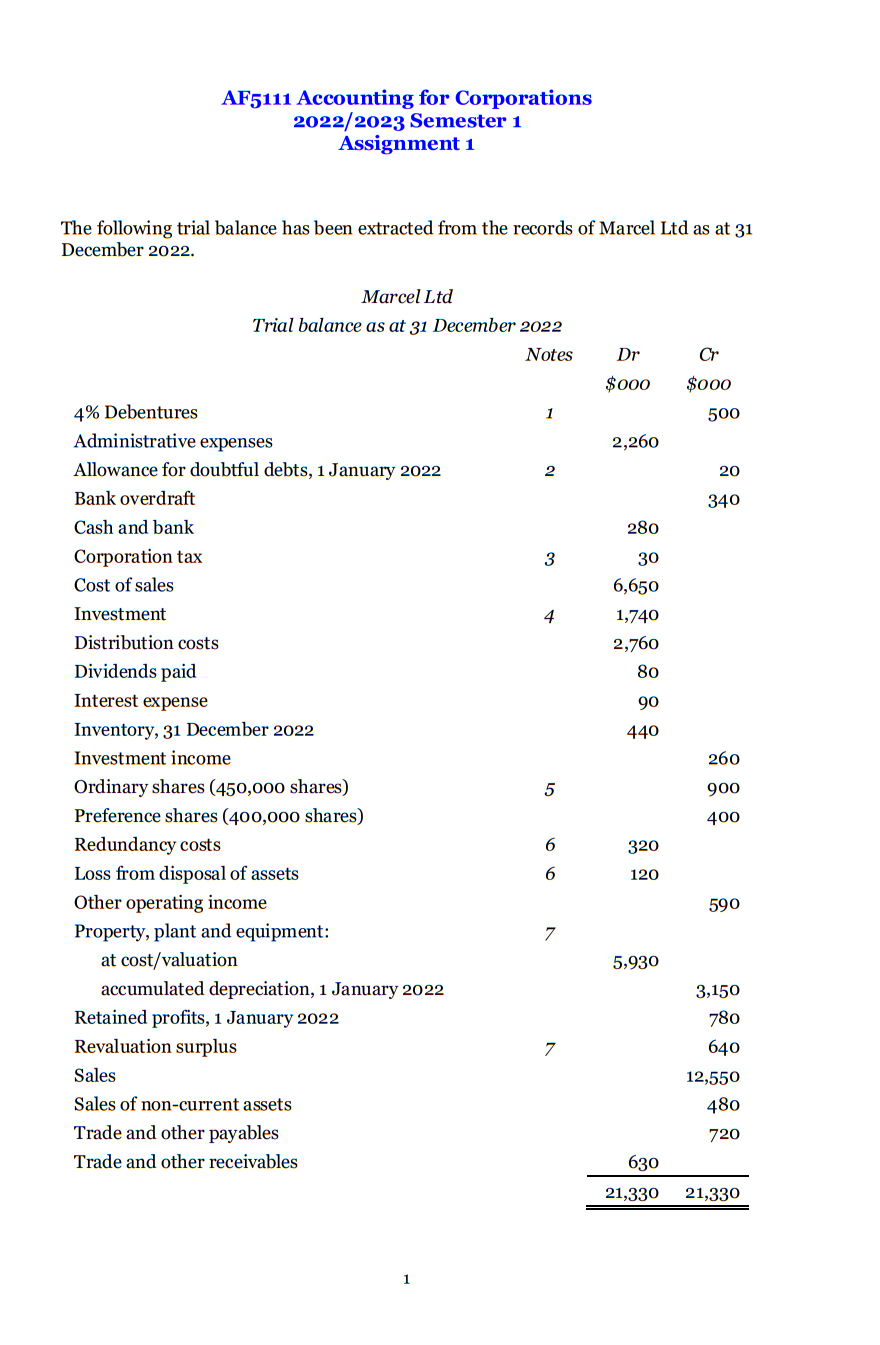

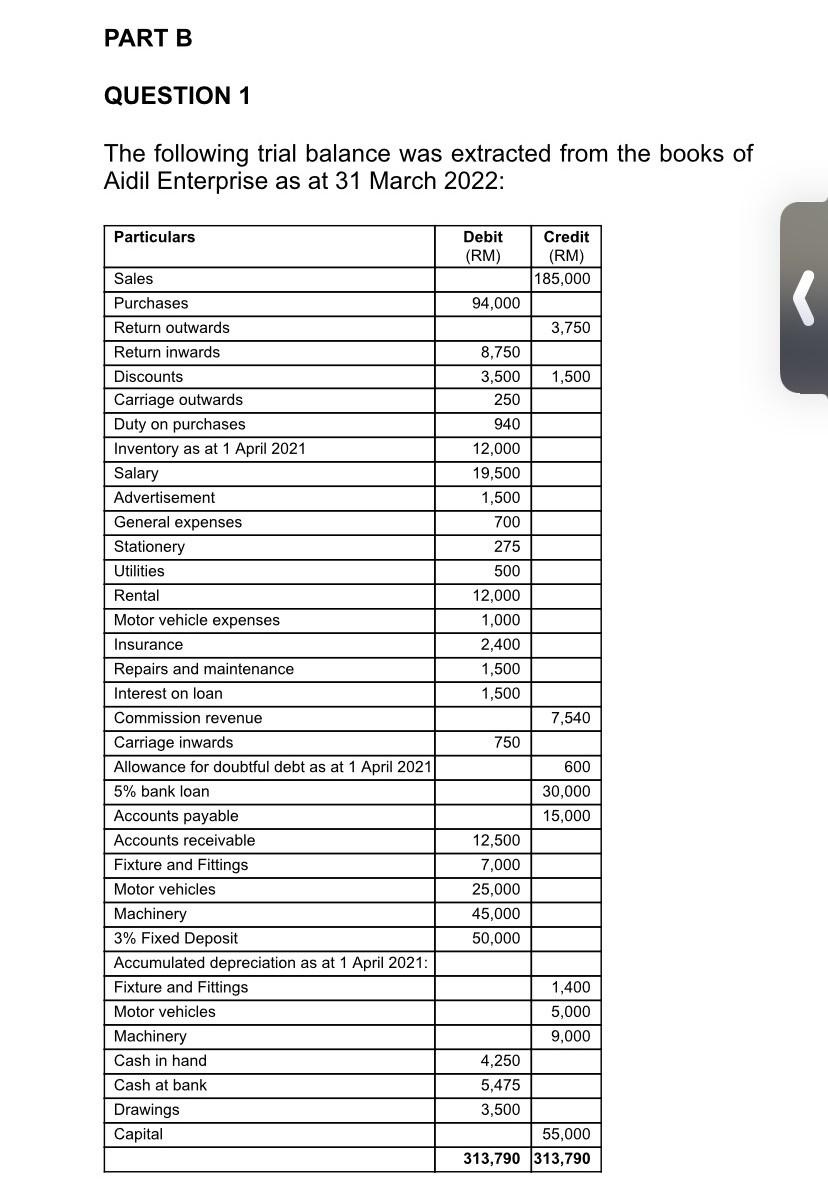

This article explains how to treat the main possible post trial balance adjustments, including:

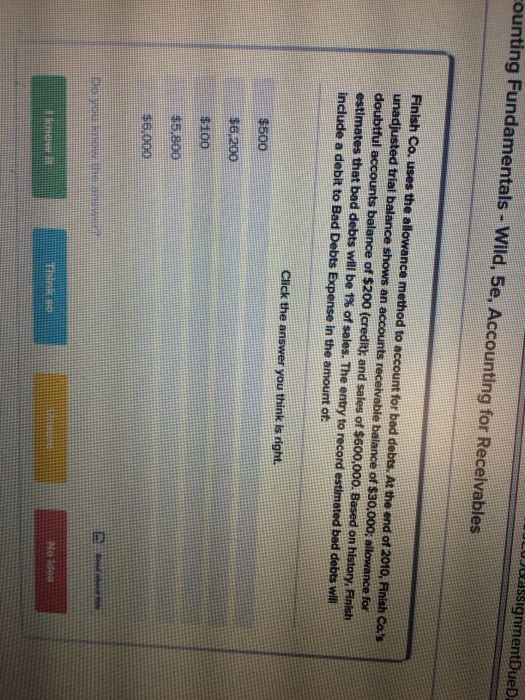

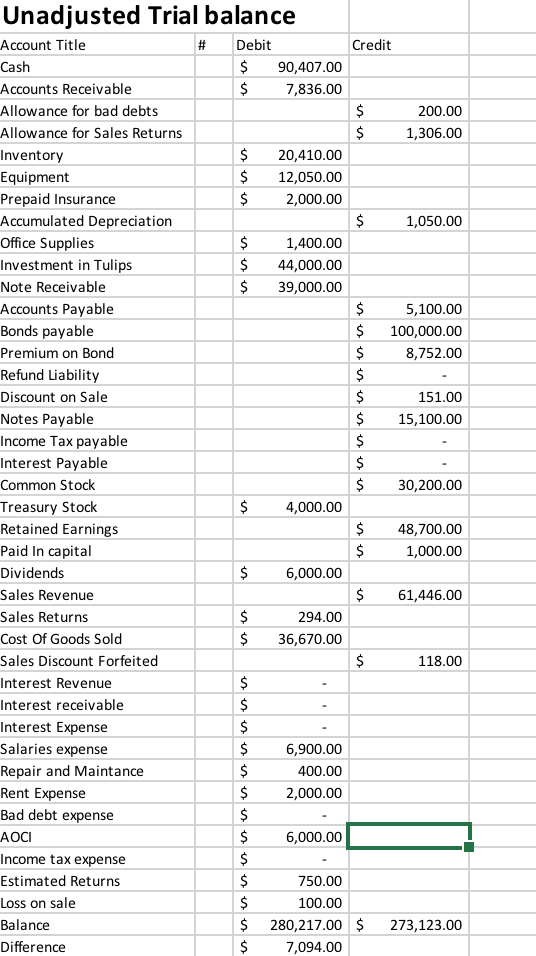

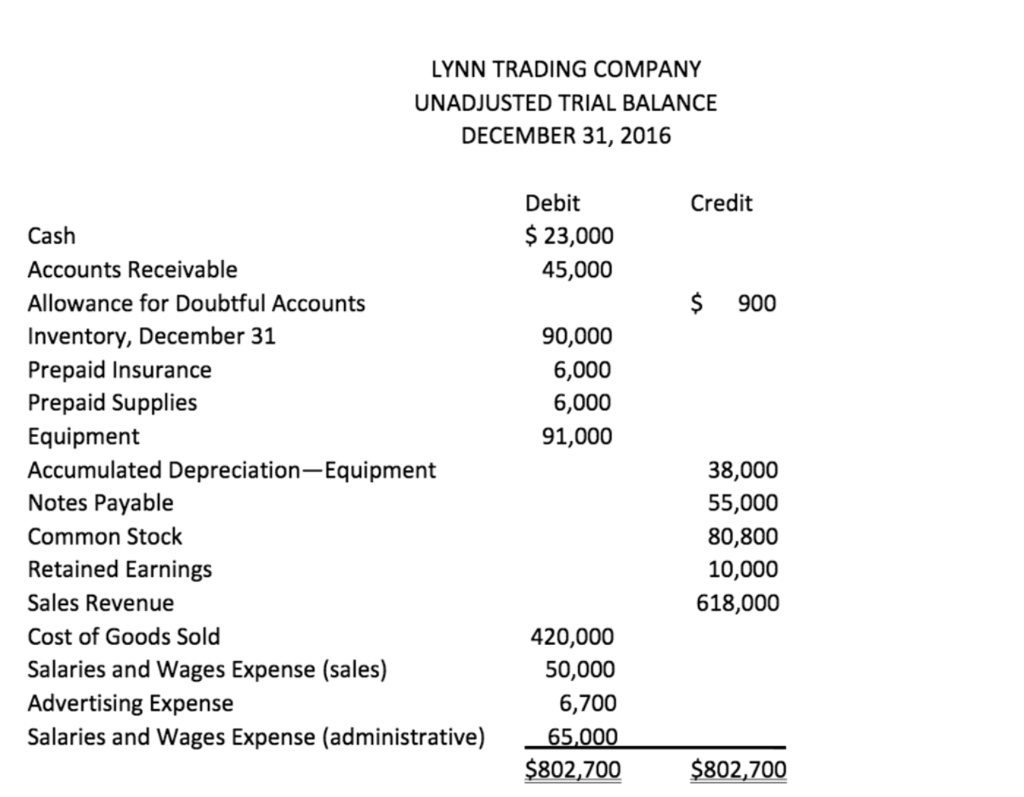

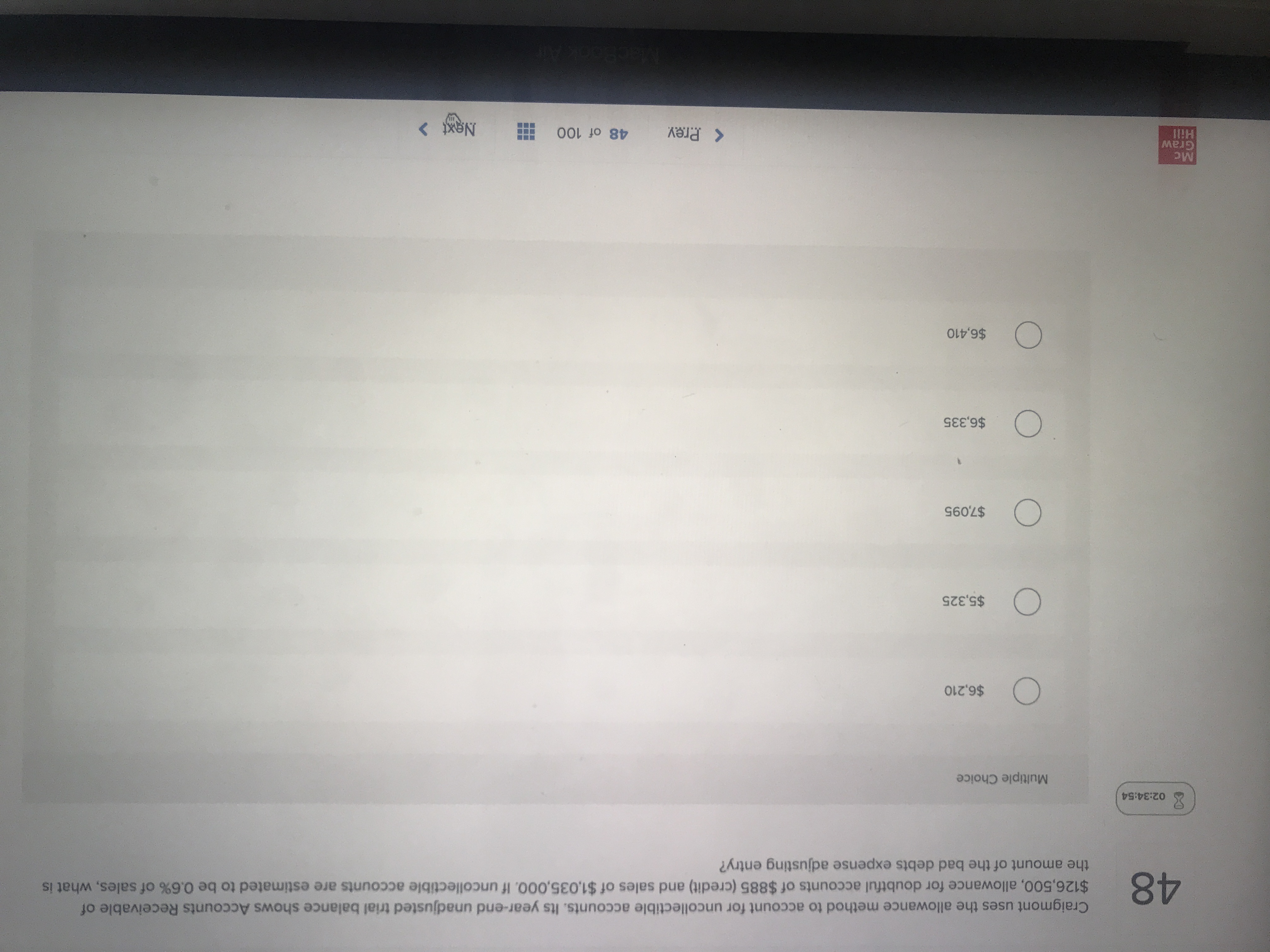

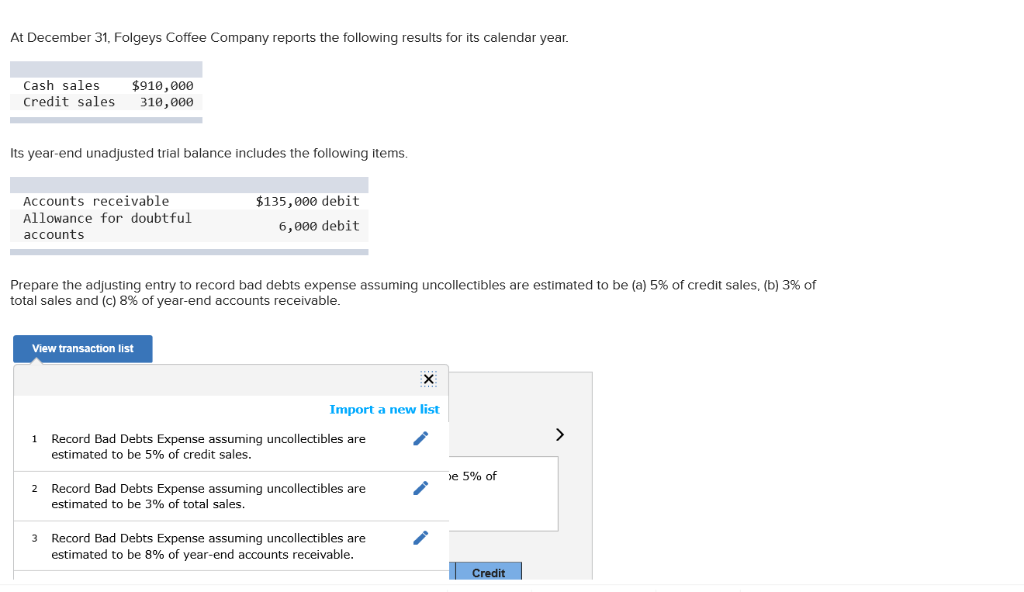

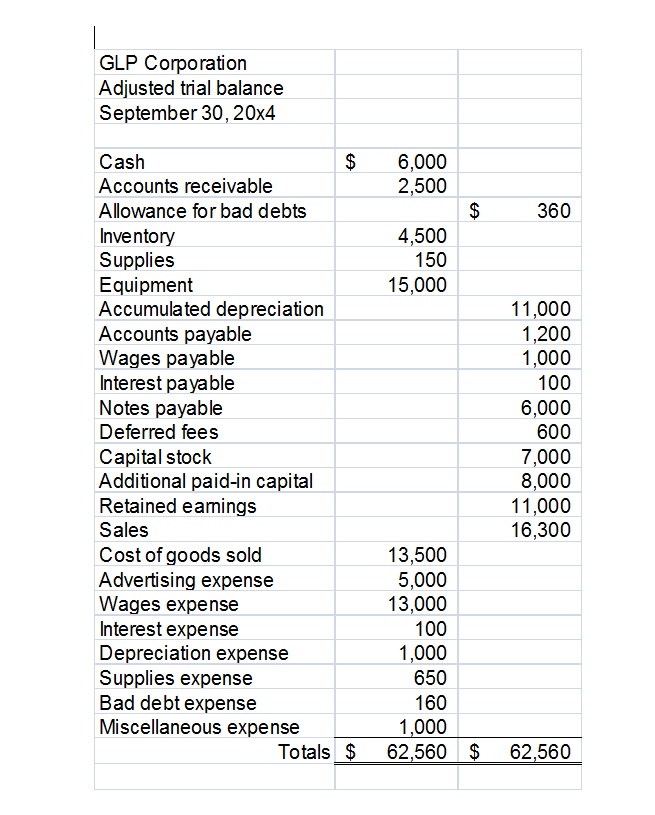

Bad debts in trial balance. For example, if you determine that the final debit balance is $24,000 then the final credit balance in the trial balance must also be $24,000. It typically has four columns with the following descriptions: Bad debt negatively affects accounts receivable (see figure 3.22).

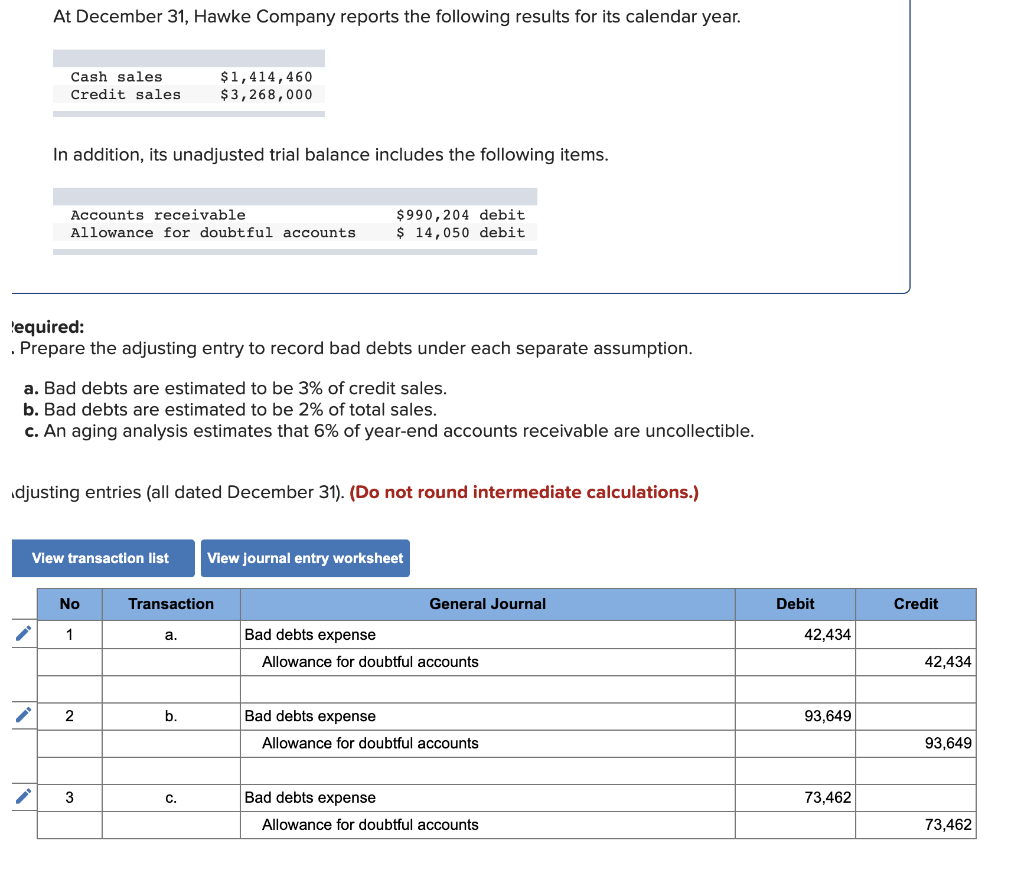

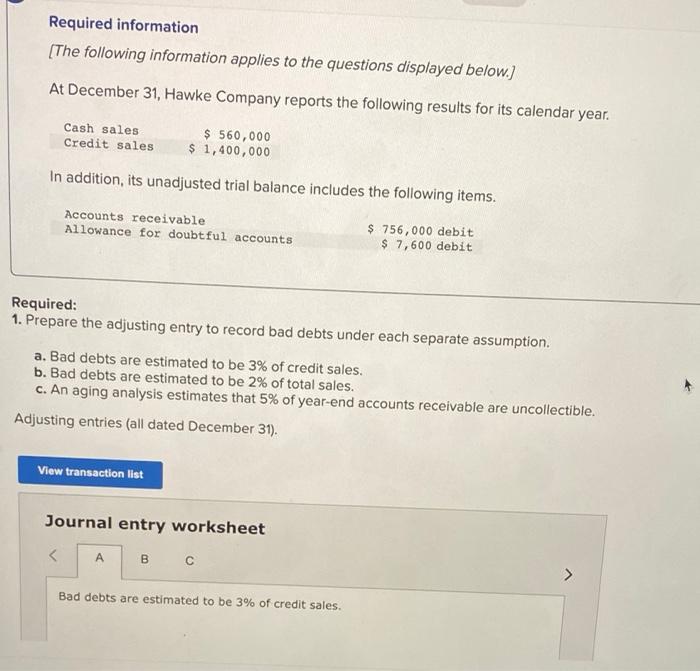

If the total debits equal the total credits,. It means the amount of sundry debtors in the trial balance is before the deduction of bad debts. If bad debts are given inside the trial balance:

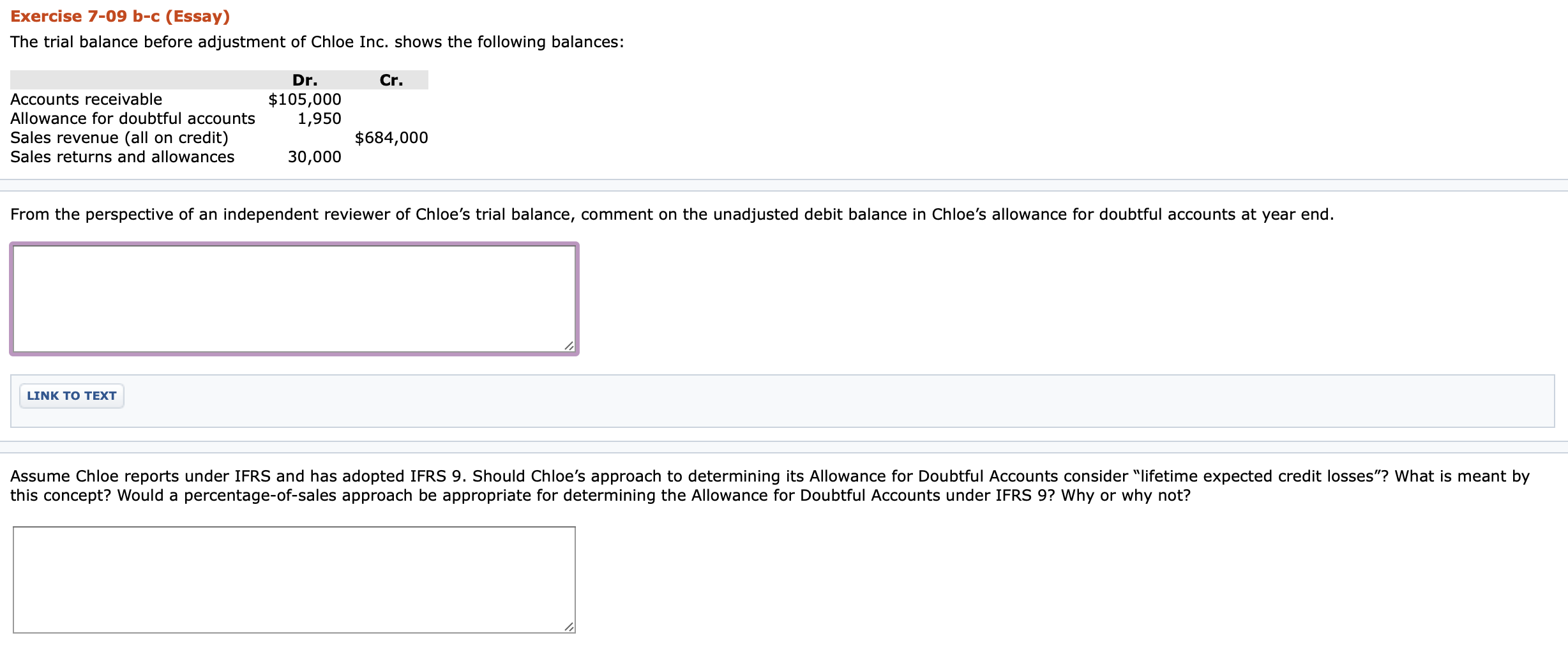

A trial balance is a list of the. The trial balance format is easy to read because of its clean layout. It is not known by many that provision for doubtful debts can appear in the trial.

It is directly transferred to profit and loss account debit side, considering as a loss to the business. The trial balance can tell you if you've mistyped an entry, forgotten half of a double entry, or incorrectly balanced an account. The ban on applying for loans from banks registered or chartered in new york could severely restrict trump's ability to raise cash.

Losses (inward returns, bad debts, depreciation, debits to p&l a/c, etc.) purchases. If the two balances are not equal,. Bad debt is the term used for any loans or outstanding balances that a business deems uncollectible.

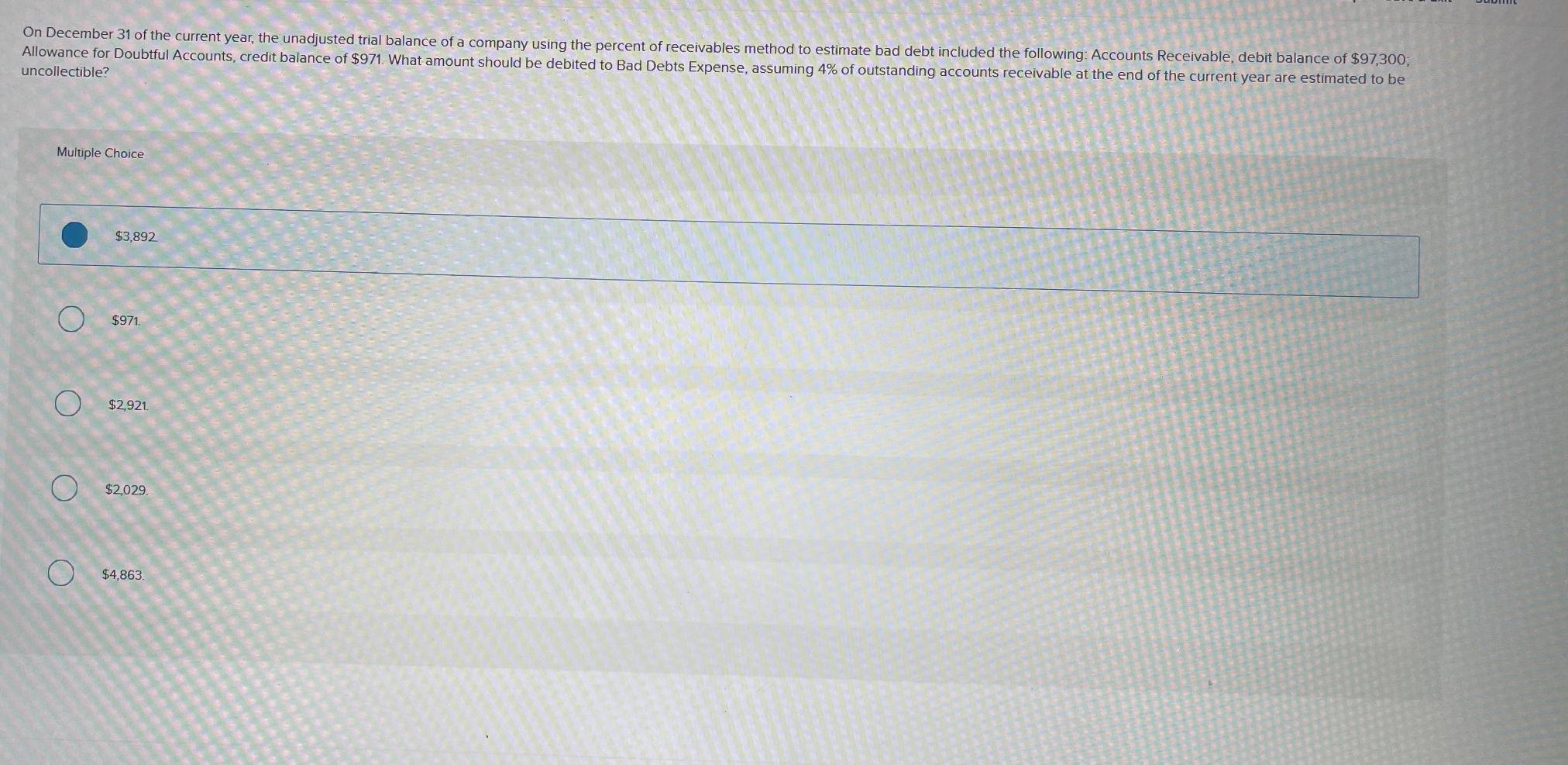

Generally capital, revenue and liabilities have credit balance so they are. In addition to the $355 million penalty — payback of what the judge. If the company's accounts receivable amounts to $3,400 and its allowance for bad debts is.

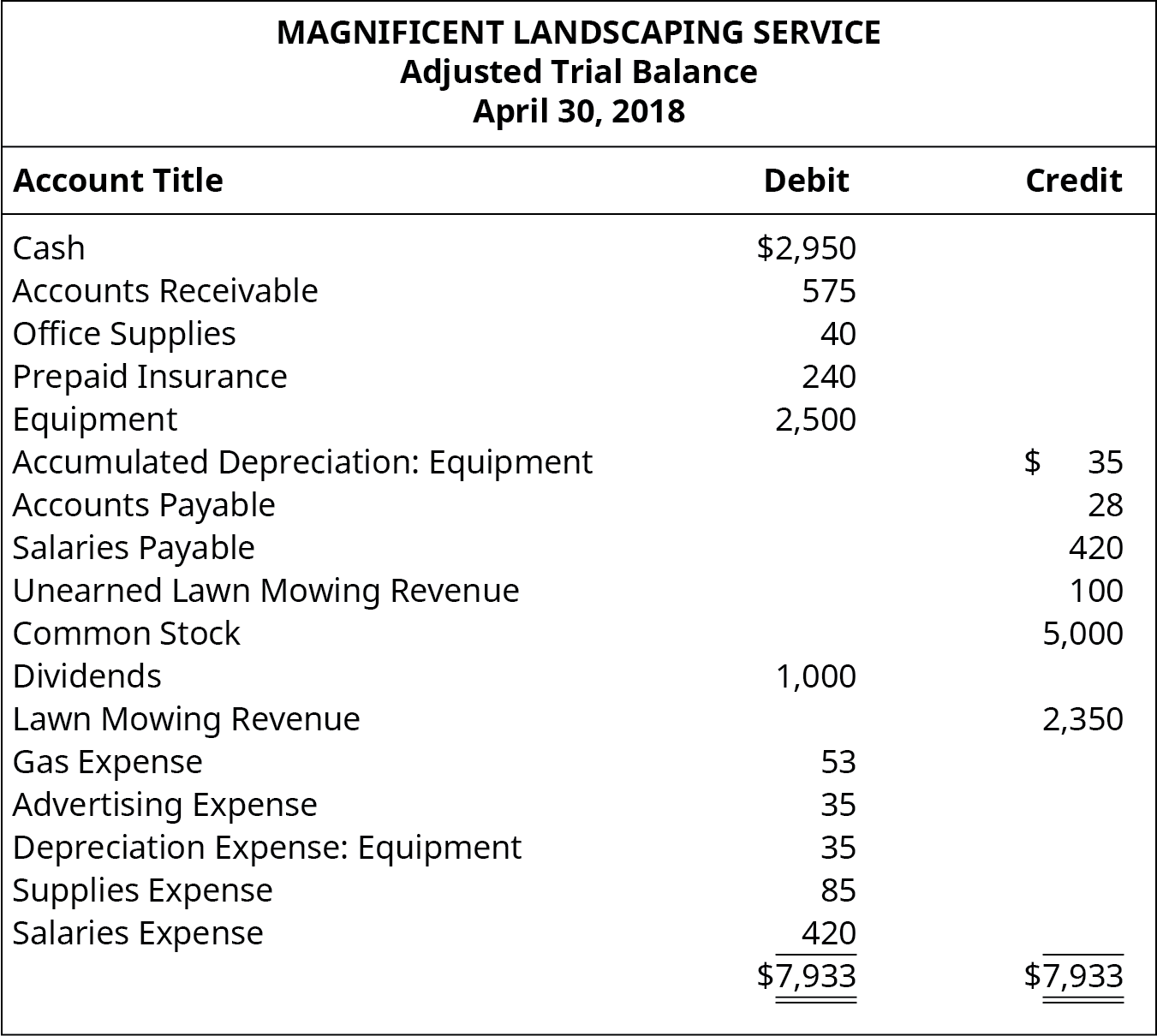

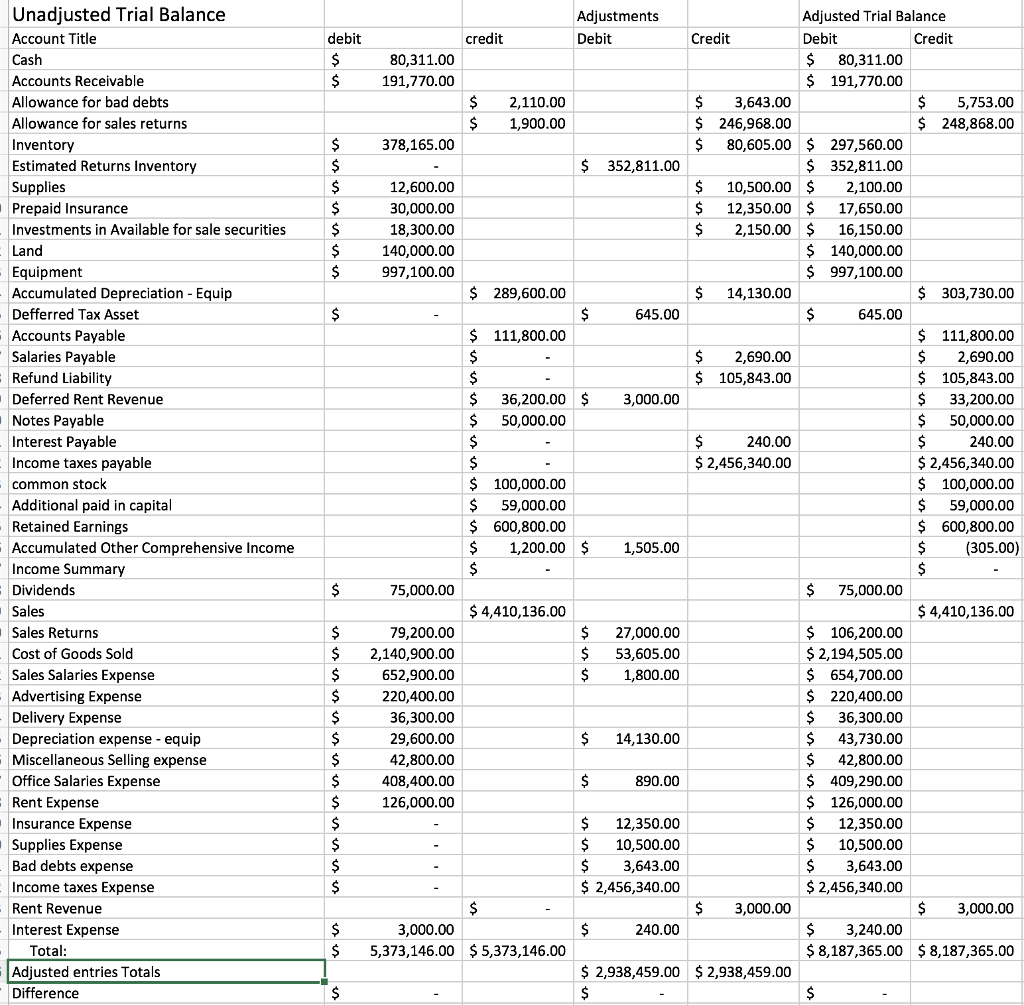

Trial balance provides you the following information: In this situation, entry for further bad debts is also passed into. A trial balance is a list of all accounts in the general ledger that have nonzero balances.

A trial balance is an important step in the accounting process, because it helps identify. The unadjusted trial balance is the preliminary trial balance report or document that lists all ending balances or totals of accounts to determine if total debits and credit balances for. In addition to the $354.9 million.

Bad debts are uncollectible amounts from customer accounts. A trial balance can be used to detect any mathematical errors that have occurred in a double entry accounting system. Treatment of provision for doubtful debts.

Bank charges items that appear on the credit side of the trial balance. Account number, name, debit balance, and. Once all accounts have balances in the adjusted trial balance columns, add the debits and credits to make sure they are equal.