Painstaking Lessons Of Info About Bank Borrowings Balance Sheet

At the heart of the debate is how small the central bank can make its balance sheet — almost $9 trillion at one point — without causing financial markets dislocations or derailing its broader.

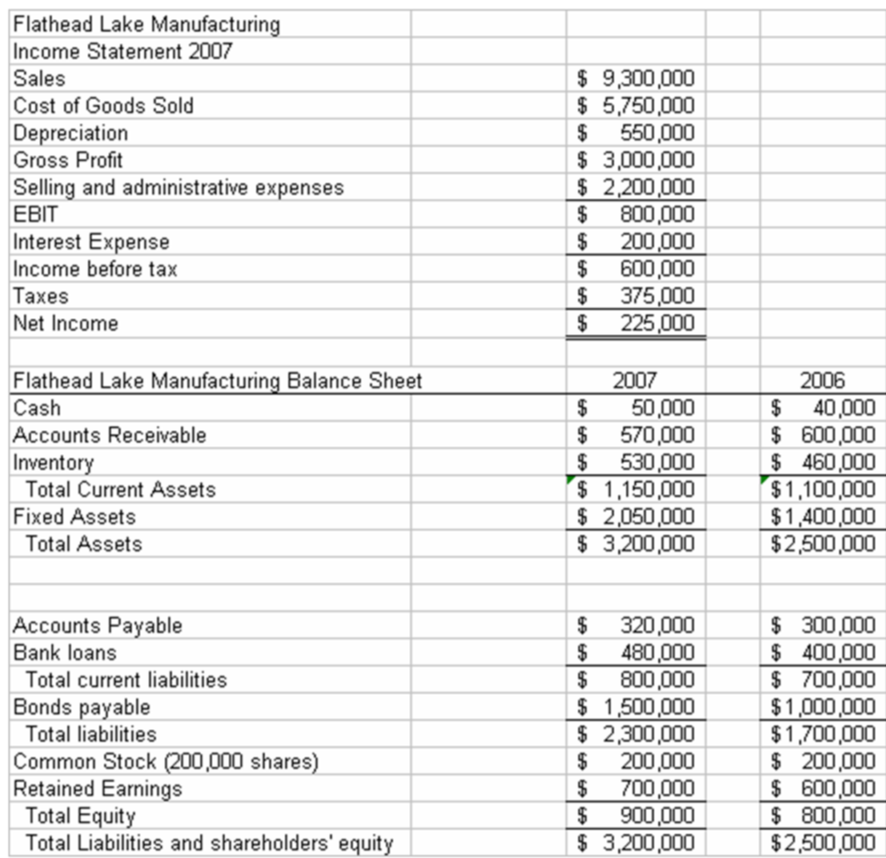

Bank borrowings balance sheet. An asset is anything that can be sold for value. A balance sheet is a financial statement that lists a company’s assets, liabilities and owner's equity to provide an overview of the business’ financials at a specific point in time. Share capital from jun 2004 to.

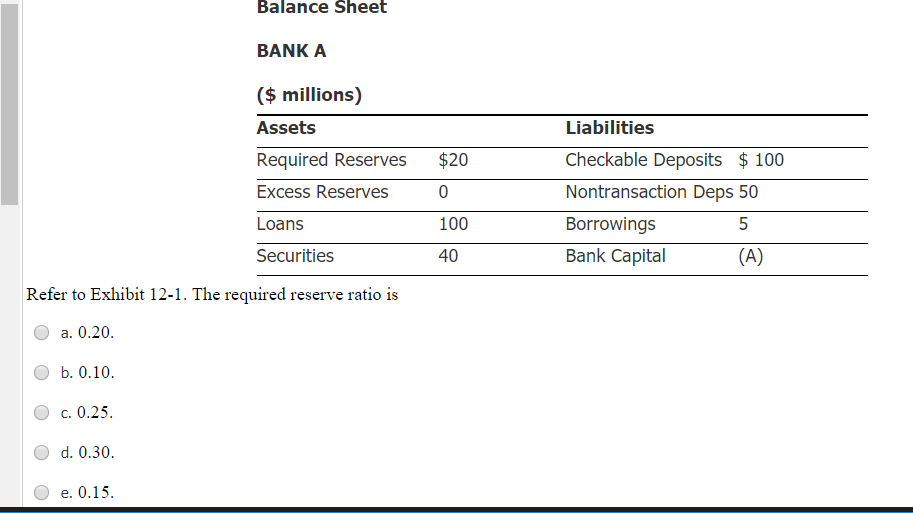

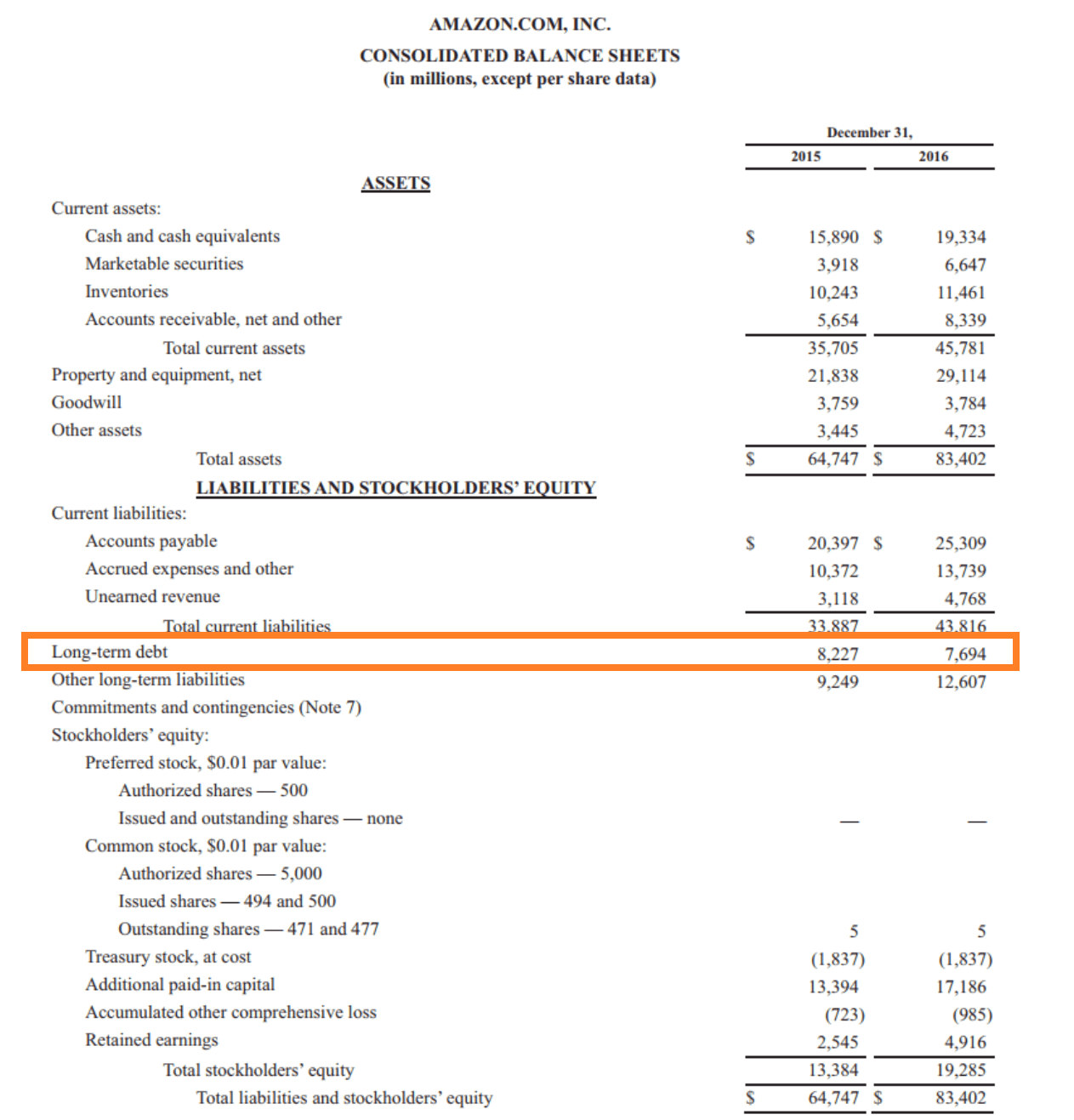

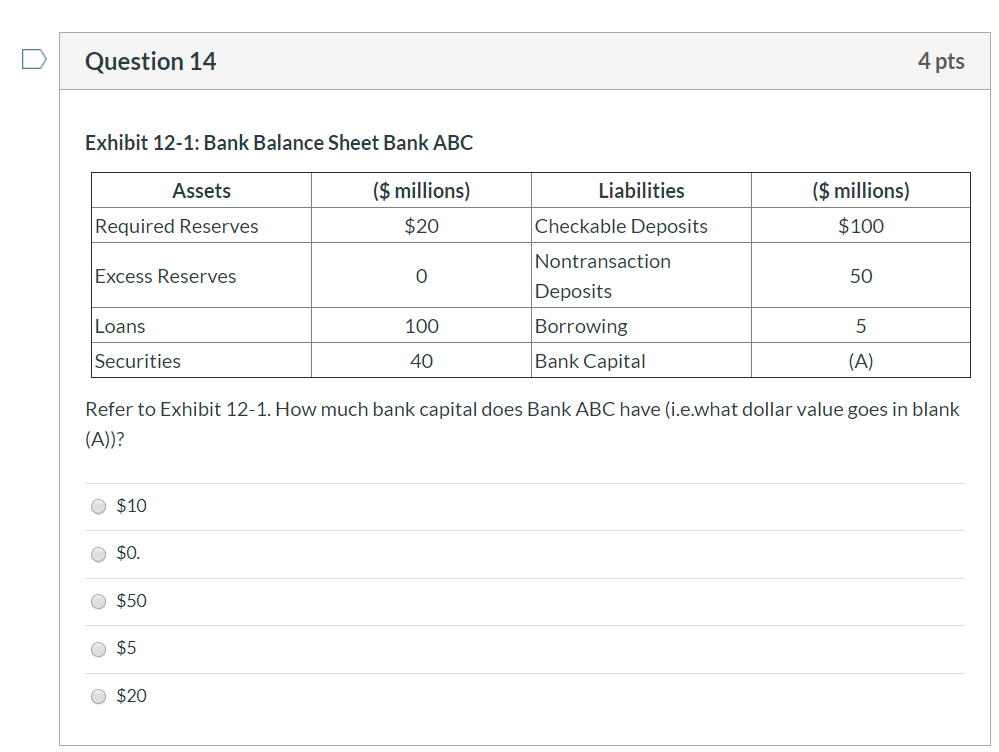

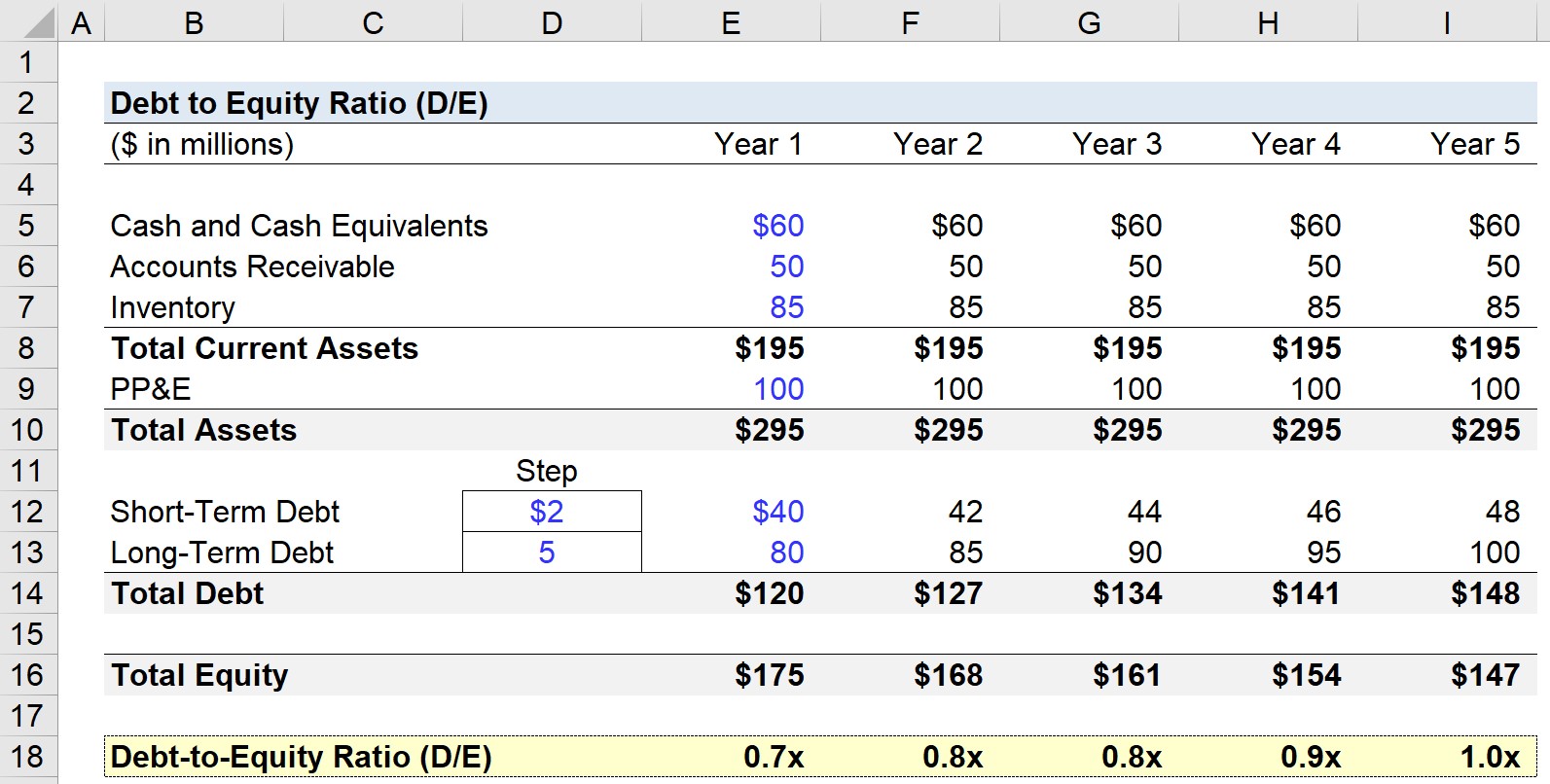

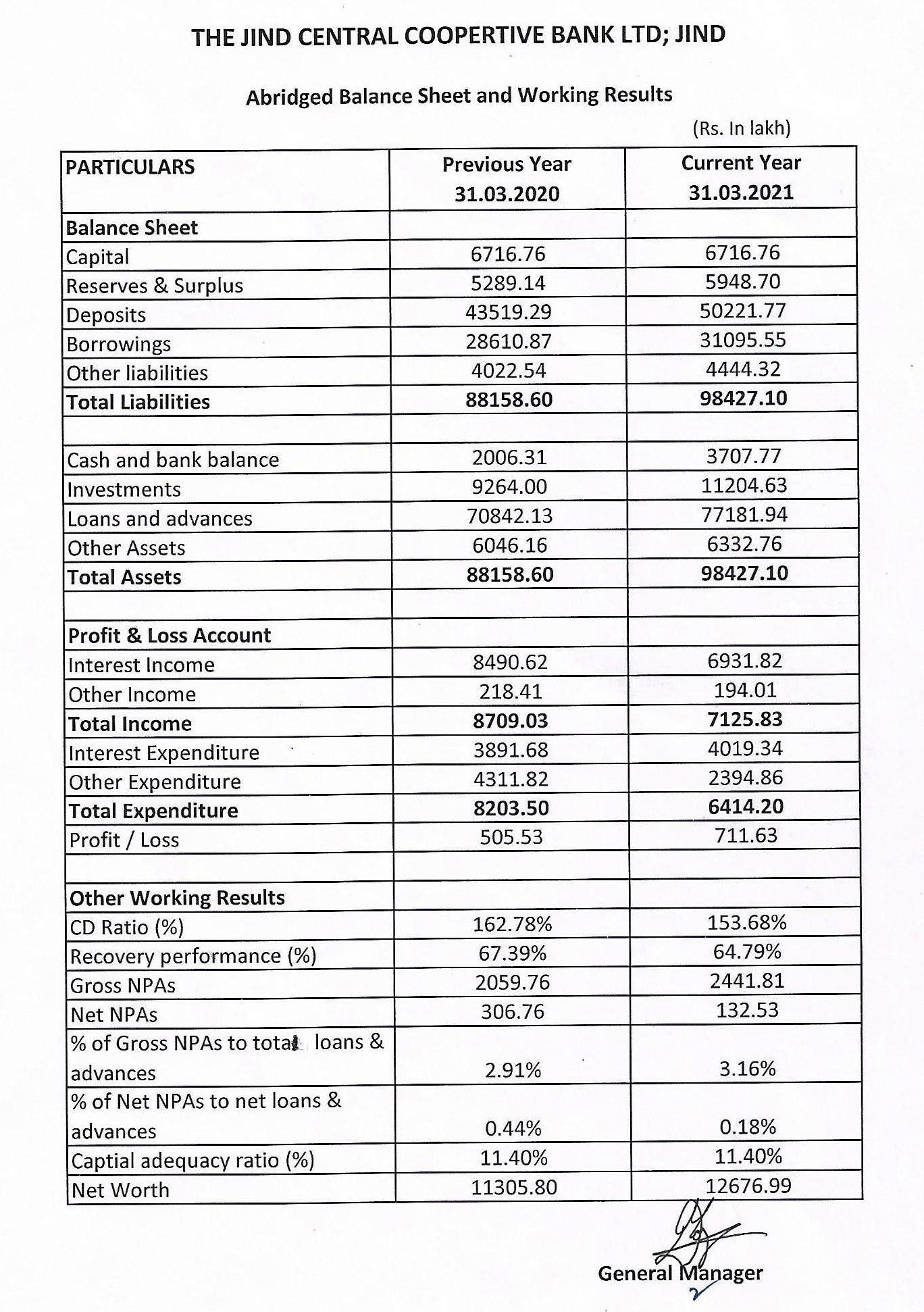

A bank’s balance sheet can be defined as a part of a bank’s financial statements, which represent the financial position, i.e., the financial health of a banking entity at a certain point of time, usually at the end of the accounting period (quarterly, annually as per applicable regulations) prepared strictly in compliance with the applicable. The balance sheet is a key financial statement that provides a snapshot of a company's finances. Liabilities are items that the bank owes to someone else, including deposits and bank borrowing from other institutions.

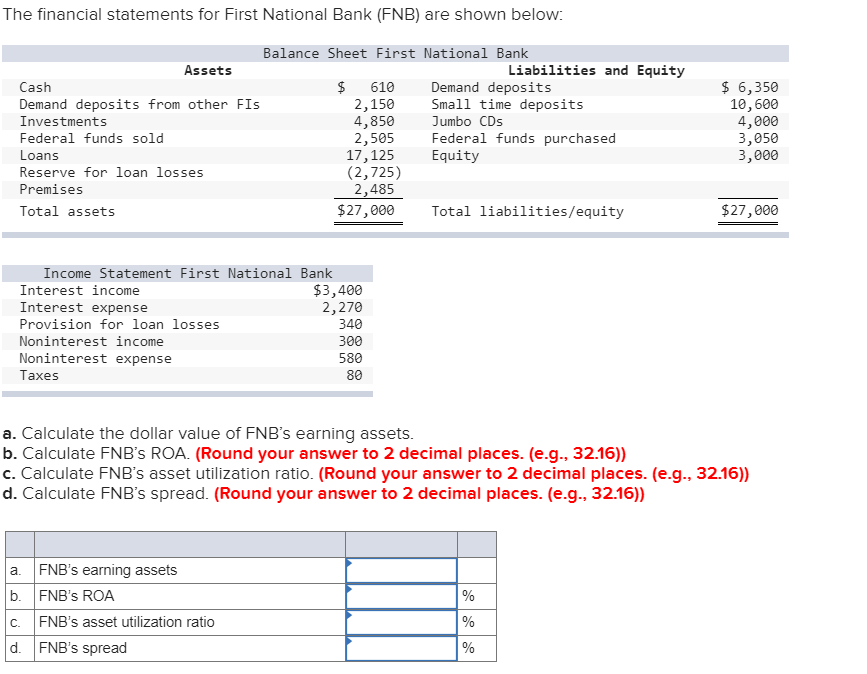

The balance sheet (also referred to as the statement of financial position) discloses what an entity owns (assets) and what it owes (liabilities) at a specific point in time. How are loans classified on a bank’s balance sheet? In the aggregate, the largest category on the asset side of commercial bank balance sheets is loans and leases.

Bank of america corporation and subsidiaries: Typical balance sheet a typical balance sheet consists of the core accounting equation, assets equal liabilities plus equity. A balance sheet (aka statement of condition, statement of financial position) is a financial report that shows the value of a company's assets, liabilities, and owner's equity on a specific date, usually at the end of an accounting period, such as a quarter or a year.

Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment plan. Graph and download economic data for balance sheet: This infographic visualizes all of the deposits, loans, and other assets and liabilities that make up the collective balance sheet of u.s banks using data from the federal reserve.

Fed asset purchases, and bank assets and liabilities. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. This made the older, lower.

The balance sheet identity is: A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. You won't find inventory, accounts receivable, or accounts payable.

Assets = liabilities + capital the assets are items that the bank owns. Other borrowed money (qbpbstlkobor) from q1 1984 to q3 2023 about borrowings, liabilities, capital, and usa. During last spring’s banking crisis, when a competing lender went under, new york community bank pounced, acquiring a big chunk of its business.

Deposits are generally augmented by other types of funding, such as federal home loan bank borrowings and other types of borrowings, with the latter sources typically viewed as secondary sources of funding. A bank's balance sheet should group assets and liabilities by nature and list them in liquidity sequence. Central banks and other banks:

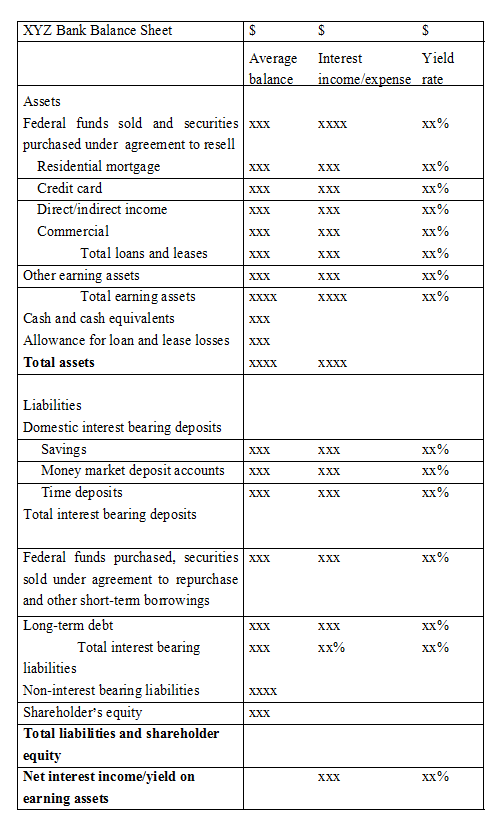

A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s regulatory authority. Consolidated balance sheet (dollars in millions) june 30 2021: The balance sheet items are average balances for each line item rather than the balance at the end of the period.