Lessons I Learned From Info About Understanding Bank Balance Sheet

$270b today's change (2.84%) $0.94 current price price as of february 15, 2024, 4:00 p.m.

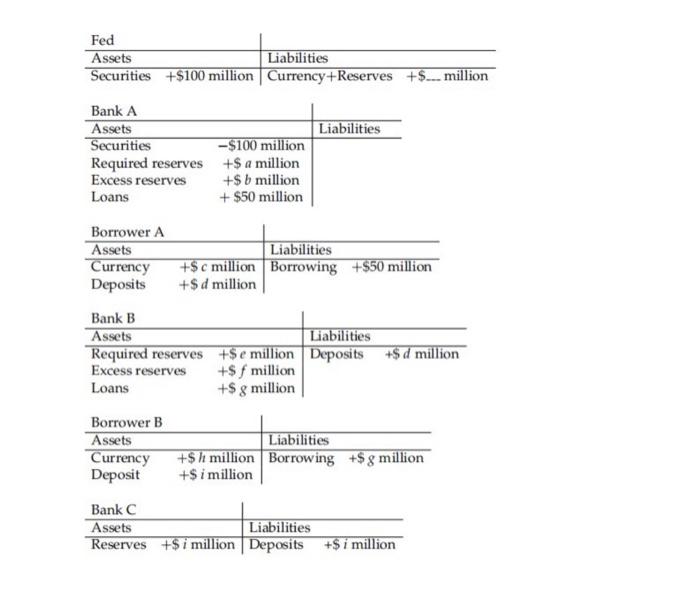

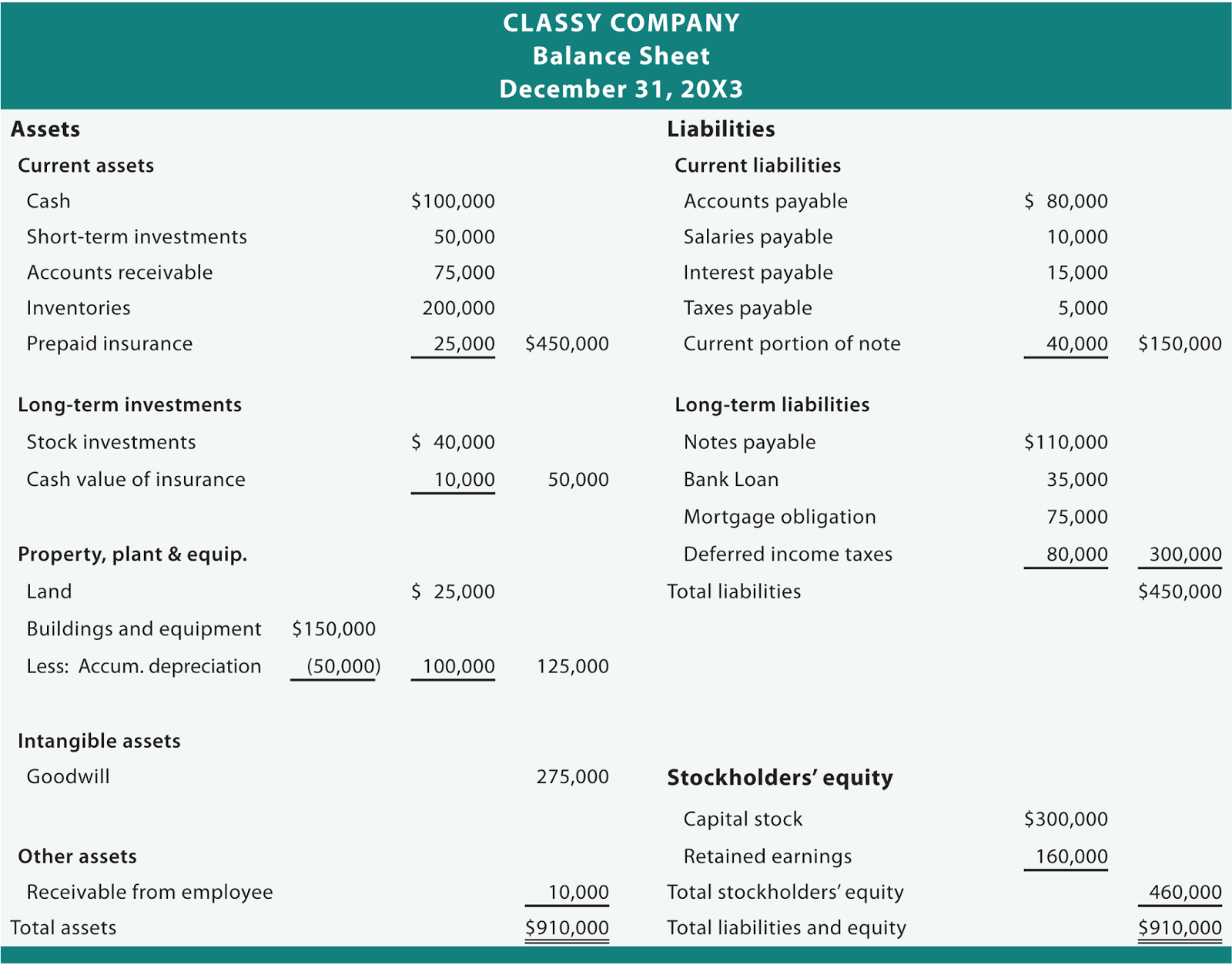

Understanding bank balance sheet. Monetary policy decisions are separated from facilities for lender of last resort, market maker of last resort, providing selective credit, and ensuring emergency government financing. A business will generally need a balance sheet when it seeks investors, applies for loans, submits taxes etc. Assets = liabilities + capital the assets are items that the bank owns.

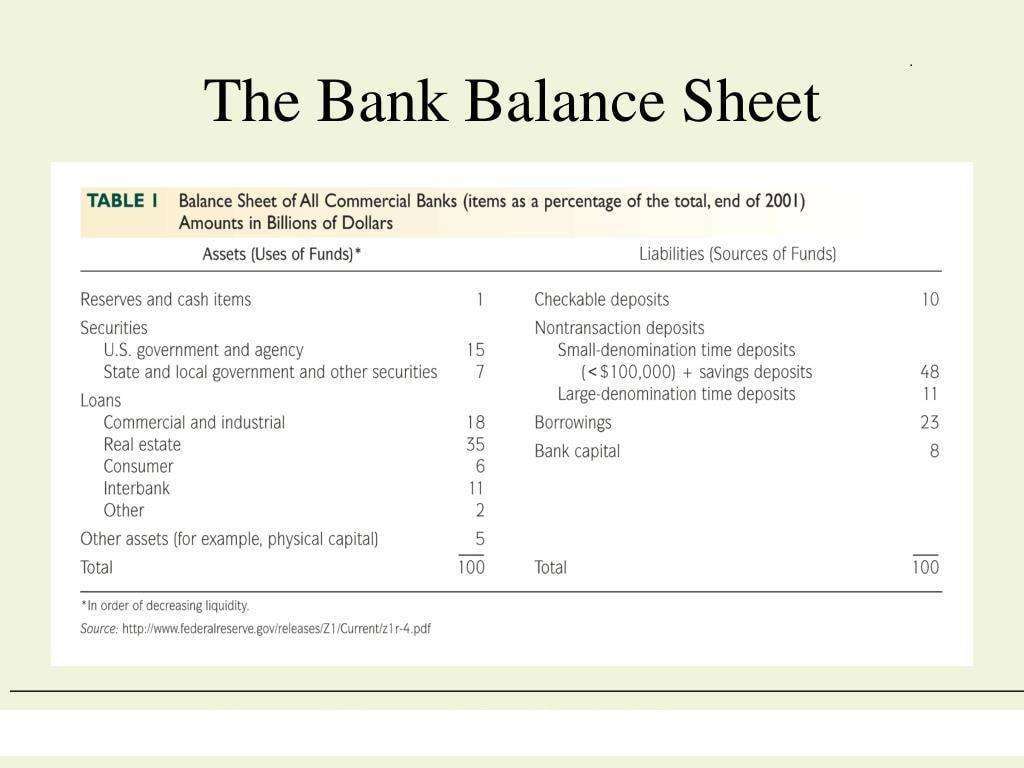

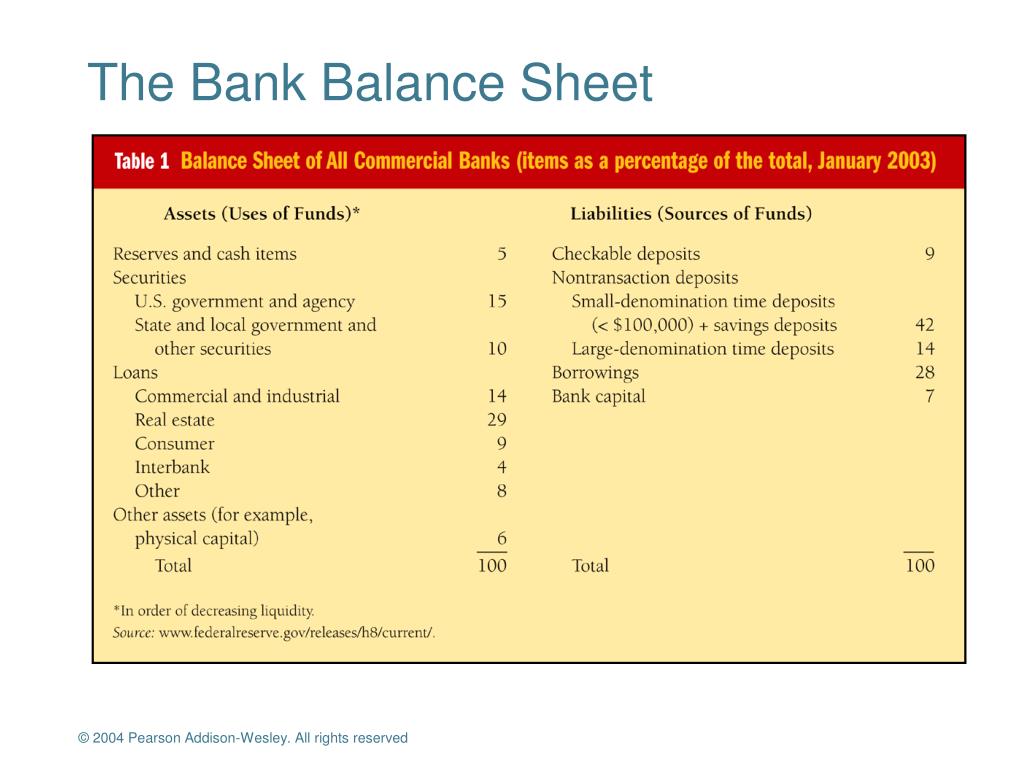

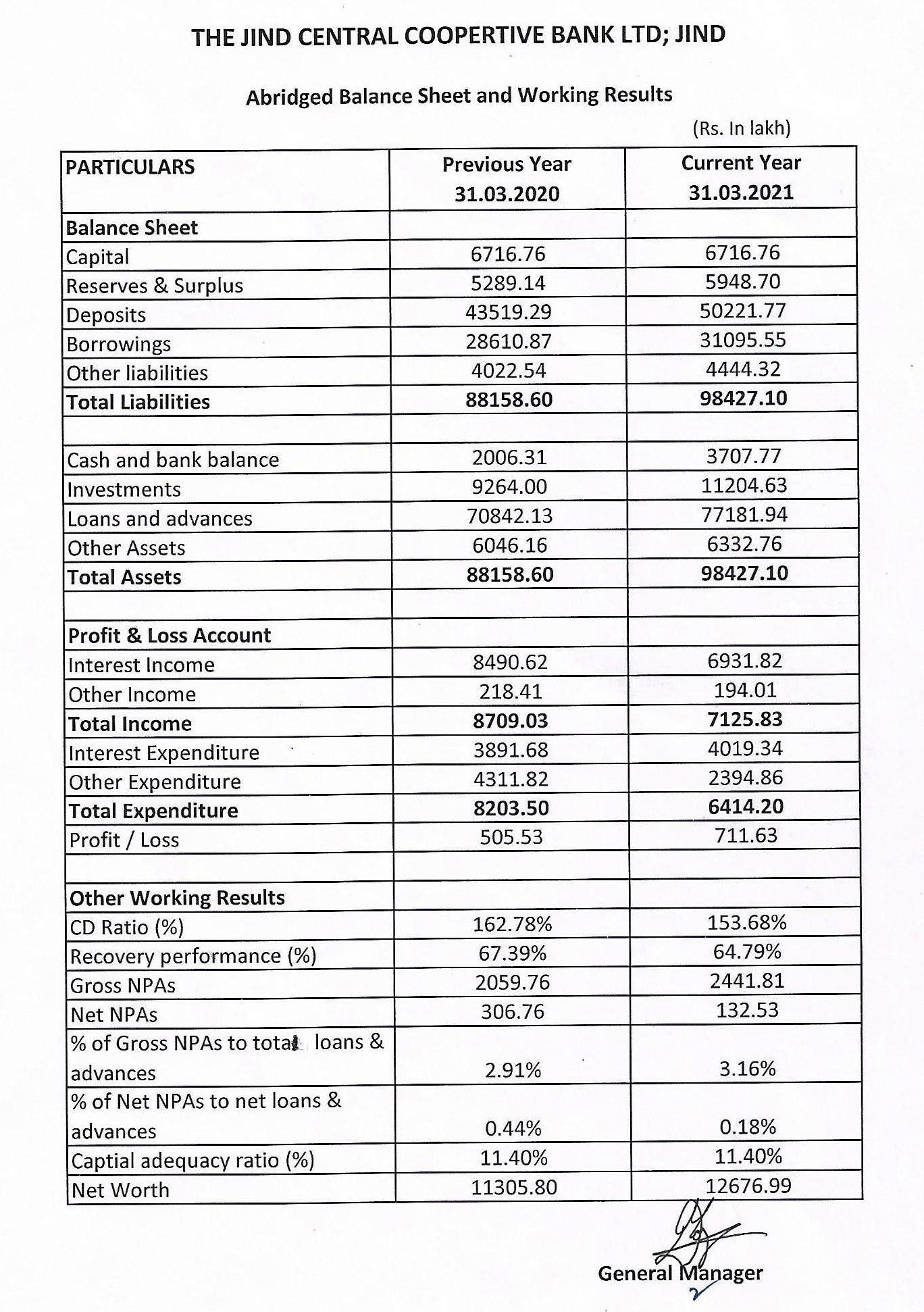

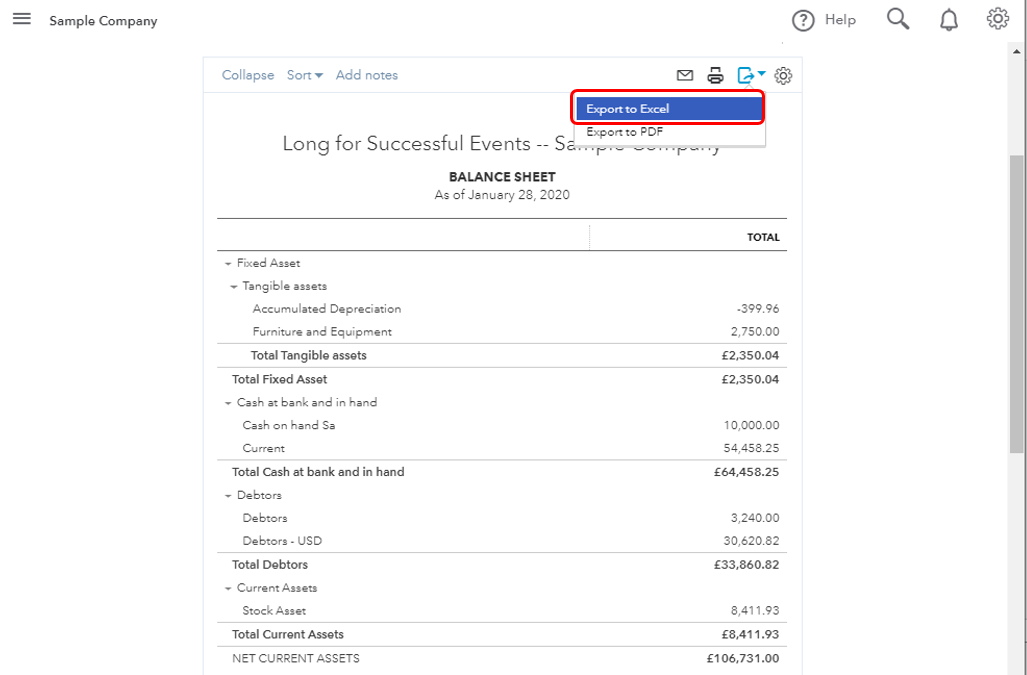

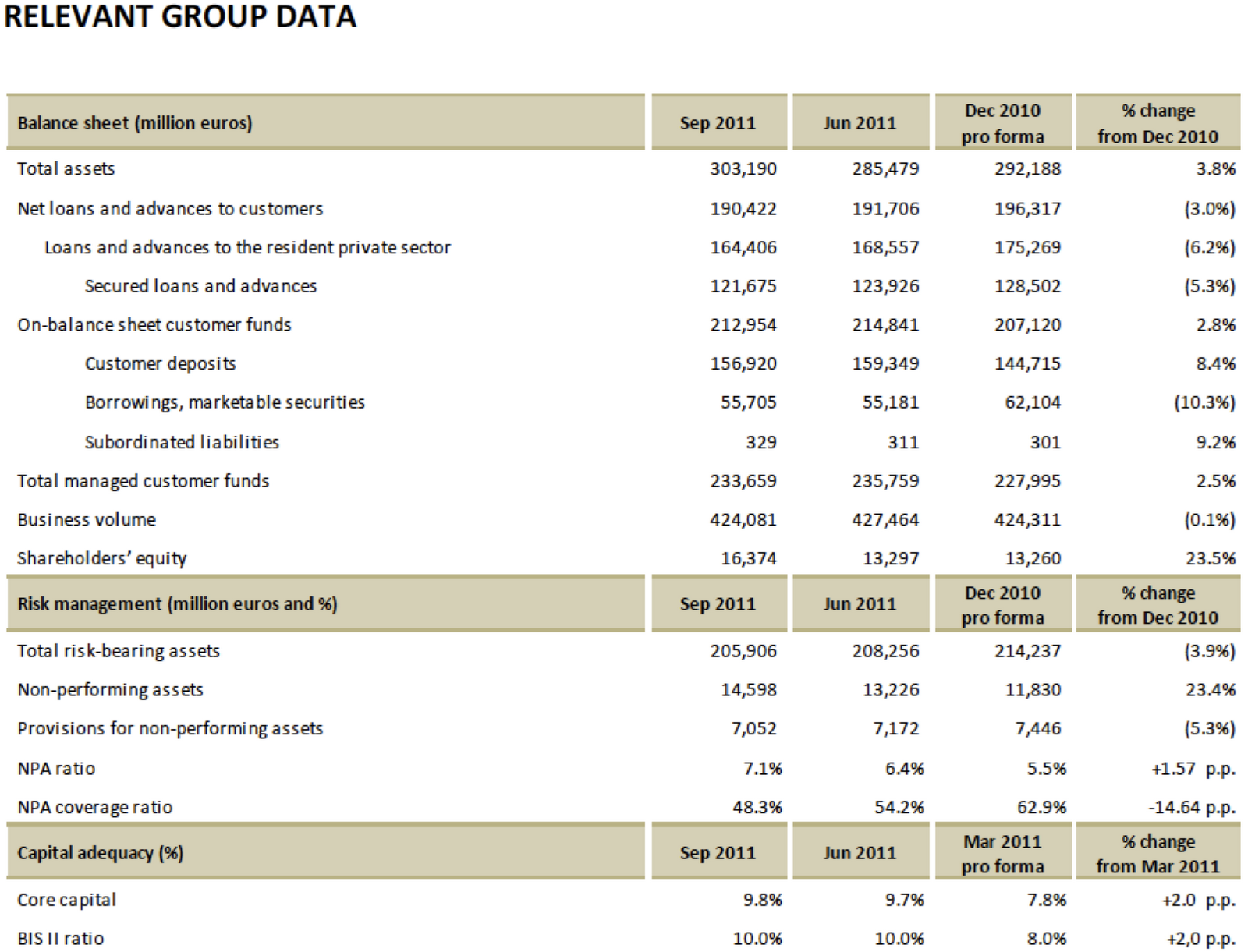

A banks balance sheet refers to the financial statement prepared by the banks based on which the current status and performance of the entity in the banking industry can be assessed and analyzed. Average balances provide a framework for the bank's financial performance. The volume of business of a bank is included in its balance sheet for both assets (lending) and liabilities (customer deposits or other financial instruments).

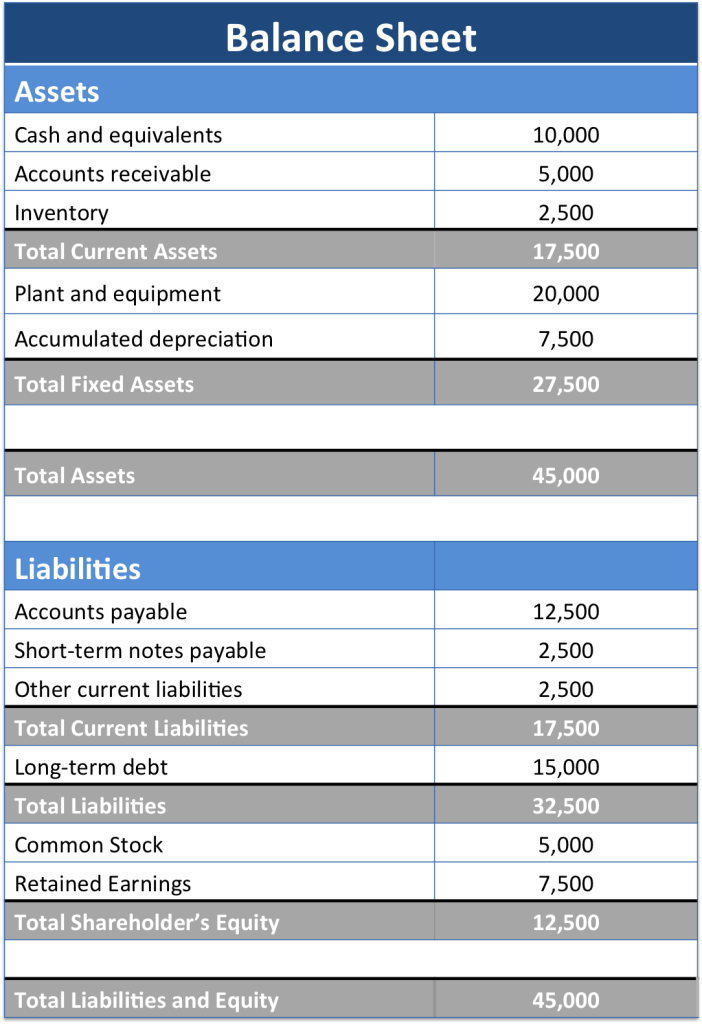

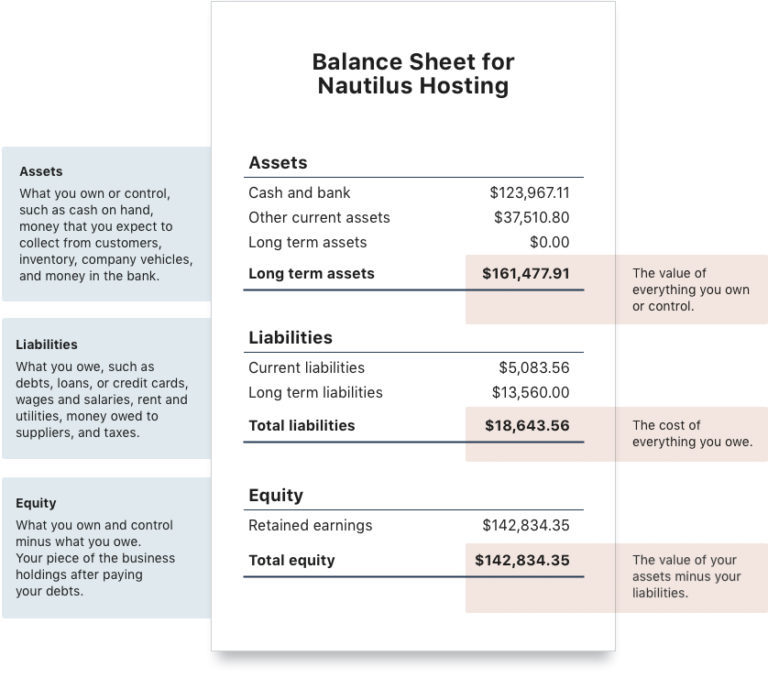

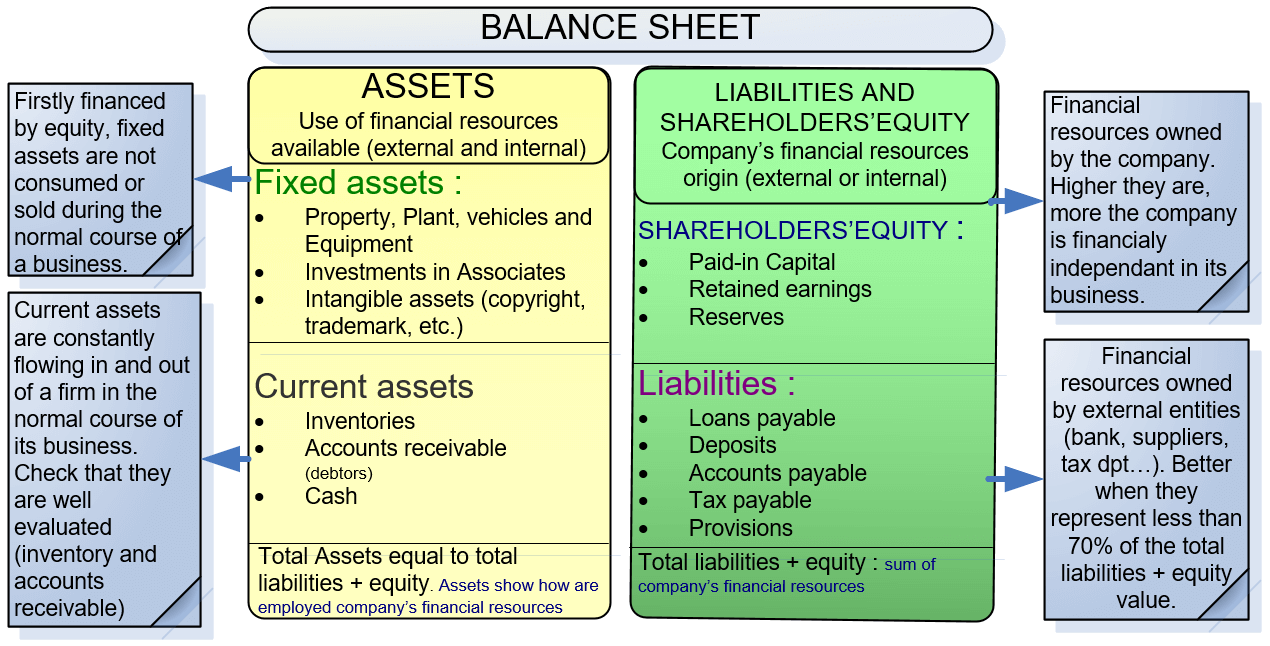

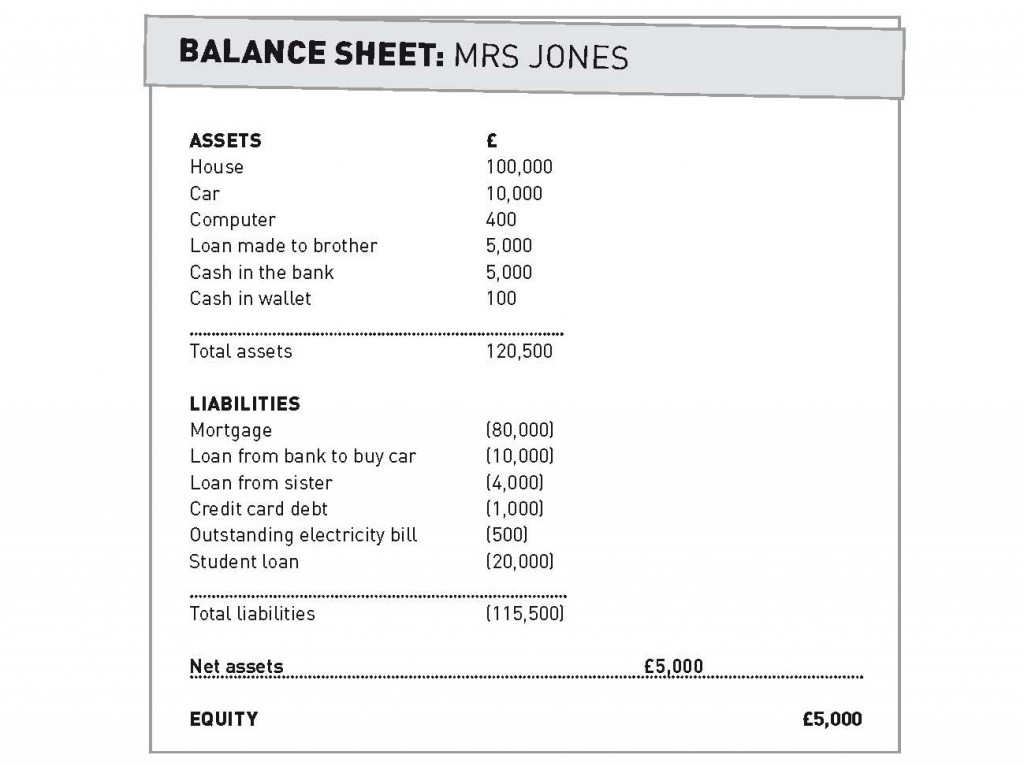

Typical balance sheet a typical balance sheet consists of the core accounting equation, assets equal liabilities plus equity. The balance sheet identity is: The balance sheet is split into two columns, with each column balancing out the other to net to.

A bank’s mandate reflects the relationship between the profit made by the bank, its risk levels, and its financial health. By garreth rule. Here’s everything you need to know about understanding a balance sheet, including what it is, the information it contains, why it’s so important, and the underlying mechanics of how it works.

A bank’s balance sheet can be defined as a part of a bank’s financial statements, which represent the financial position, i.e., the financial health of a banking entity at a certain point of time, usually at the end of the accounting period (quarterly, annually as per applicable regulations) prepared strictly in compliance with the applicable. Balance sheet basics one of the fundamentals of accounting is that assets equal liabilities plus equity. The risks in the different business lines and products offered by financial institutions and how they are reflected in the financial statements

This column introduces a new framework for categorising and understanding central bank balance sheet operations. Despite this critical role the central bank’s balance sheet remains an arcane concept to many observers. The balance sheet items are average balances for each line item rather than the balance at the end of the period.

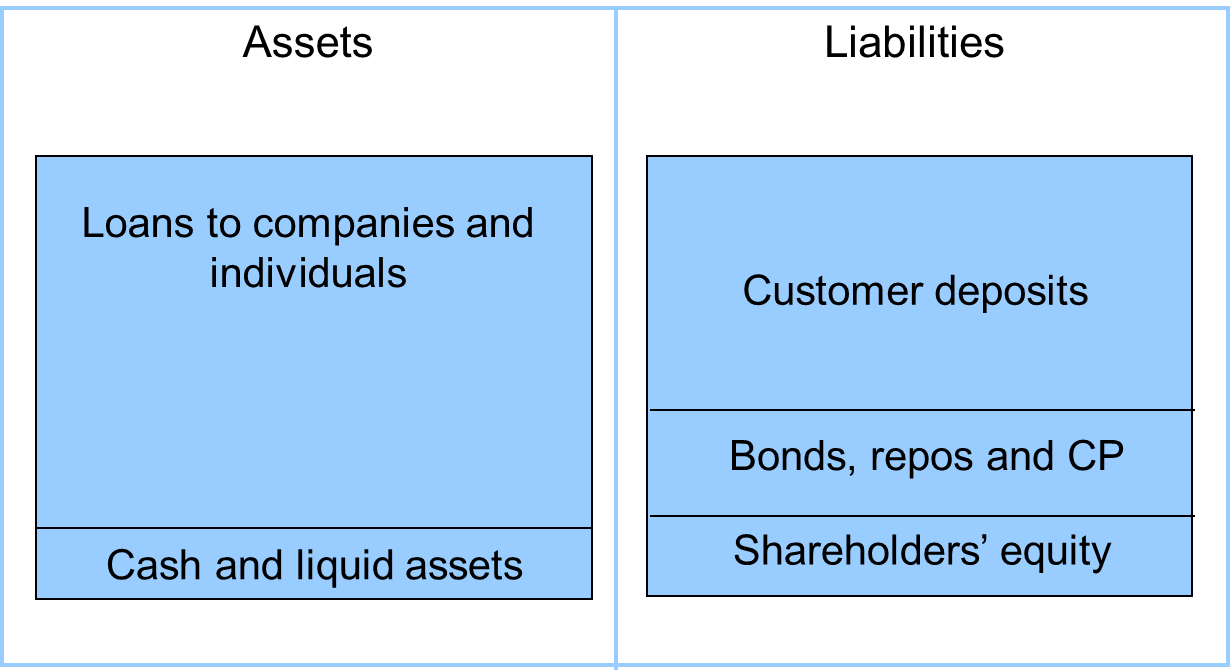

That’s where this guide comes in. Instead, under assets, you'll see mostly loans and. Et bank balance sheets look a lot different from those of other companies.

Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment plan. An understanding of the balance sheet enables an analyst to evaluate the liquidity, solvency, and overall financial position of a company. The main elements if this balance sheer are assets, liabilities, and the bank capital.

A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s regulatory authority. This interactive course provides participants with an understanding of the key performance indicators and main balance sheet and income statement accounts for banks. This column introduces a new framework for categorising and understanding central bank balance sheet operations.

Before it is possible to consider how well this worked, it is necessary to be clear about what policymakers’ various operations were trying to achieve. They’re also essential for getting investors, securing a loan, or selling your business. By the end of 2020, the fed’s balance sheet was 34% of gdp, the ecb’s 59%, the bank of england’s 40%, and the bank of japan’s 127%.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)