Wonderful Info About Leasing Balance Sheet

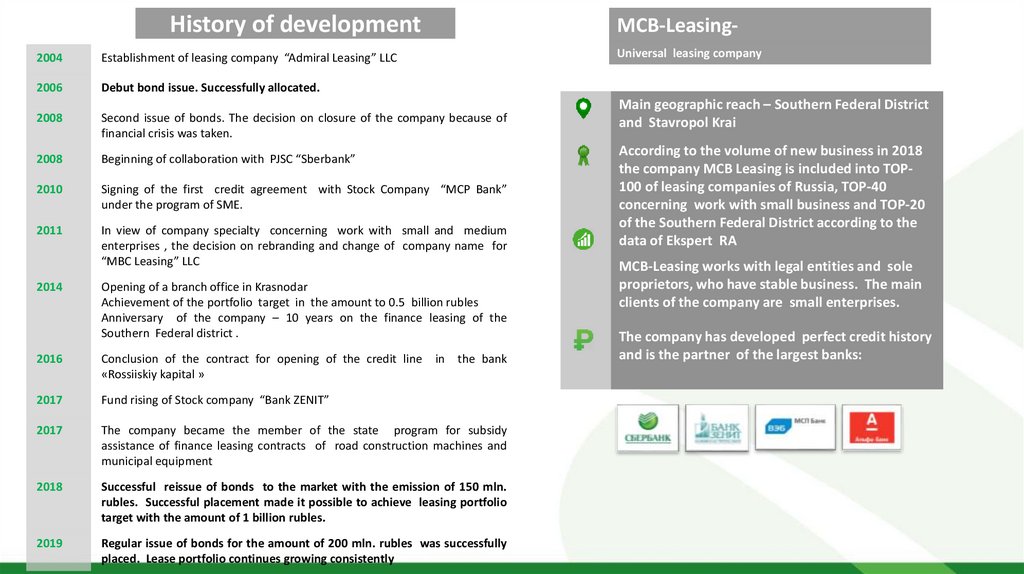

On may 14, 2019, the company signed a land lease in central california for 602 acres at $1,000 per acre to grow hemp for fiber usage.

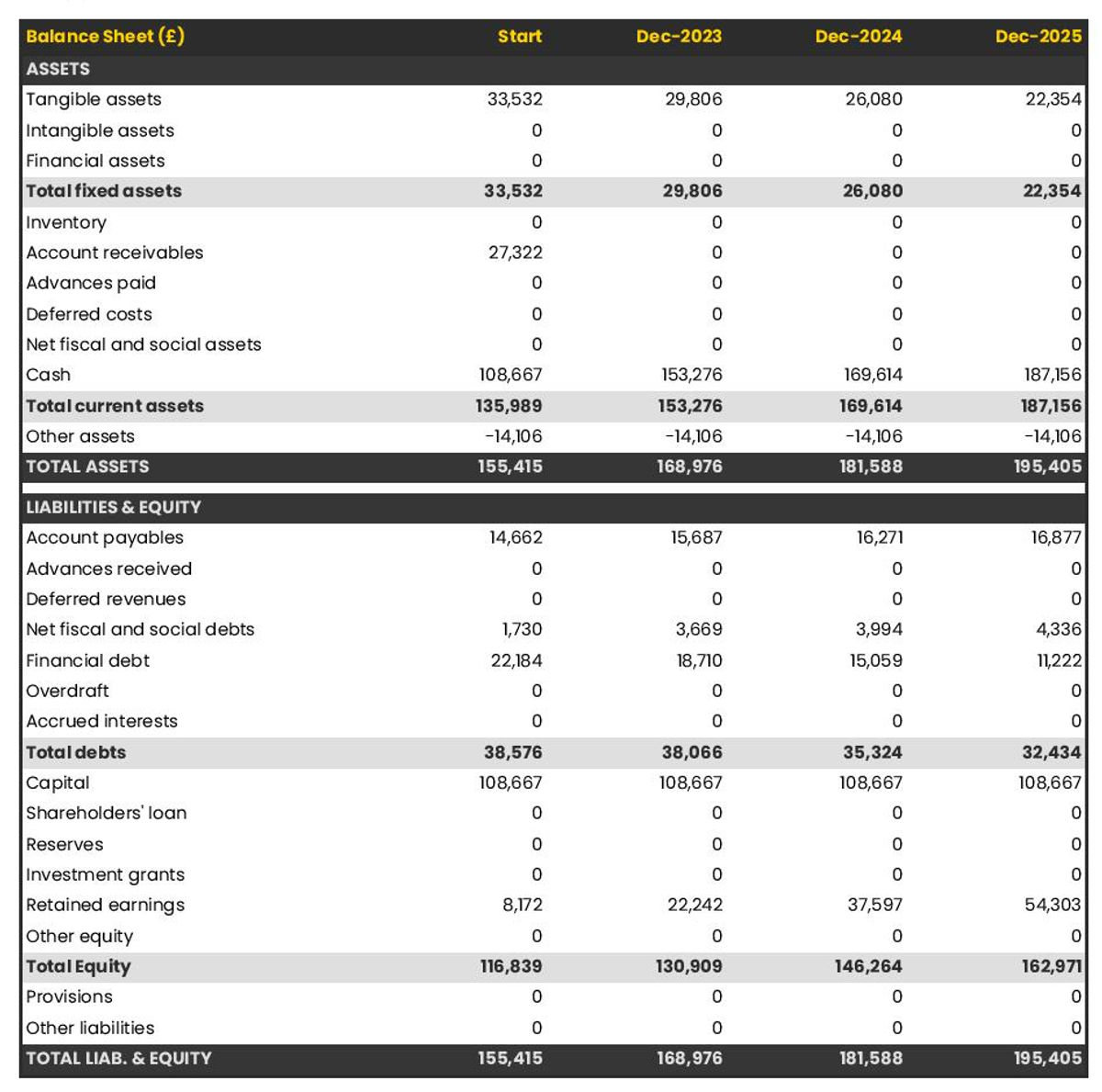

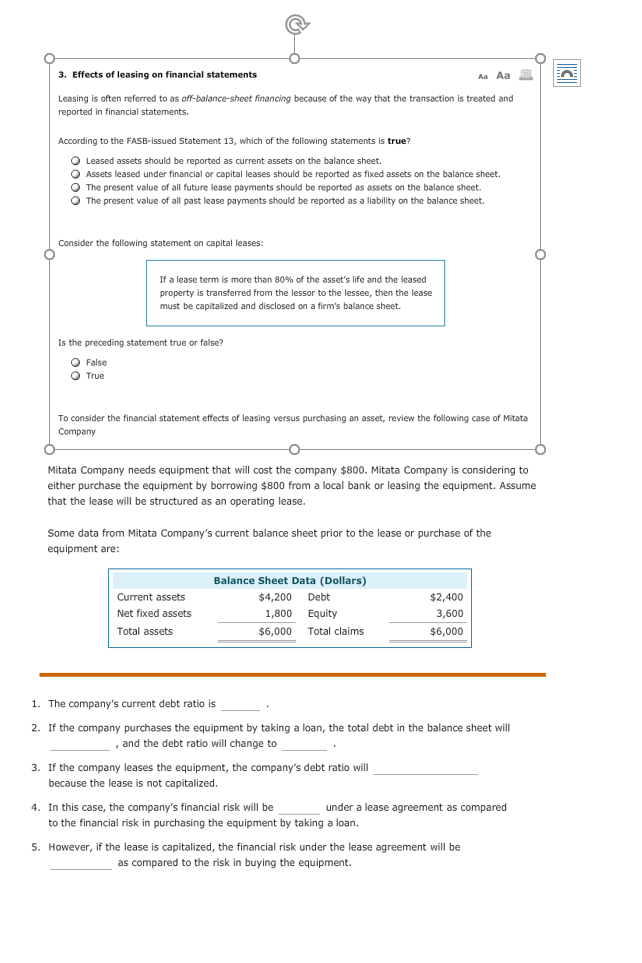

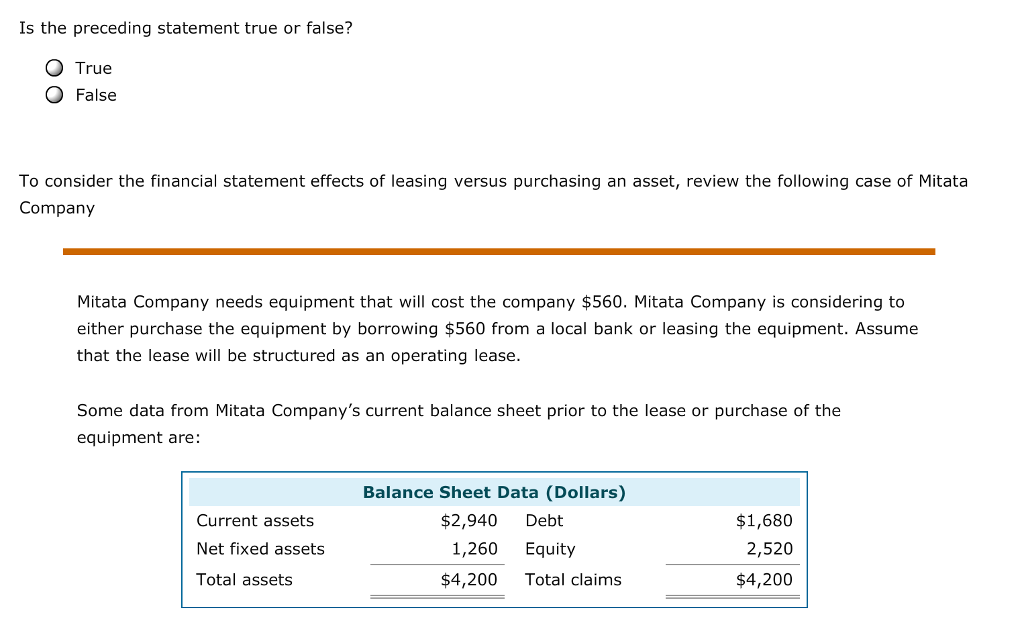

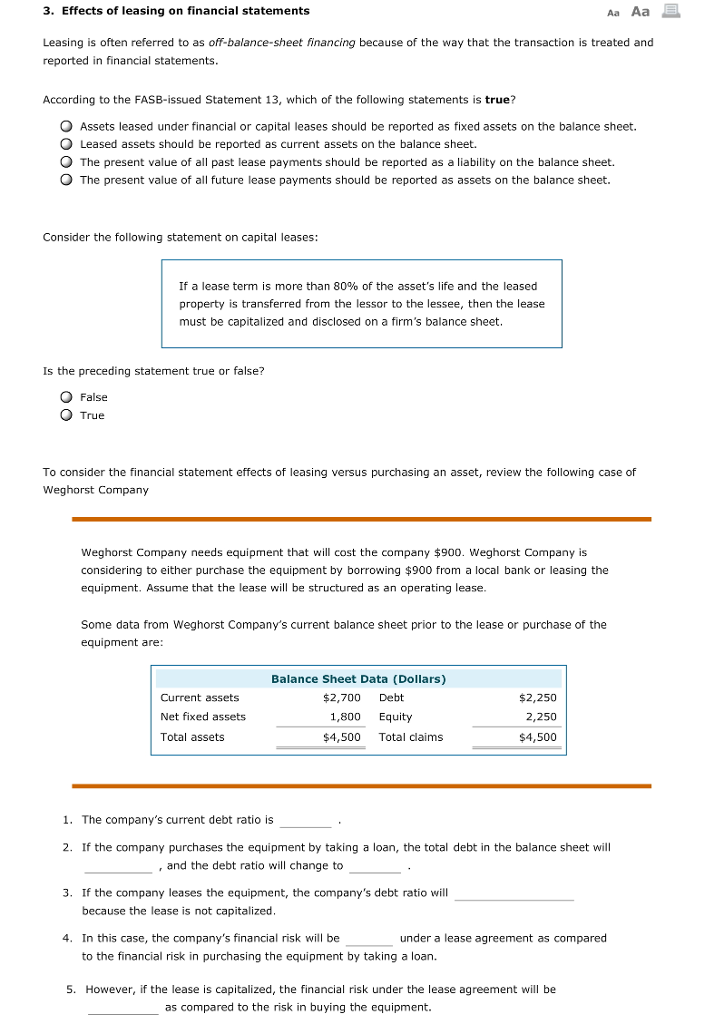

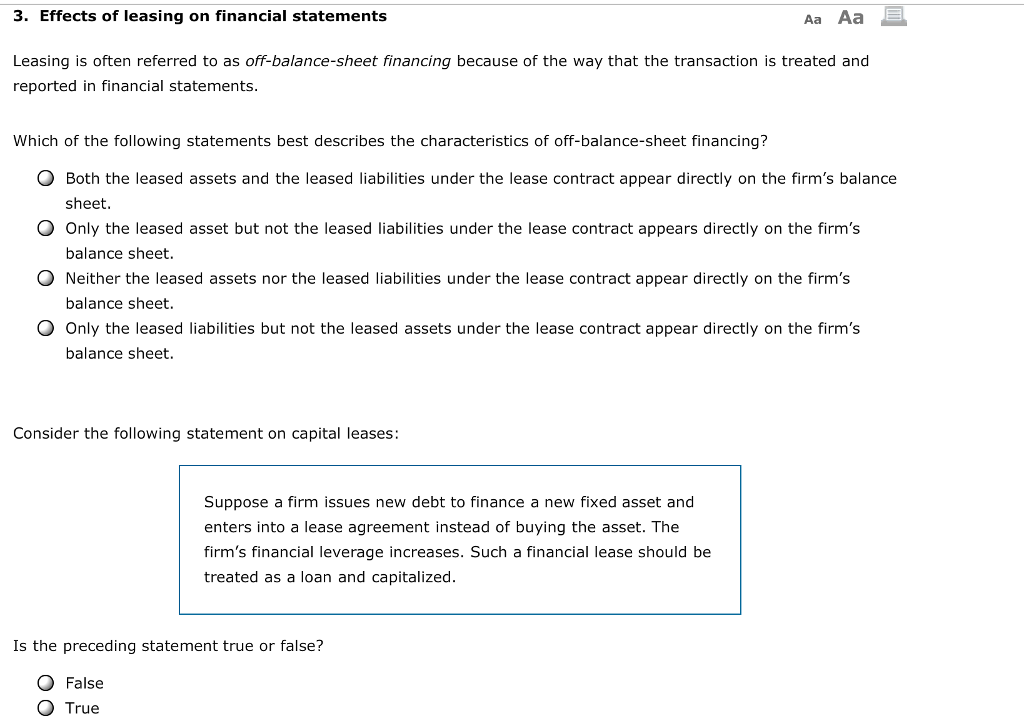

Leasing balance sheet. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. It comes into effect on 1 january 2019. Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for some consideration, usually money or other assets.

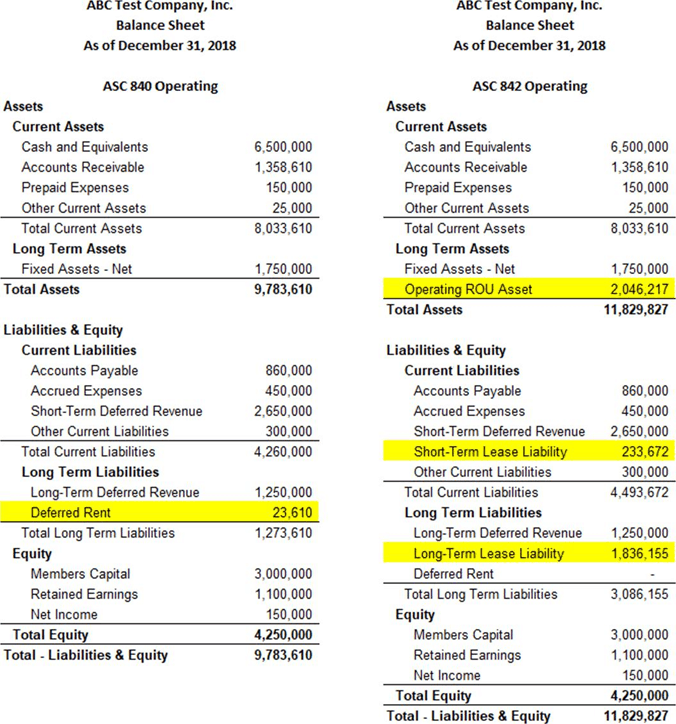

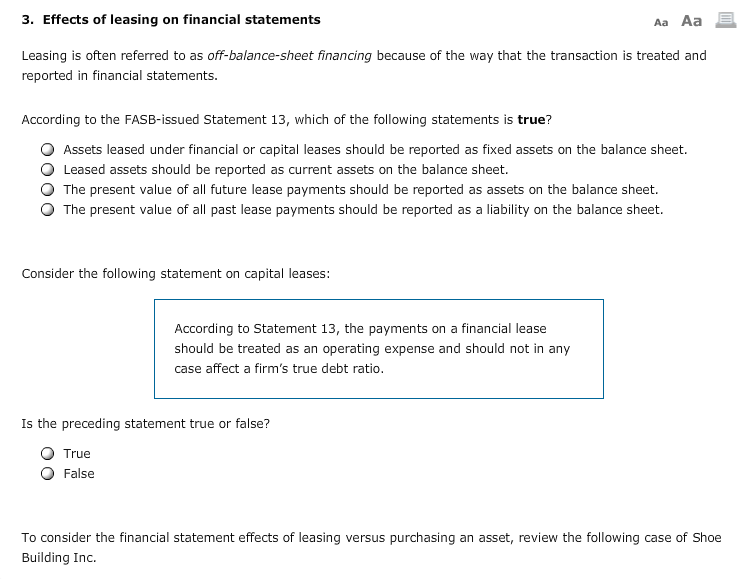

Assets acquired under operating leases do not need to be reported on the bal ance sheet. Contingent rent recognised as an expense; Finance lease and operating lease liabilities should be presented separately from each other and from other liabilities on the balance sheet or disclosed in the notes to the financial statements along with the balance sheet line items in which those liabilities are included.

The two most common types of leases in accounting are operating and finance (or capital) leases. Asc 842 lease accounting balance sheet examples. Fitch wins multiple rating agency of the year awards.

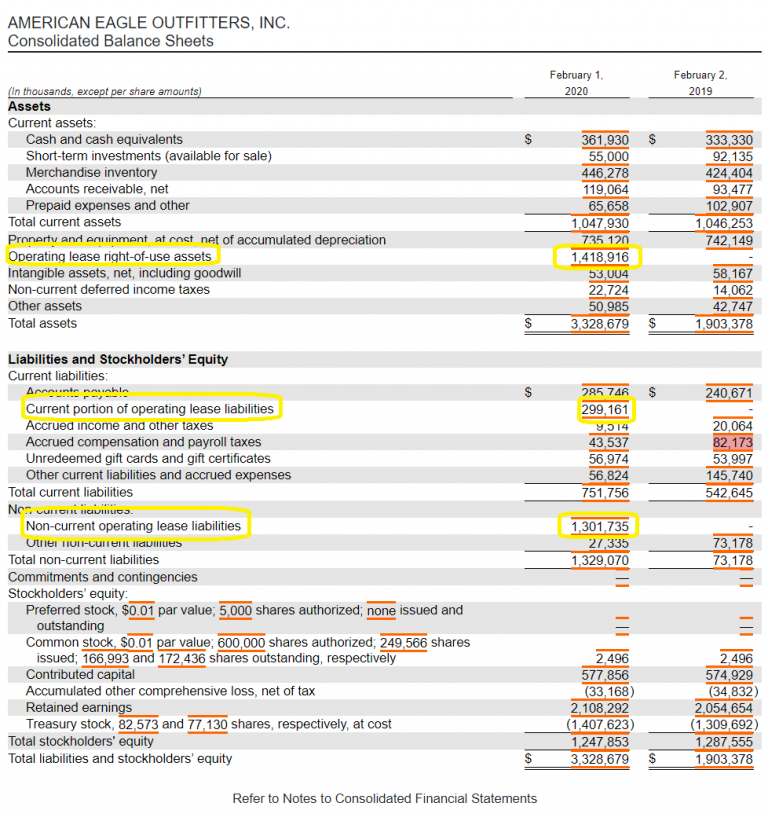

Fitch ratings updates sme balance sheet securitisation rating criteria. They also state that companies must record a liability for operating leases with a corresponding asset known as the ‘right of use’ assets’ on their balance sheets. Operating leases as a percentage of total assets for its rou assets were 7.4%.

Amounts of minimum lease payments at balance sheet date and the present value thereof, for: With so many facets of accounting to consider, each plays a key role in providing financial insights that can. For operating leases, the assets underlying the leases and related depreciation are presented in accordance with other accounting guidance (e.g., asc 360).

If a company issues bonds, they will have to pay back the purchaser of. This expands the balance sheet. In addition, companies employed a fairly broad range of discount rates in calculating the values of their operating lease liabilities.

Unwinding the land lease agreement. Bavarian sky s.a., compartment german auto loans 13. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

Total future minimum sublease income. Whether a contract is, or contains a lease: The federal accounting and standards board (fasb) created the new lease accounting standard (asc 842), which has raised questions about how balance sheets are affected.

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year. We’ve answered your top 10 questions about how asc 842 will impact your balance sheet. The new requirements eliminate nearly all off balance sheet

This requirement does not exist under ifrs, since there is. They reported operating lease assets and liabilities recorded in the balance sheet for fiscal year 2020 but not the year prior (2019). Significant effects on balance sheet amounts and financial ratio, however, are observed at the industry and individual company levels where leased assets are employed extensively.