Formidable Info About Relationship Between Balance Sheet And Income Statement Cash Flow

Identify connected elements between the balance sheet and the income statement.

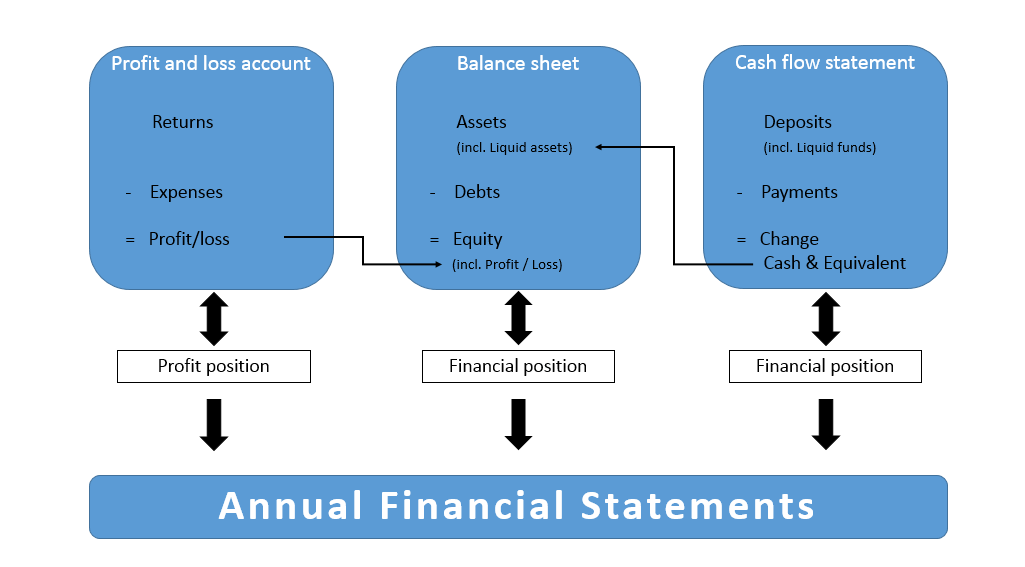

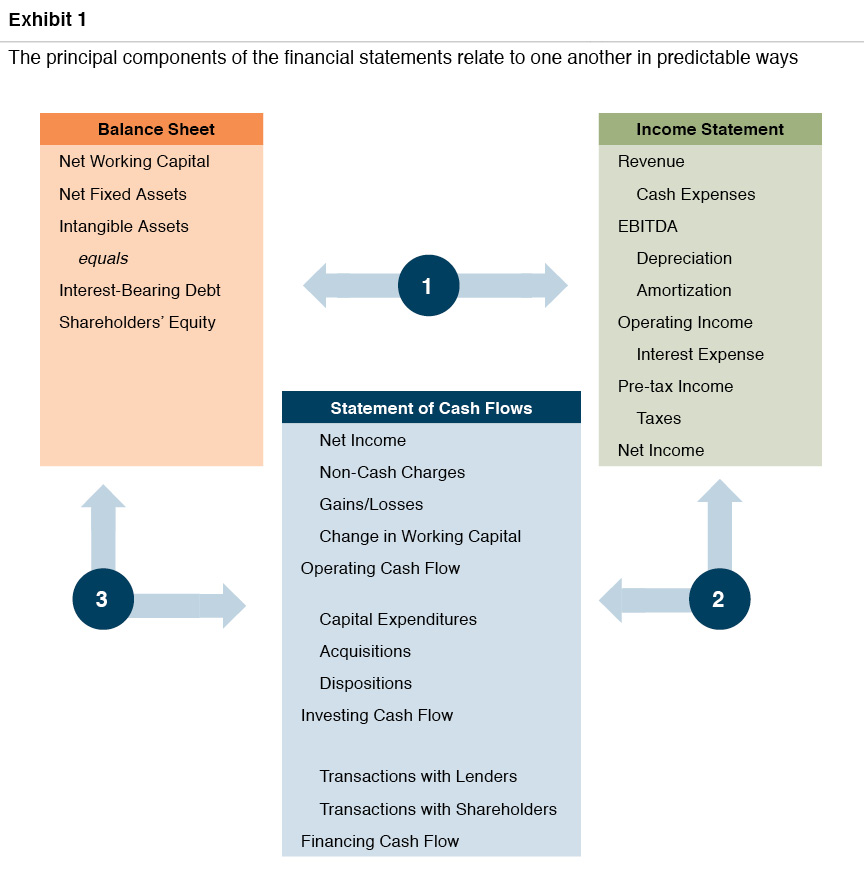

Relationship between balance sheet and income statement and cash flow. The different types of financial statements are not isolated from one another but are closely related to one another. What is an income statement? The significant difference between the two entities is that the balance sheet is classified into two sections while the cash flow statement is classified into three parts.

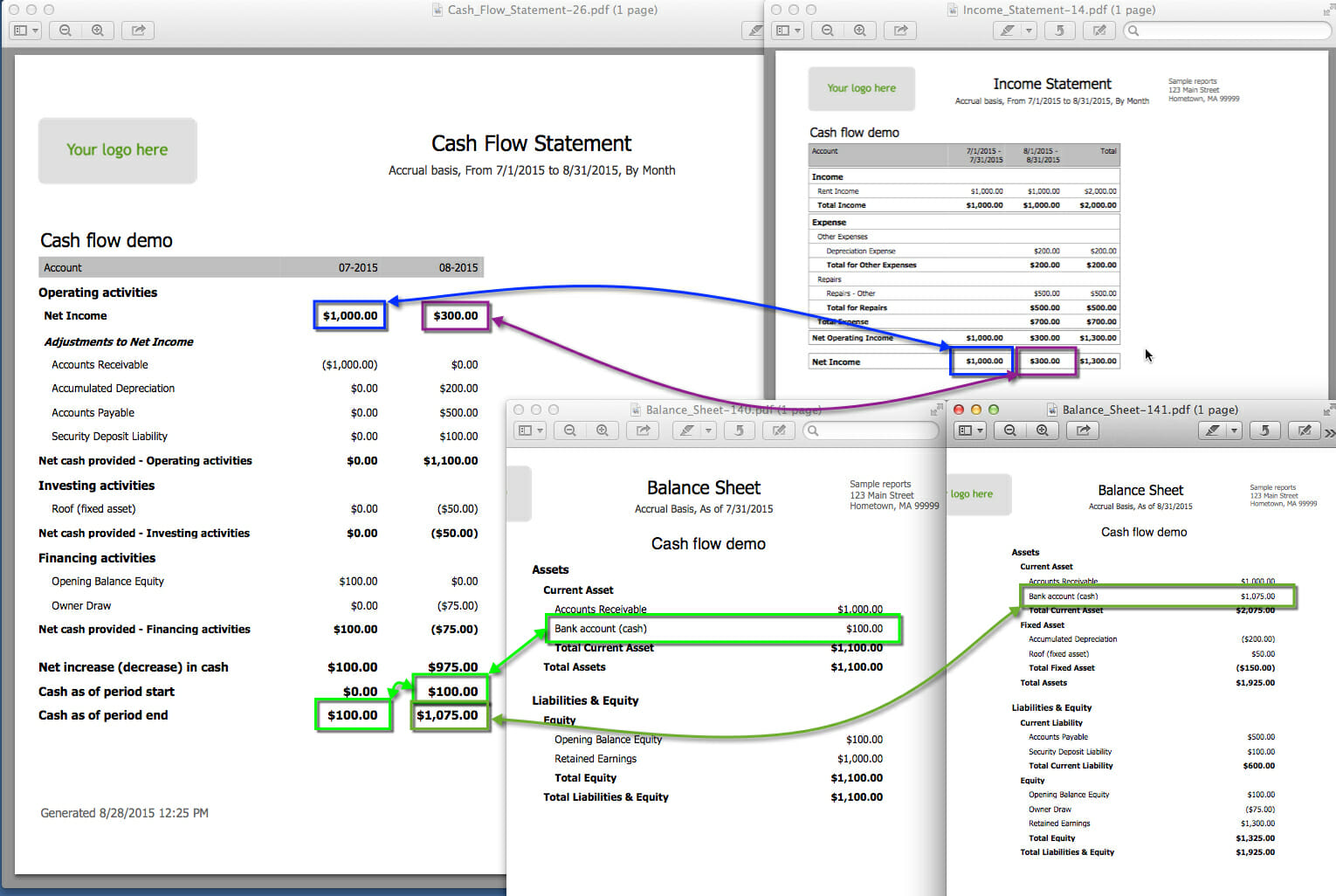

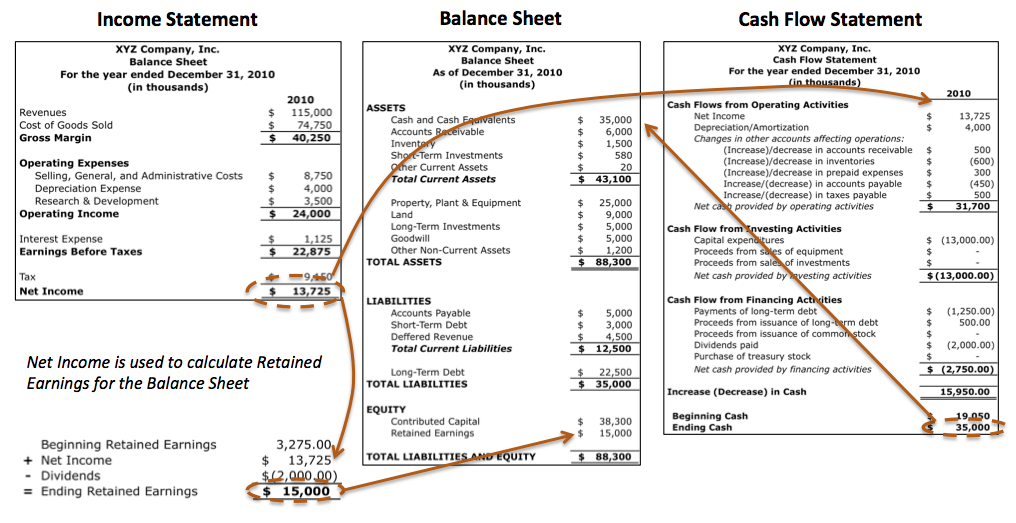

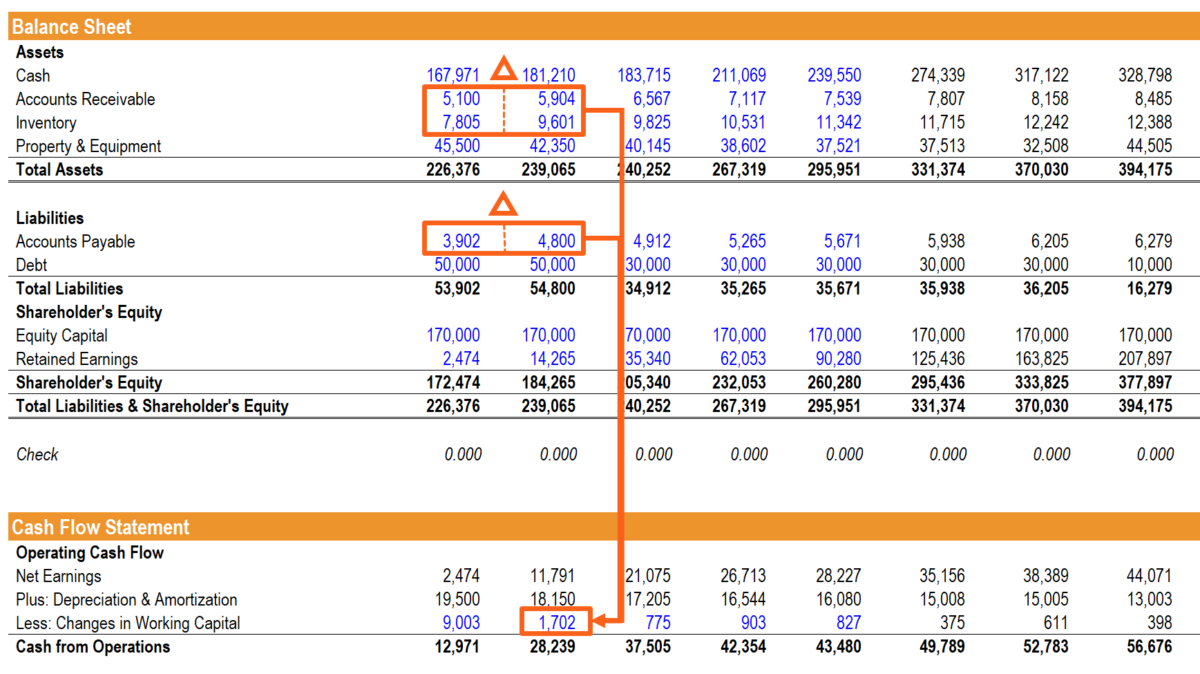

The important linkages among the cash flow statement, income statement, and the balance sheet include the following: The financial statements are comprised of the income statement, balance sheet, and statement of cash flows. The blue highlighted row shows the beginning and ending cash balances and the cash movement.

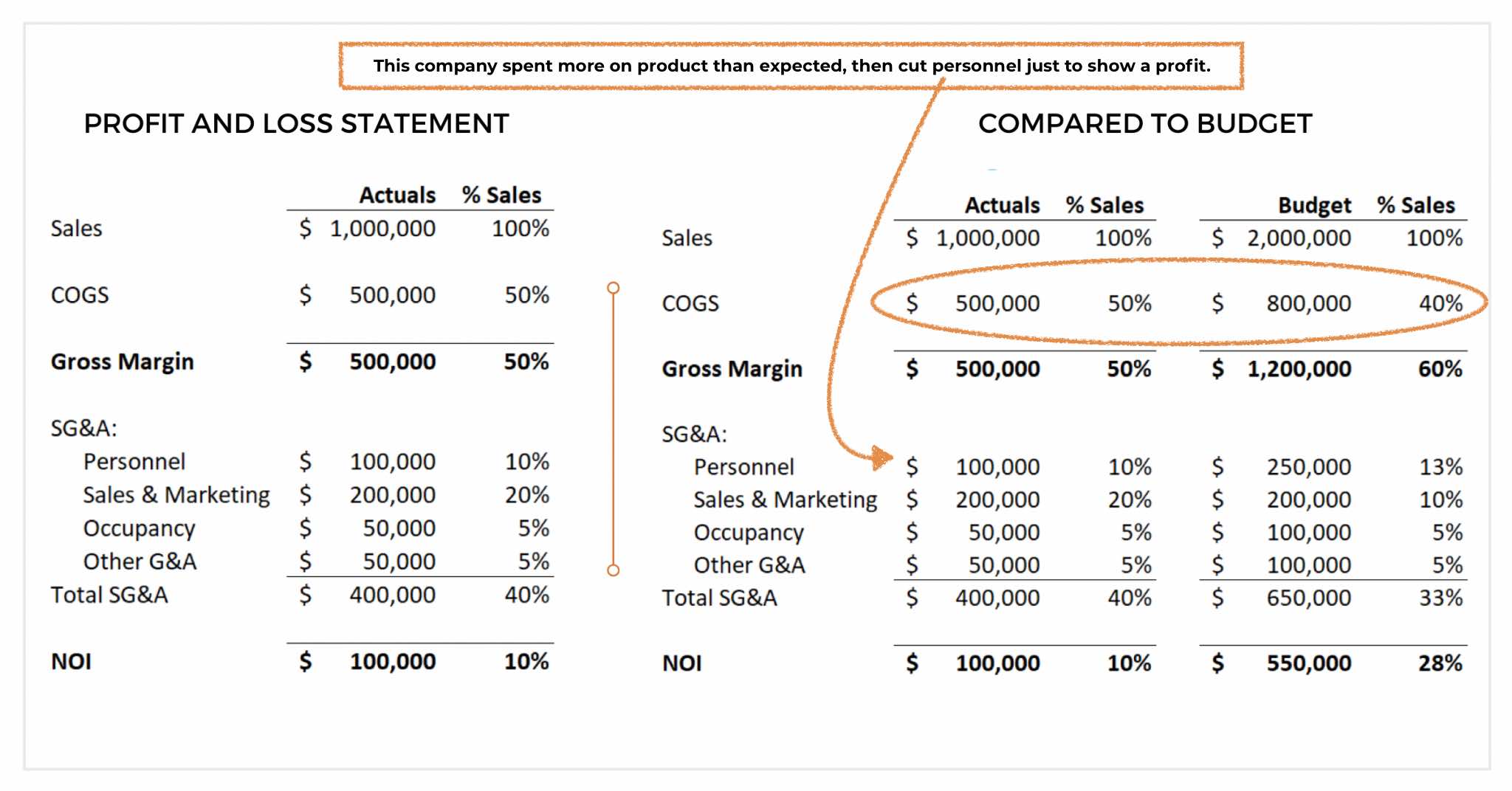

Its main aim is to calculate how much cash flow your business generated or losses within a given period. Adjusted income statement, balance sheet and cash flow adjusted income statement (in euro million) fy 2022 fy 2023 % change revenue 19,035 23,199 22% other recurring operating income and expenses (16,724) (20,155) share in profit from joint ventures 97 122 recurring operating income 2,408 3,166 31% % of revenue 12.6%. The three core financial statements are 1) the income statement, 2) the balance sheet, and 3) the cash flow statement.

The financial statements are used by. The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. An income statement is a measure of a company's profitability.

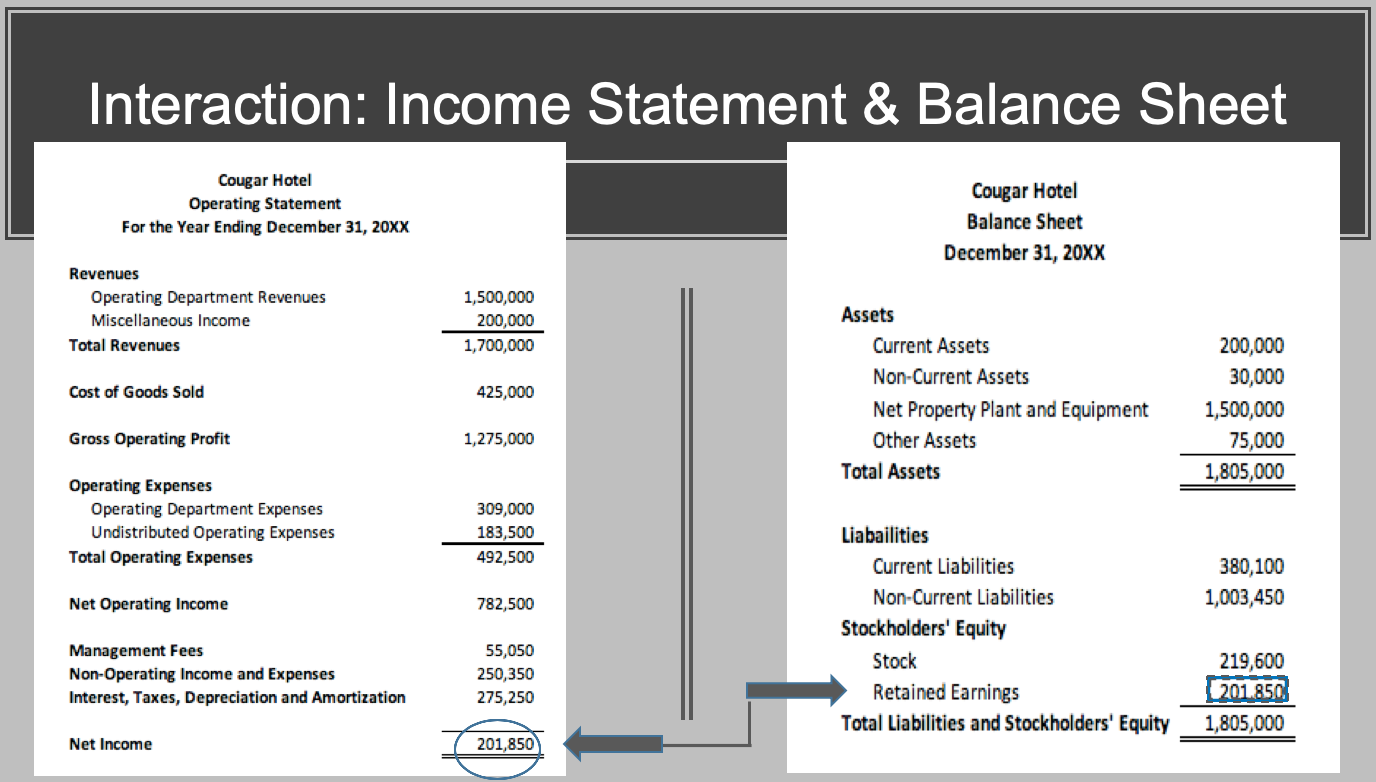

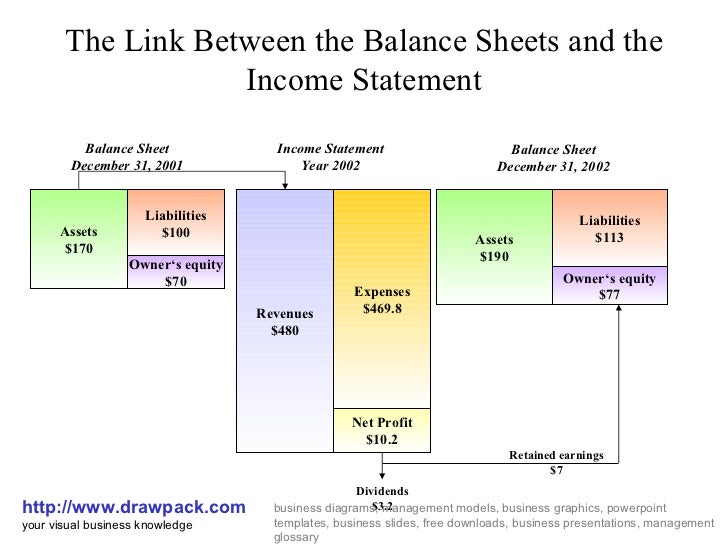

Differentiate between expenses and payables. Net income from the bottom of the income statement links to the balance sheet and cash flow statement. Relationships between an income statement and the balance sheet under the accrual basis under the accrual method, expenses and revenue are recorded in the income statement of the accounting period to which they relate.

Three core financial statements doing the example with accounts payable growing fair value accounting economics > finance and capital markets > accounting and financial statements > three core financial statements We can see that the cash movement between the balance sheets is the ending cash balance (75) less the beginning cash balance (30) which, comparing this to the cash flow statement above, is the same as the cash flow (45), so the link. Why do shareholders need financial statements?

The income statement shows all your business’s expenses and incomes over a period of time. Finance and capital markets > unit 5 lesson 2: Lenders may want to evaluate both along with the cash flow statement you create from them as part of their funding decision.

The financial statements are comprised of the income statement, balance. An expense versus a payable. While an income statement shows how your business earned money across time, your balance sheet provides a snapshot of your company’s financial health in the present.

Analyzing these three financial statements is one of the key steps when creating a financial model. These three financial statements are intricately linked to one another. The two bases of accounting are the cash basis and the accrual basis, briefly introduced in describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate.

On the balance sheet, it feeds into retained earnings and on the cash flow statement, it is the starting point for the cash from operations section. Expenses versus payables. In this article, we explain what income statements, balance sheets and cash flow are, share how companies use them to determine their financial health and show what makes them different from one another.

:max_bytes(150000):strip_icc()/AppleCFSInvesto2-6a84aed790a5476abbc3ef04b1718106.jpg)