Impressive Tips About Cost Of Goods Sold On Balance Sheet

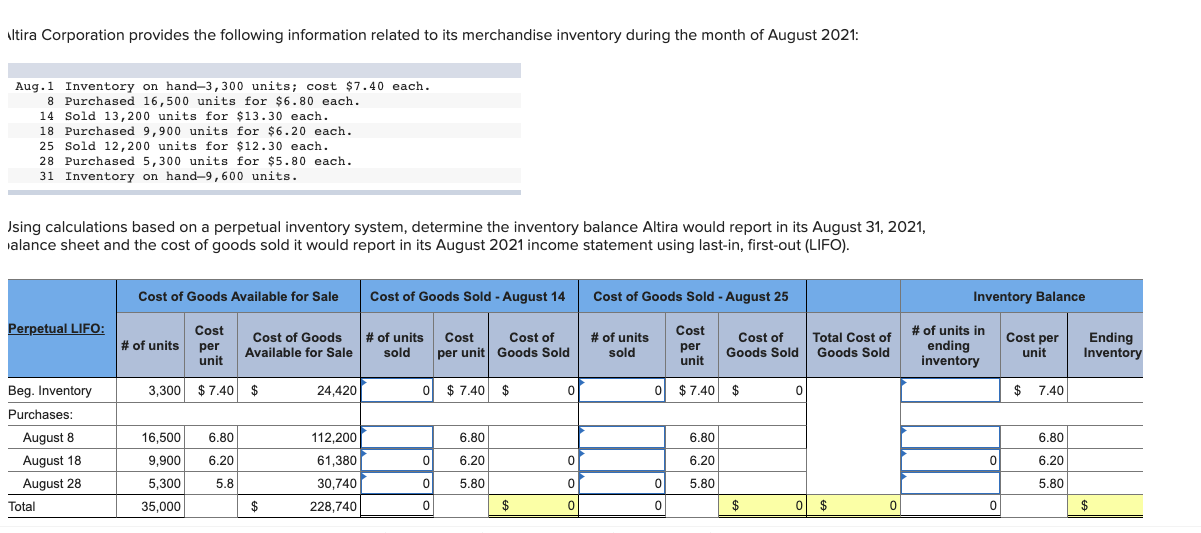

How to calculate the cost of goods sold (cogs) cogs and inventory;

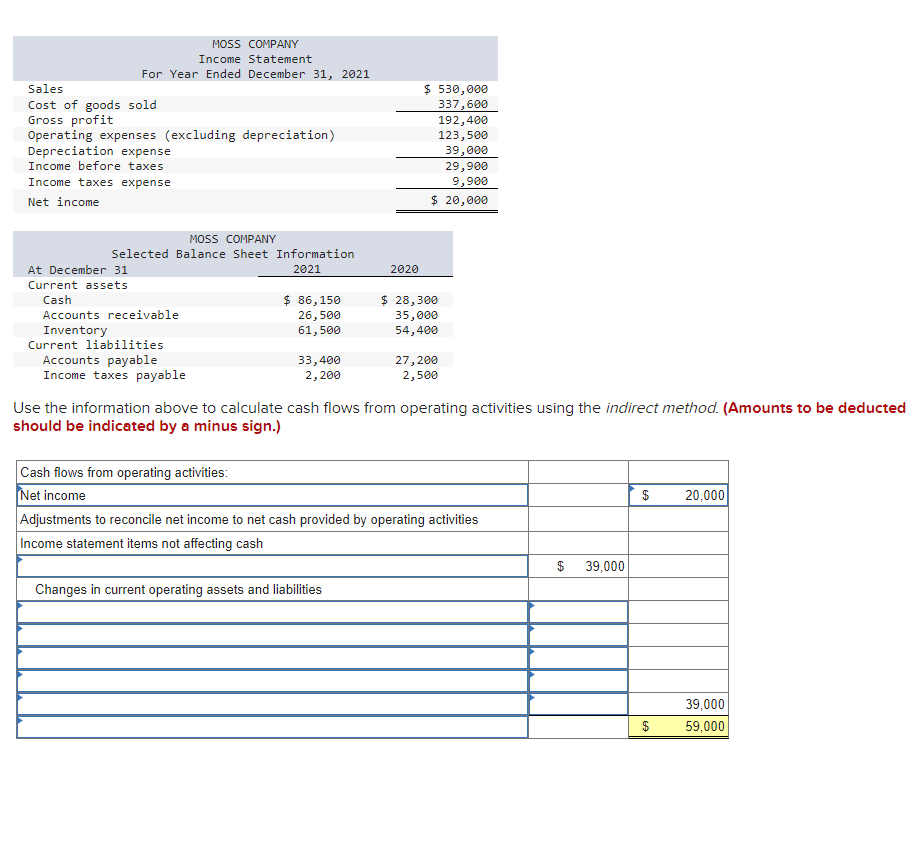

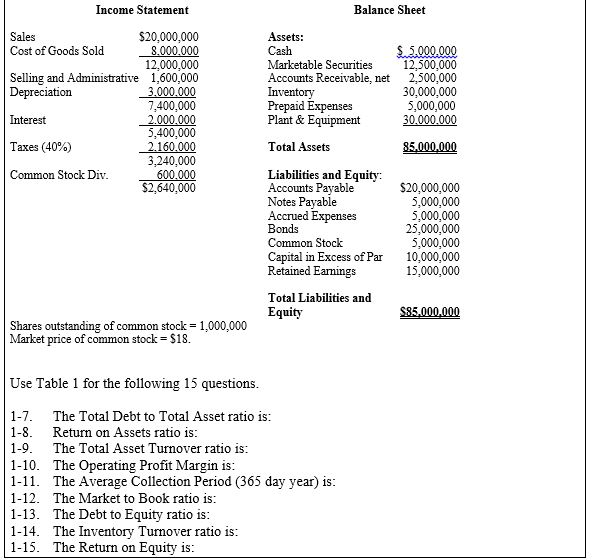

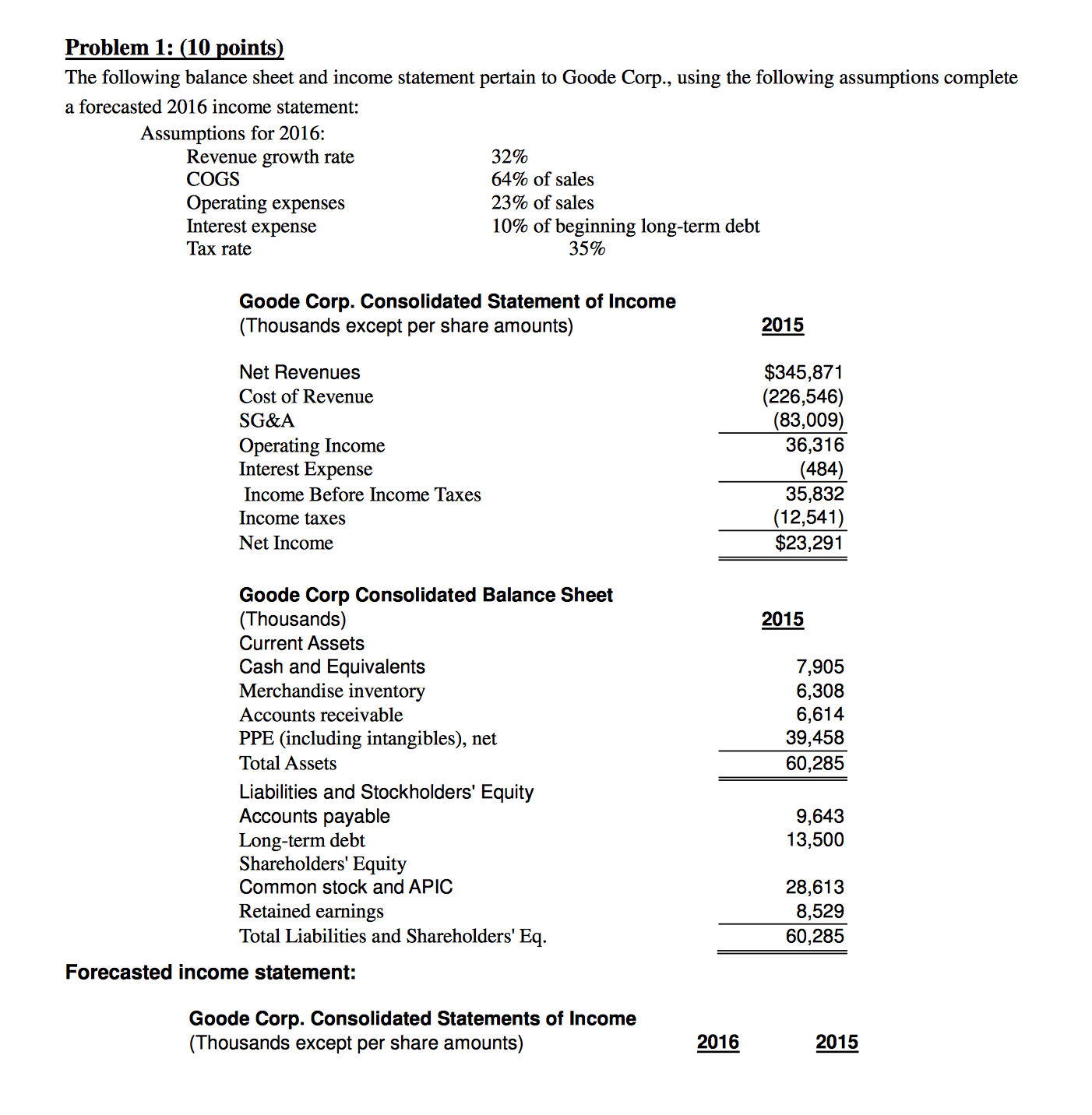

Cost of goods sold on balance sheet. How to use cost of goods sold for your business Expenses are costs your business incurs during operations. Now, if your revenue for the year was $55,000, you could calculate your gross profit.

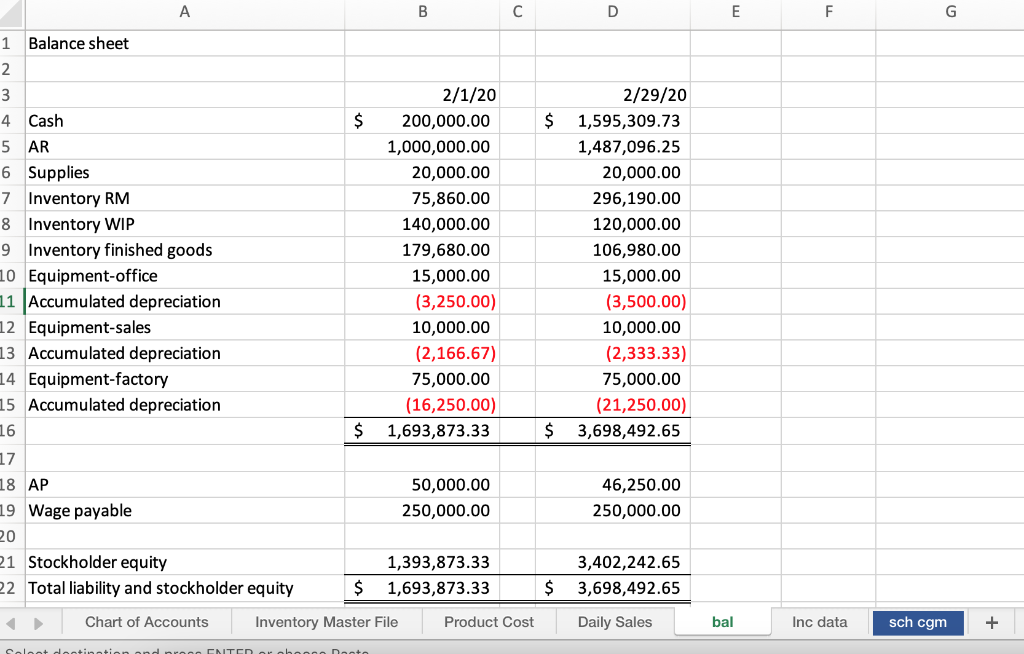

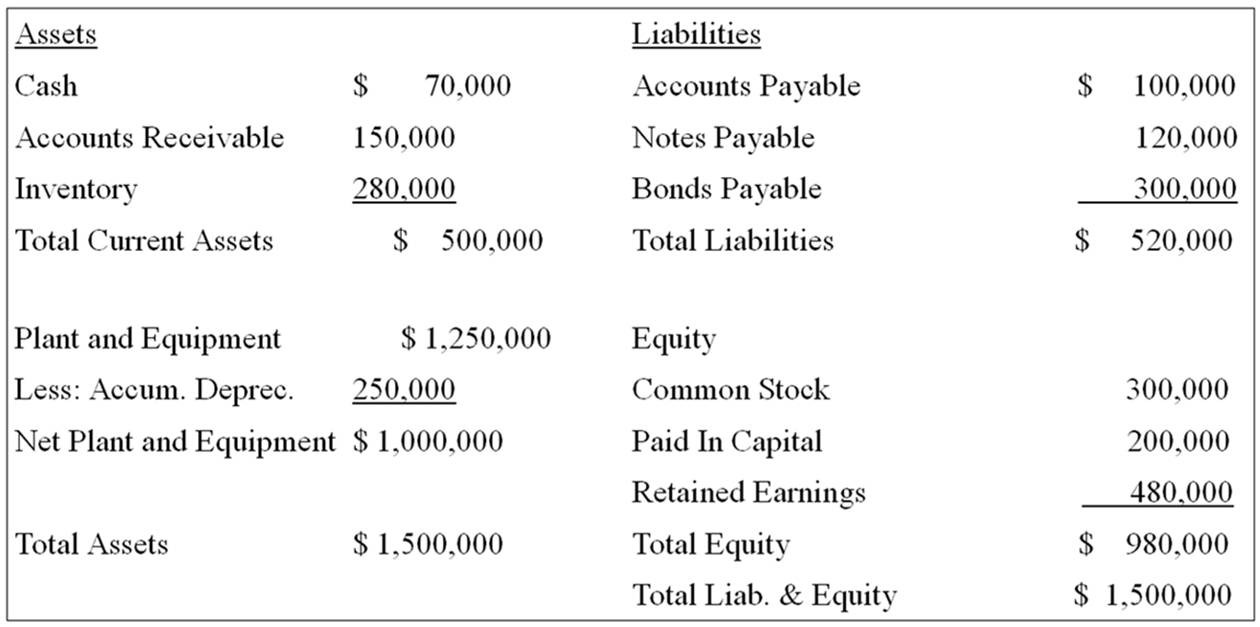

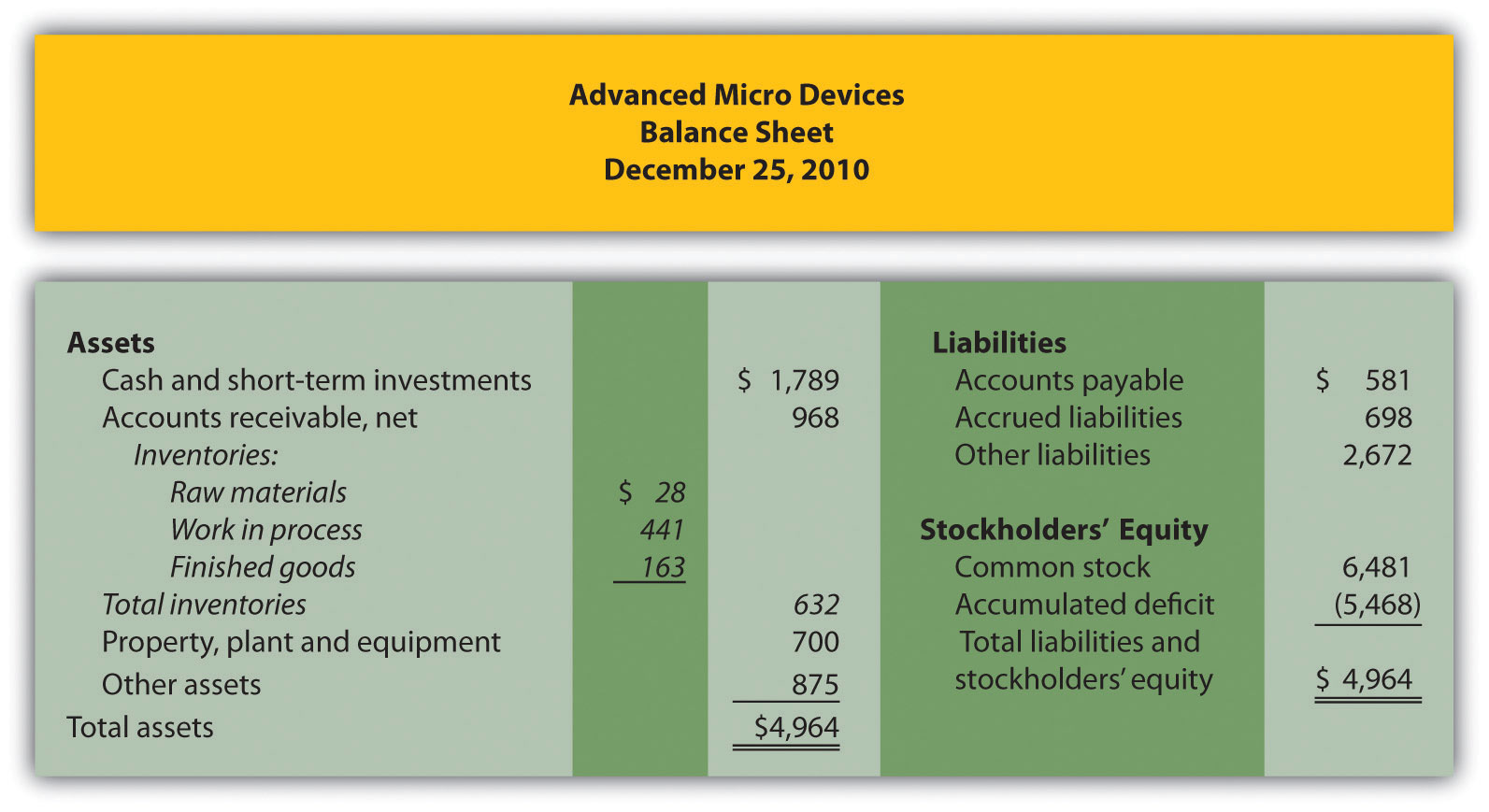

What goes into cost of goods sold Accountants record the ending inventory balance as a current asset on the balance sheet. You might depreciate it at $8,000 per year.

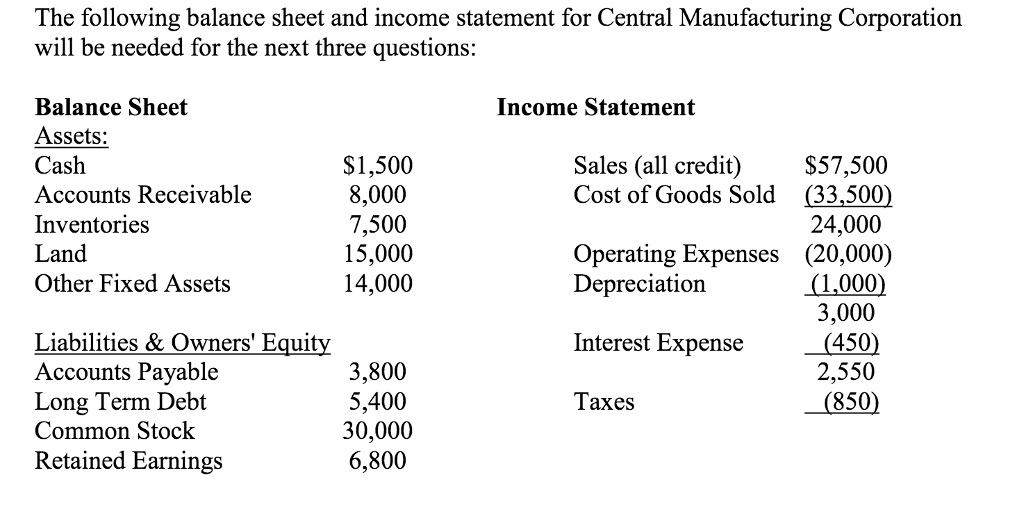

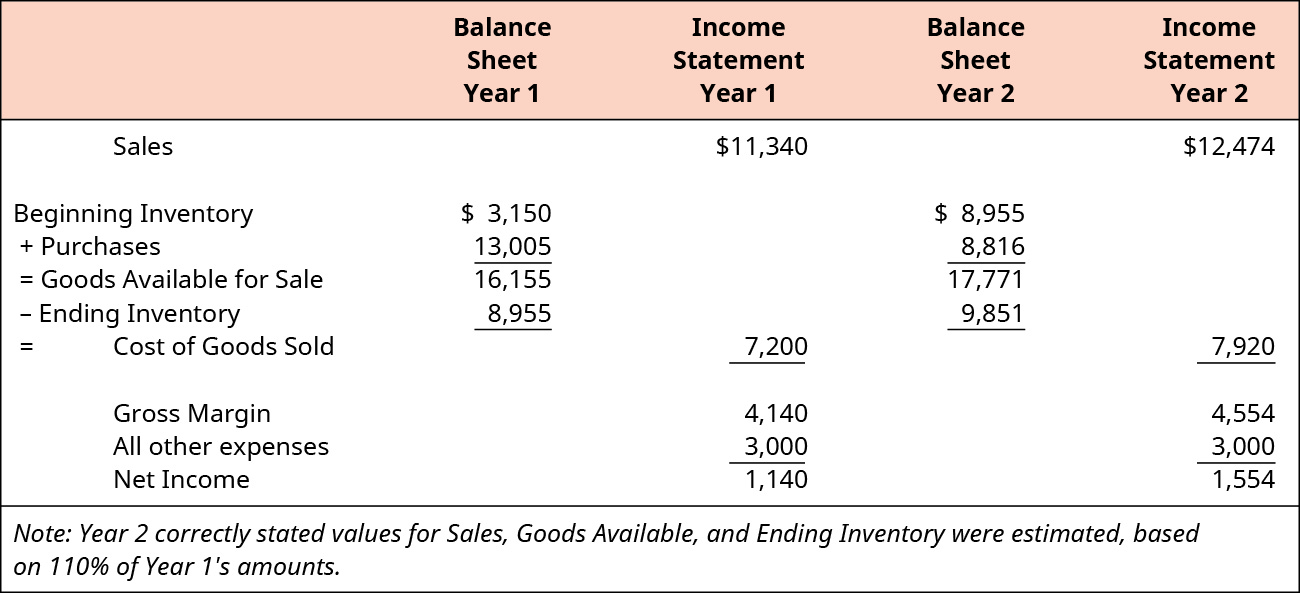

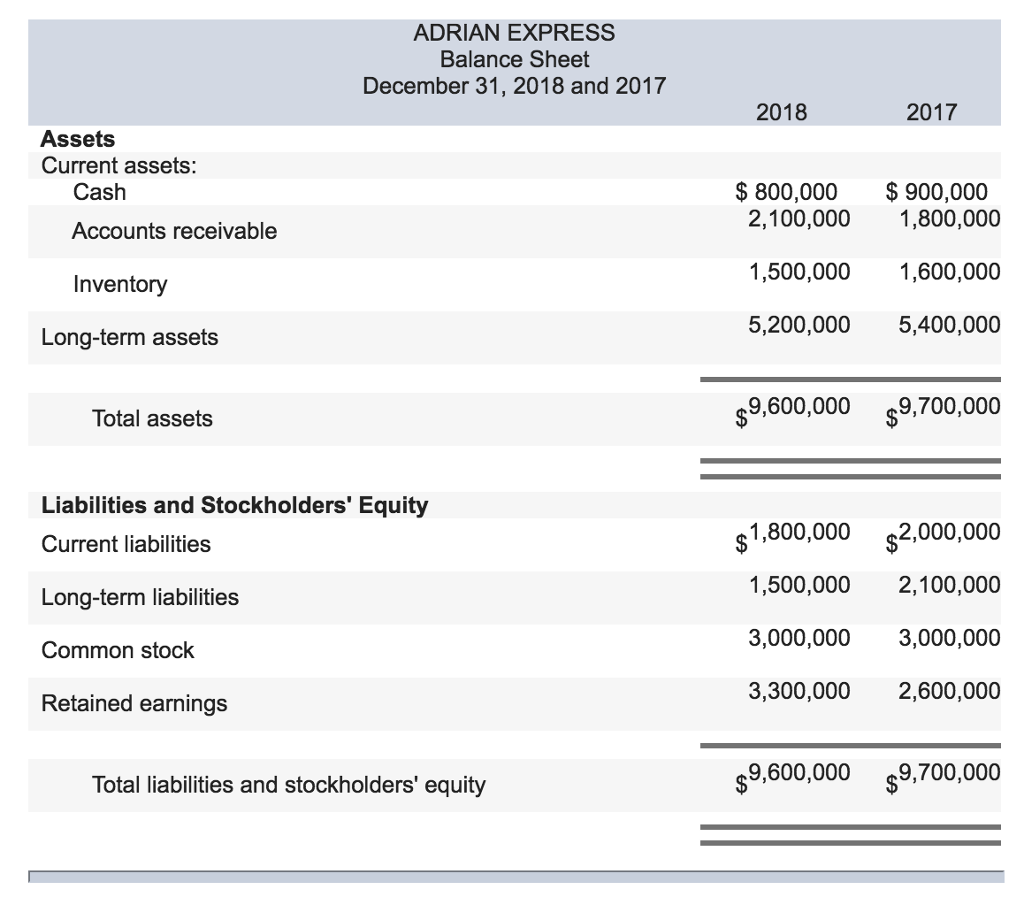

The balance sheet serves as a financial ledger that records a company’s assets, liabilities, and shareholder equity at a specific point in time. Determine the year 1 amount of cost of goods sold and the ending inventory balance that would appear on the financial statements that are prepared in accordance with gaap. This amount includes the cost of the materials and labor directly used to create the good.

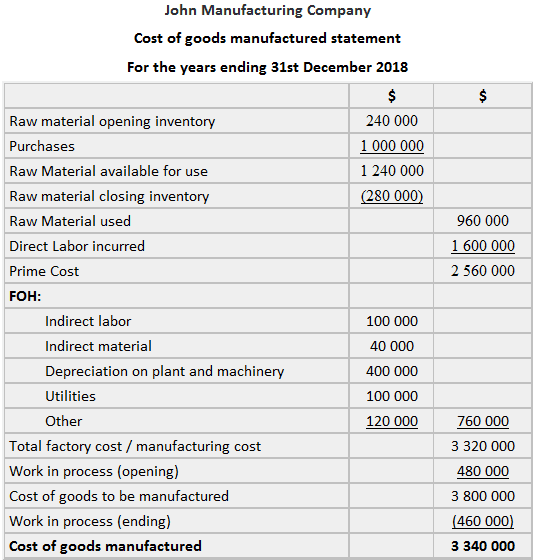

Determine the sales price assuming that adams desires to earn a profit margin that is equal to 25 percent of the total cost of. Cost of goods sold is likely the largest expense reported on the income statement. How is cogs different from cost of revenue and operating expenses;

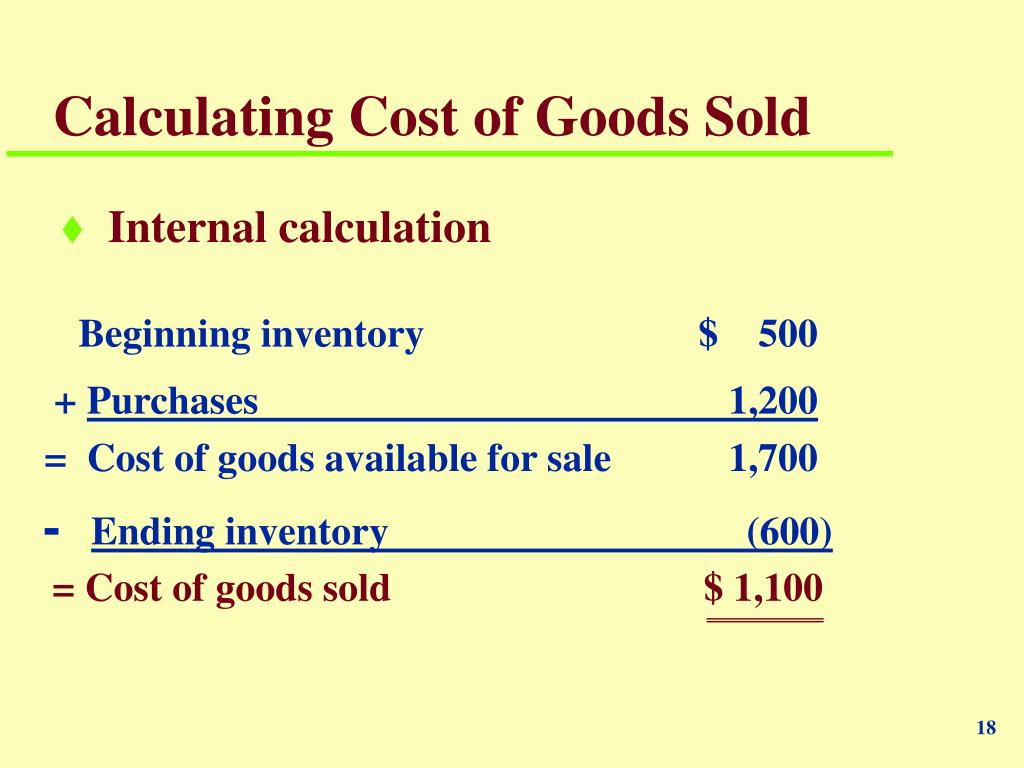

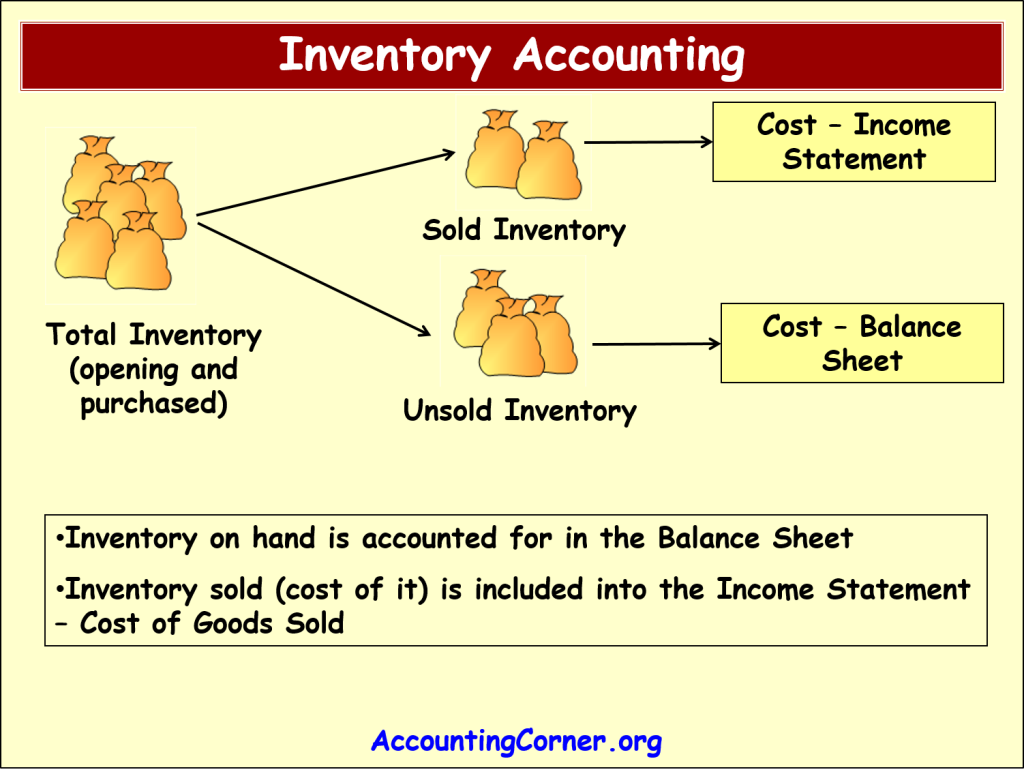

On the income statement , the cost of goods sold (cogs) line item is the first expense following revenue (i.e. Formula to calculate cost of goods sold (cogs) the formula to calculate the cost of goods sold is: Basically, the cost of goods sold is an accounting item of profit and loss account used in.

The cost of goods sold by the company is $51,000. The unsold 430 items would remain on the balance sheet as inventory for $1,520. Cogs are listed on a financial report.

What does cost of goods sold tell you, and why is it important? Cogs includes materials, labor, and other overhead expenses that are directly attributable to the production process. In other words, it is the expense directly attributable to the products a company produces and sells.

The cost of goods sold is the costs of goods or products sold during a specific period by the entity to its customers. Knowing the cost of goods sold can help you calculate your business’s profits. Cost of goods sold vs operating expenses.

Cost of goods sold (cogs) is an essential component of a business’s financial statements. 50 items at $5/item = $250; Cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company.

Cogs represents the inventory costs of goods sold to customers. The cost here refers to costs or expenses attributable directly to the goods or products that the entity sold, including the cost of direct labor, direct materials, and direct overheads. Cost of goods sold = $51,000.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

![[Solved] MOSS COMPANY Statement For Year Ended Dec](https://media.cheggcdn.com/media/c50/c50cca1f-cfa5-4c81-a37f-2810754a3a83/phpTzrprB)