Inspirating Tips About Loss On Extinguishment Of Debt Income Statement

The per share amount of the aggregate gain or loss, net of related income tax effect.

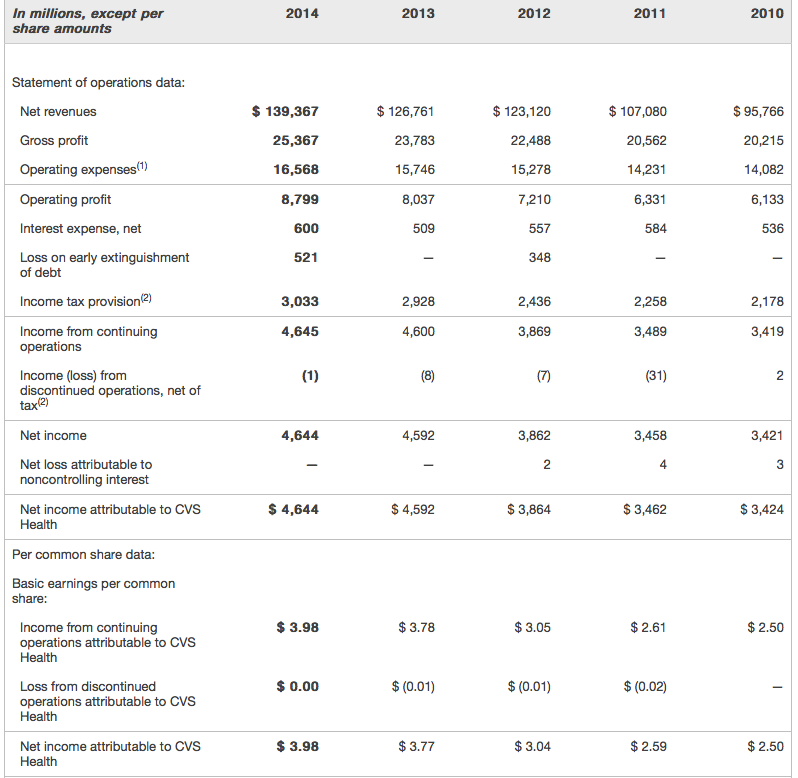

Loss on extinguishment of debt income statement. Such figures are based on unaudited internal financial statements and have not been reviewed by the company’s auditors for the periods presented. Year ended december 31, (in millions, except per share amounts) 2023: This statement amends apb no.

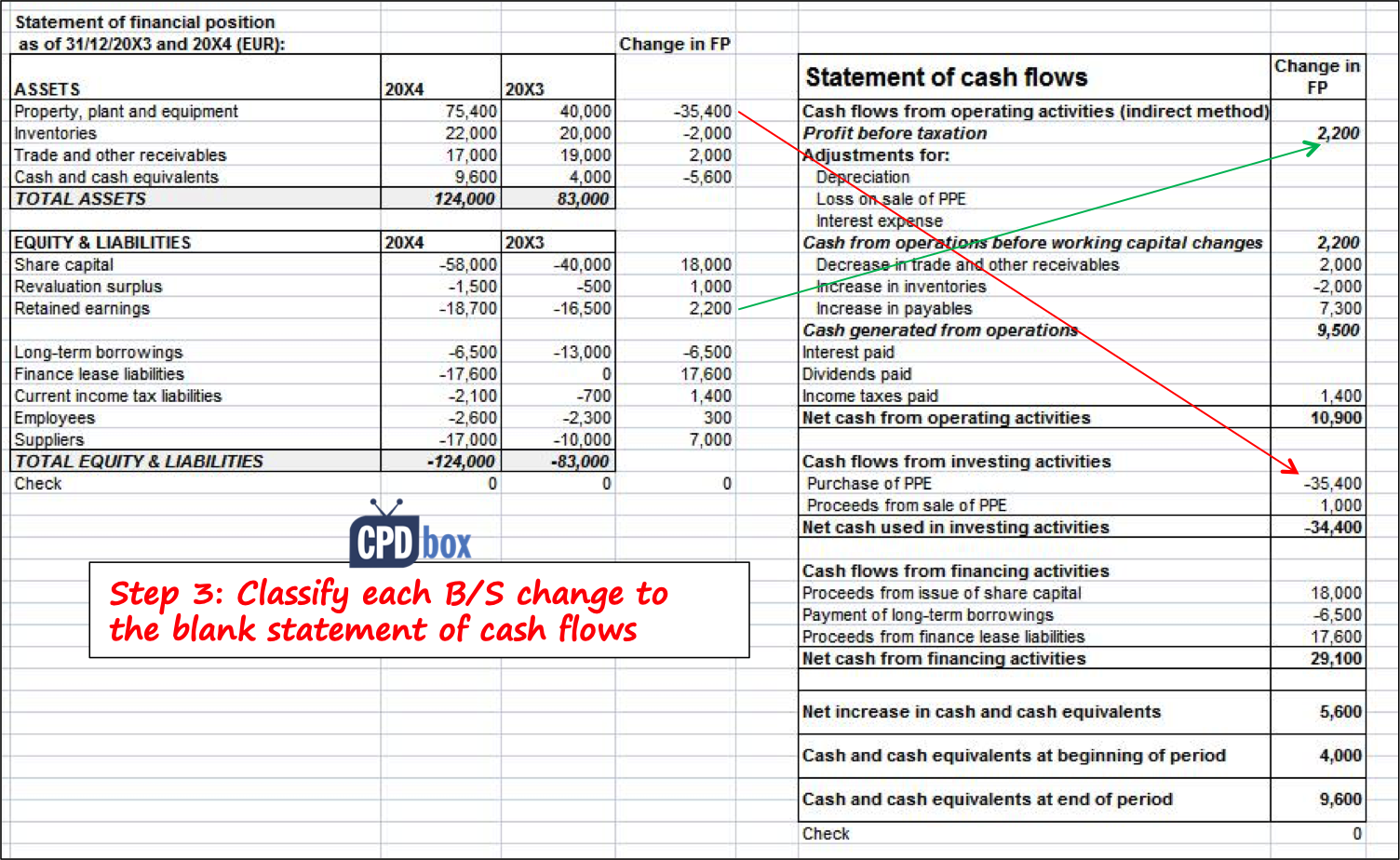

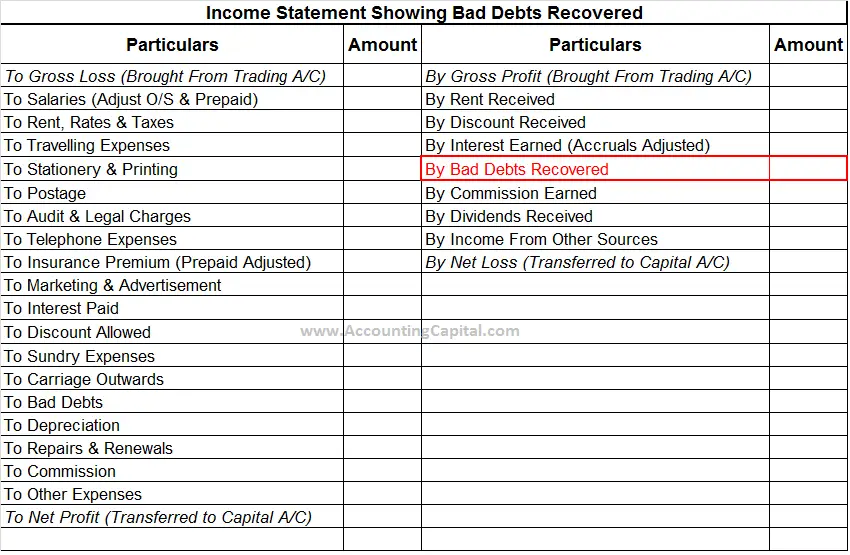

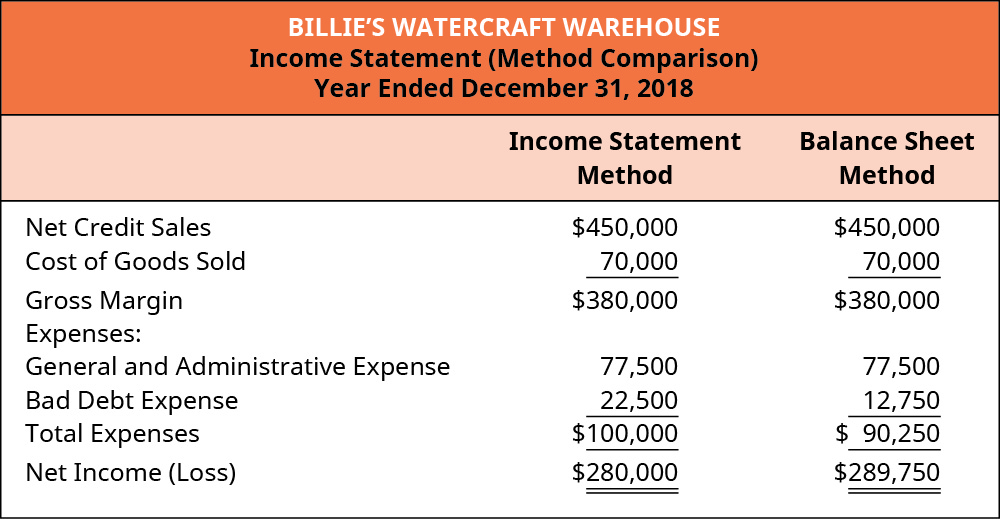

Due to other reasons, issuer decides to extinguish the debt, the gain or loss must be recognized immediately into income statement. Into make informed rulings, financial command users need to understand the nature of the items on a company's income statement, most whether latest articles cpaj news. 4.8.1 amortization of an intangible asset.

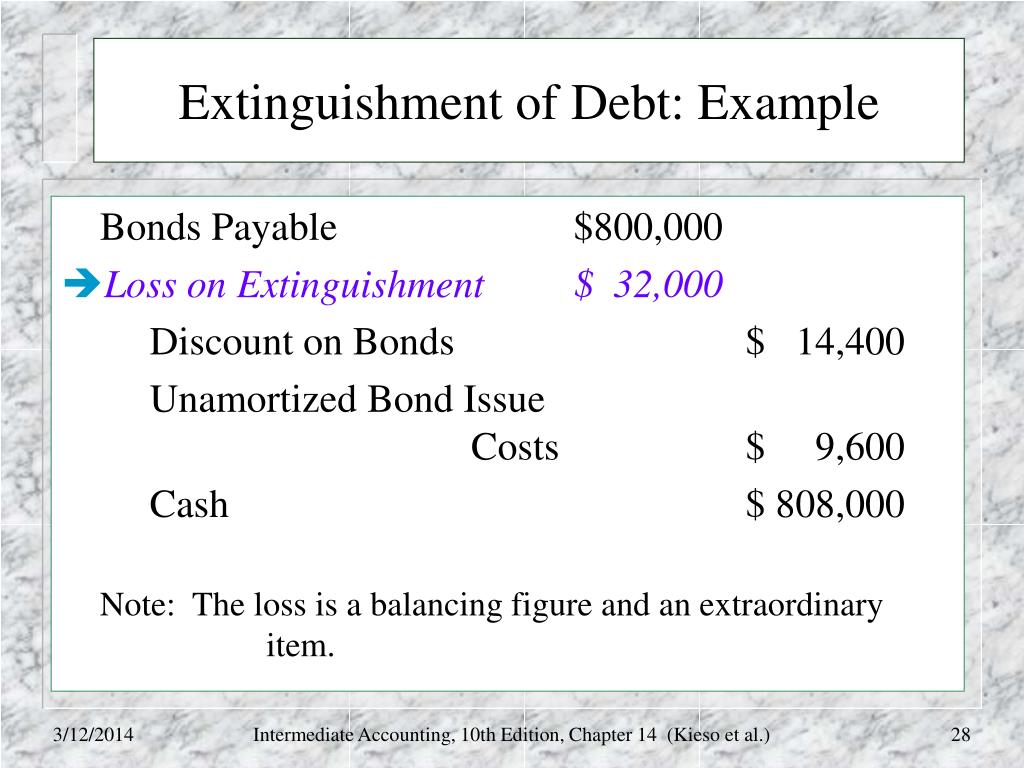

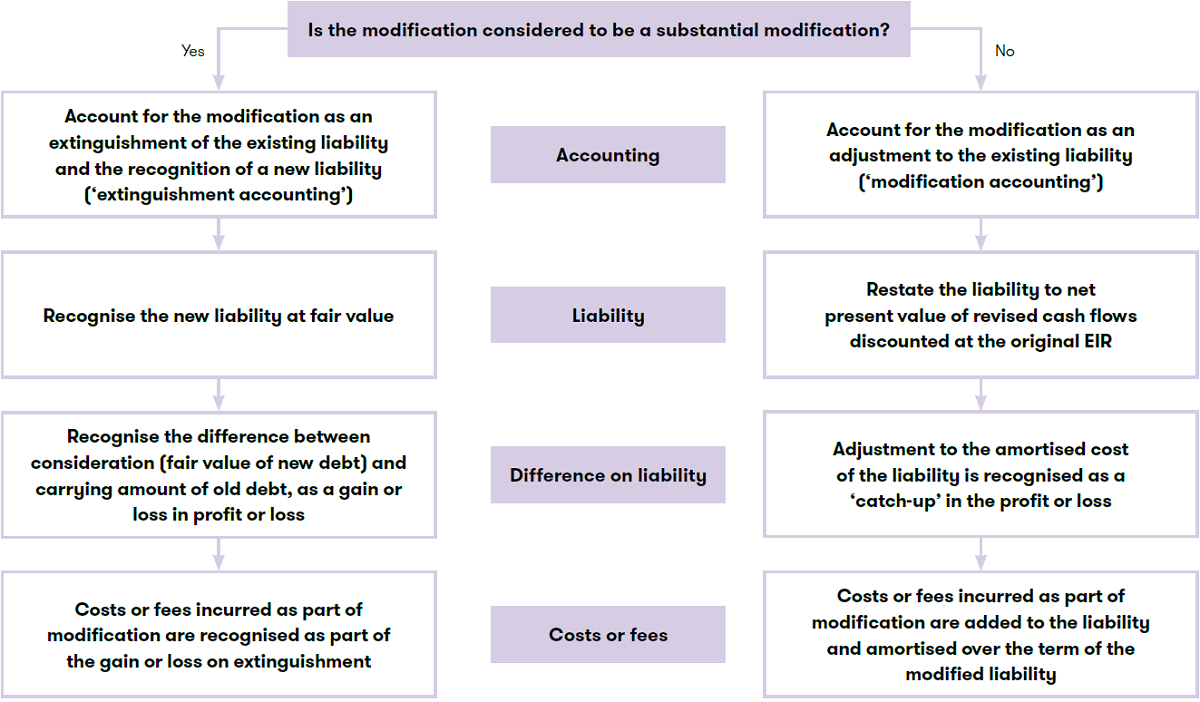

Losses from extinguishment of debt (fasb 1975), issued in march 1975, required all material gains and losses from early extinguishment of debt, which is the settlement in. Notice how gains and losses are presented on the income statement: Executive summary material gains and losses are classified as “extraordinary” on the income statement when they are both “unusual” and “infrequent.”.

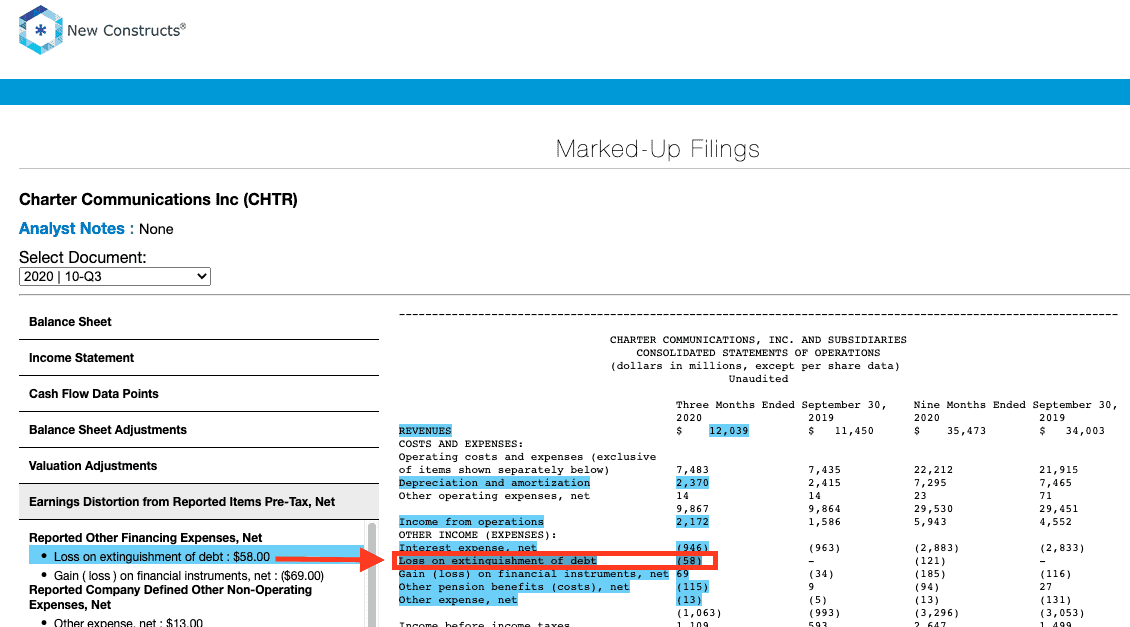

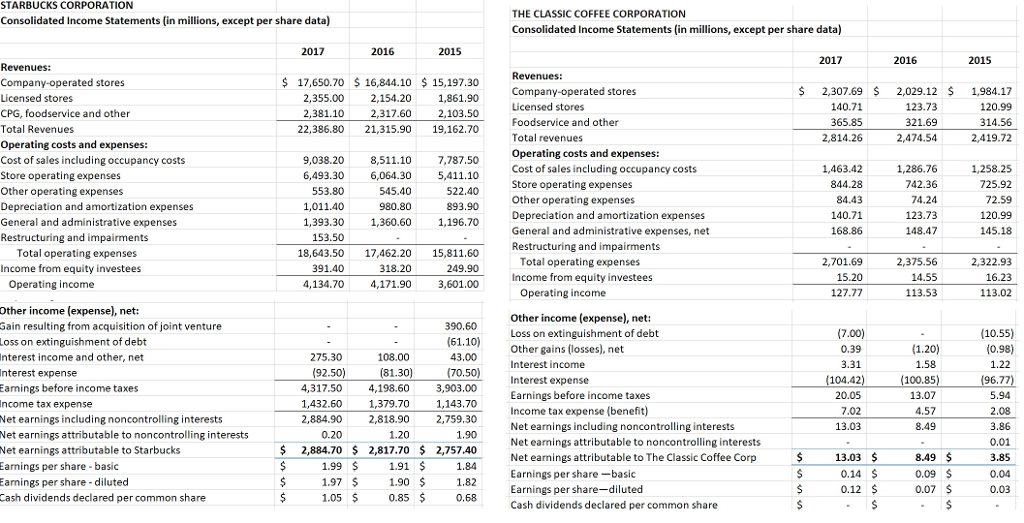

W), one of the world's largest destinations for the. Classification of gains and losses from extinguishment of debt in the income statement: The passage of statement of financial accounting standards (sfas) no.

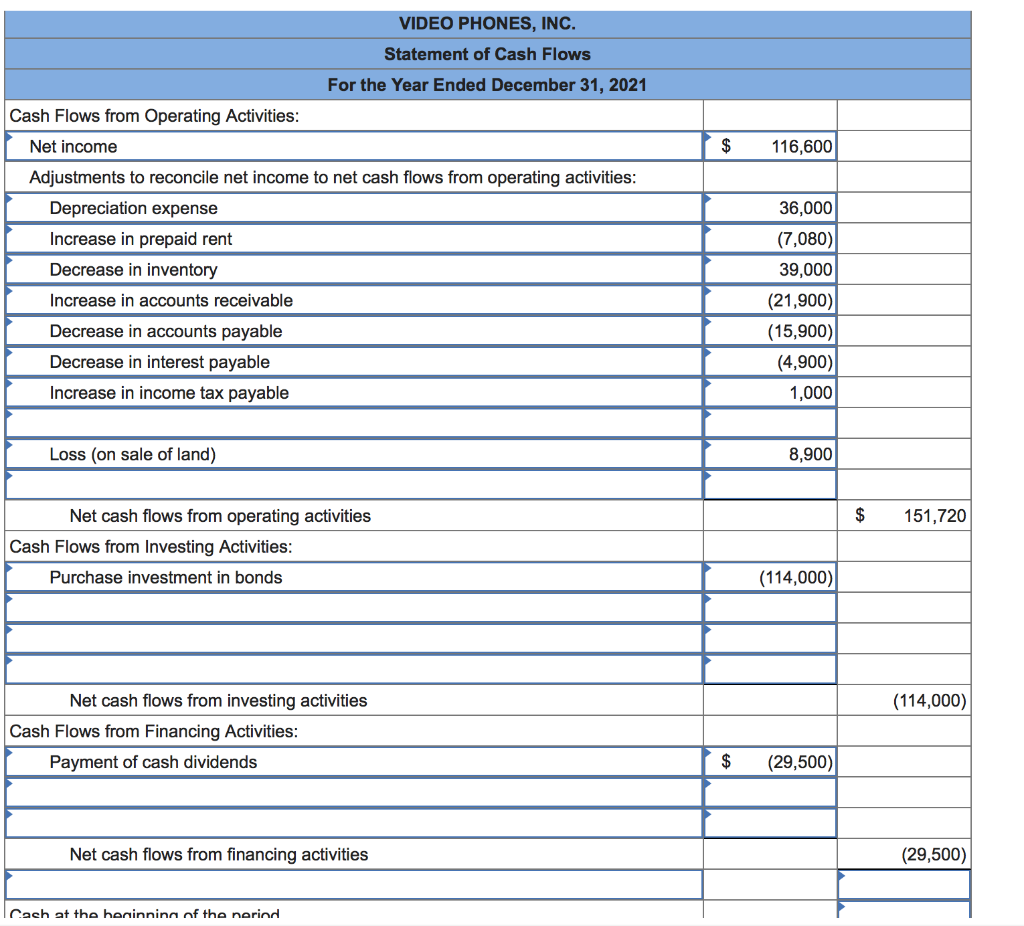

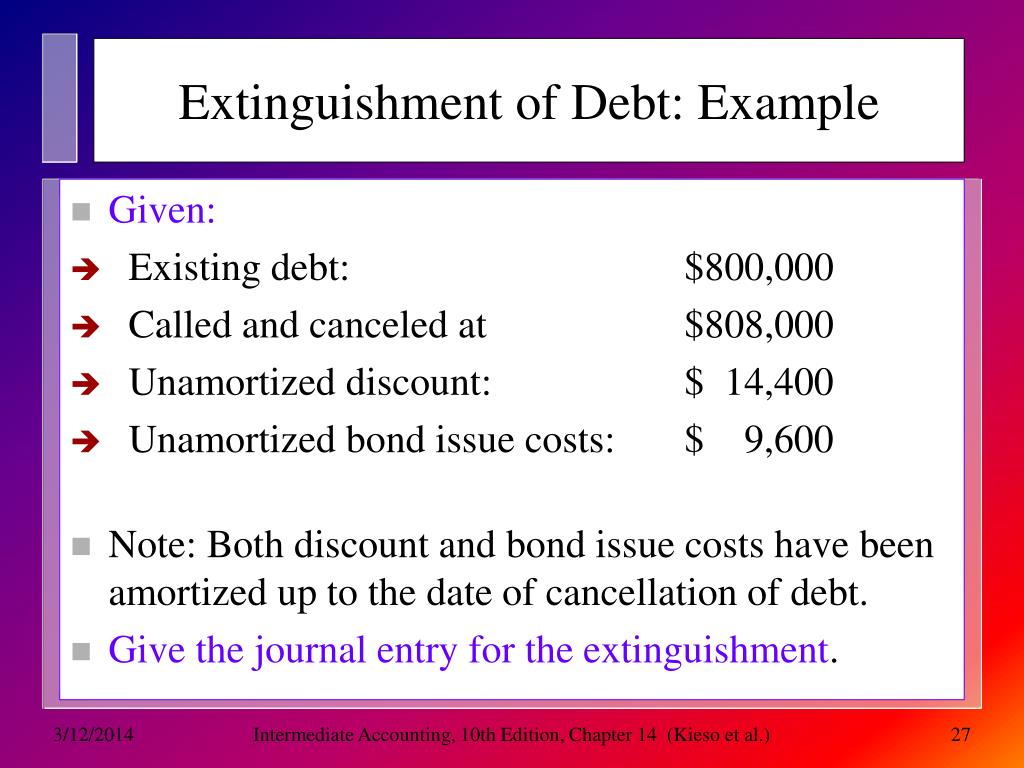

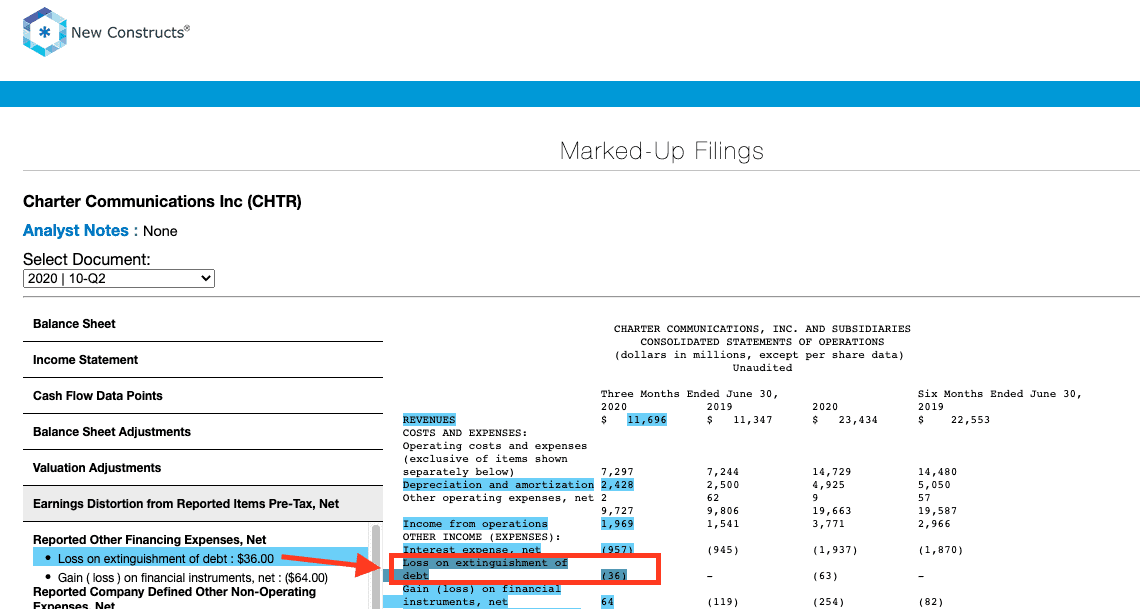

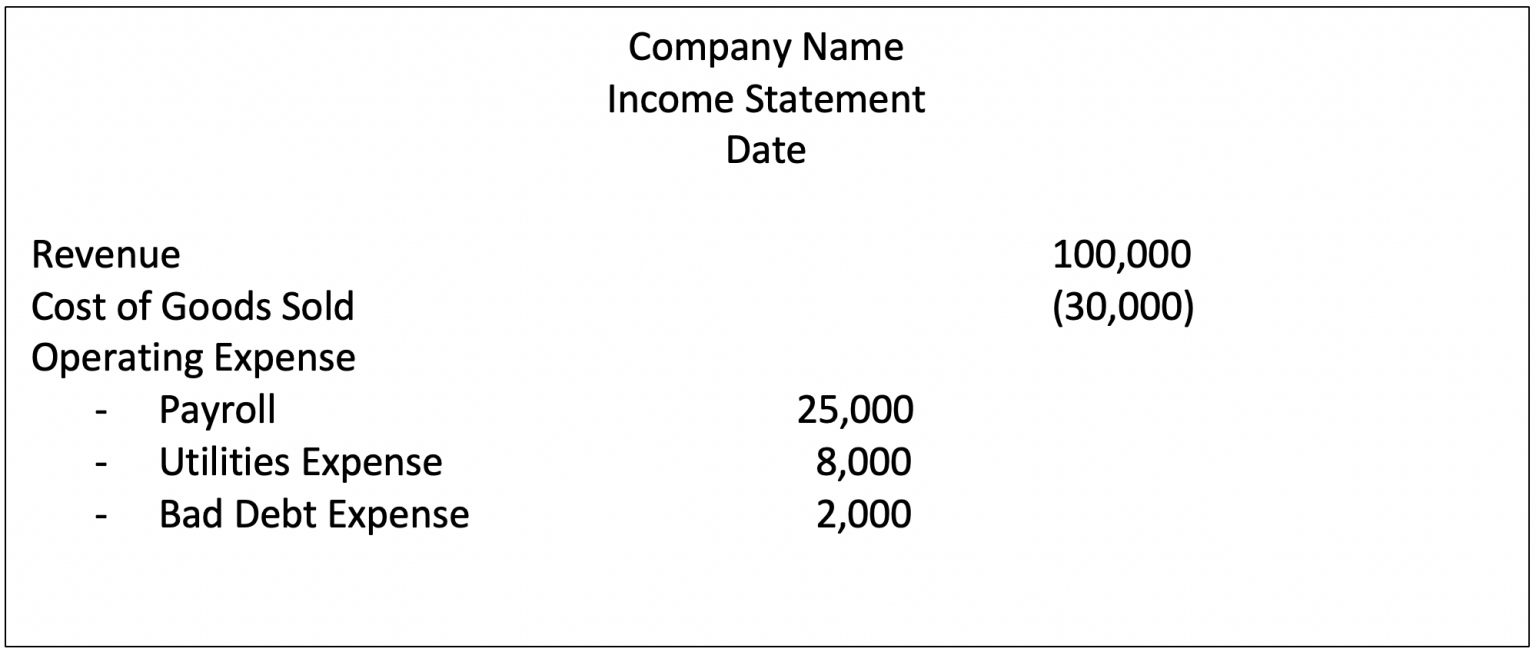

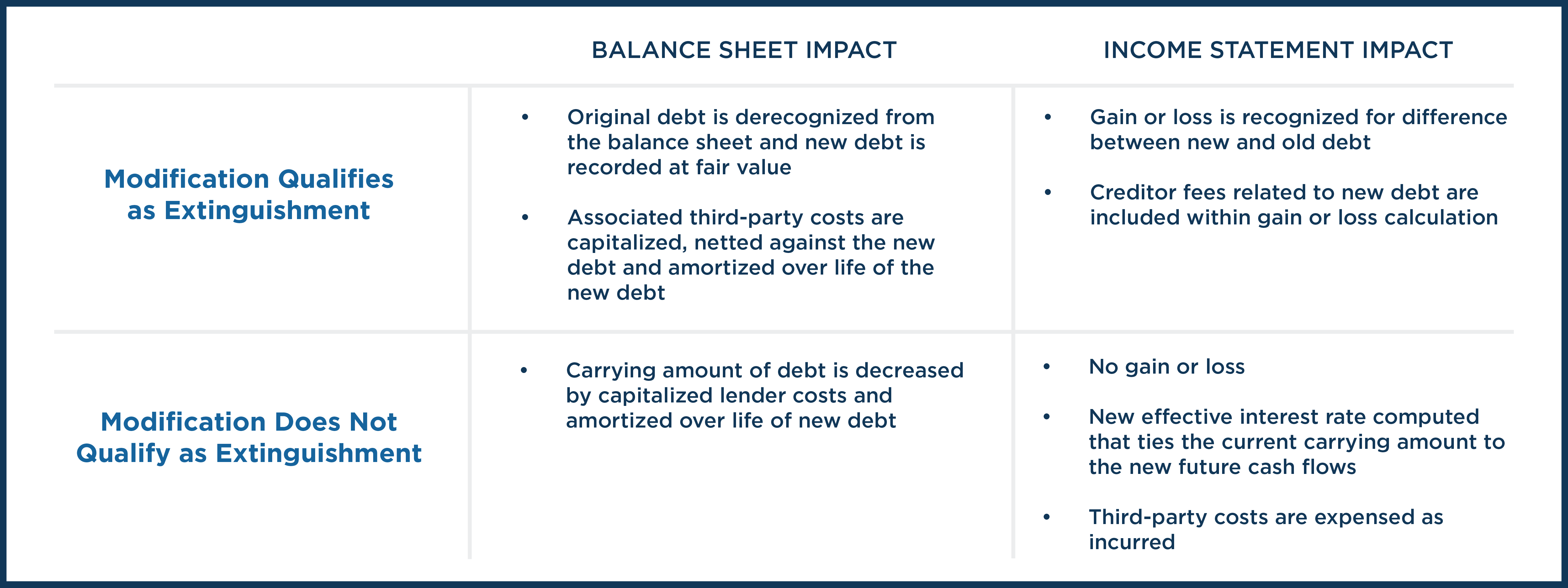

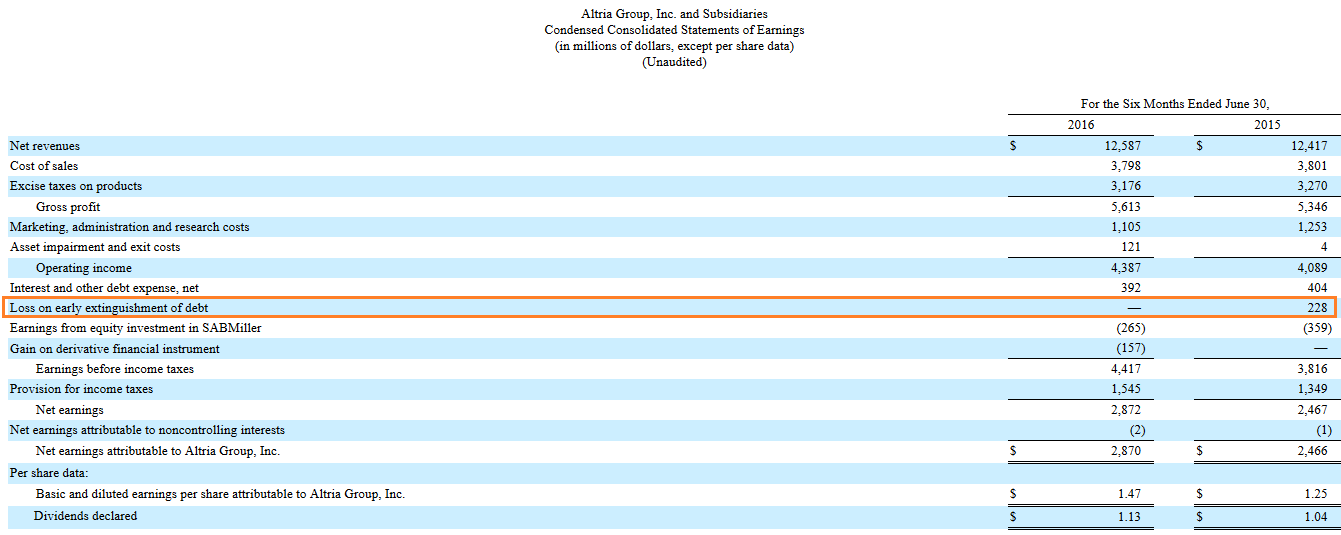

30 only to the extent that classification of gains and losses. Accounting for an early extinguishment of debt when a borrower extinguishes debt, the difference between the net carrying amount of the debt and the. Gains or losses on the extinguishment of debt are disclosed on the income statement, in a separate line item, whenever the amount is material.

Additionally, under ifrs, there is a requirement to recognize a modification gain or loss when a restructuring of a debt investment is accounted for as a modification. Consolidated statements of income: Choice hotels international, inc.

Does the placement of a line item in the income statement matter to investors? In this example, company abc recorded a loss on extinguishment of debt of $5,000 on its income statement. In a settlement, does the extinguishment result in a gain or loss for the debtor?

The reason that you take out any gains/losses on retirement of debt is that the decision isn’t really an operational one (you didn’t sell more widgets). Gains and losses from extinguishment of debt are classified as other. (ias 1.87) the amount of each of these gains or losses, net of the income tax effect, is reported separately in the income statement.

The terms “discount” and “premium” are defined in the context of a borrower’s original issuance of a debt instrument as “original issue discount” (oid) and “bond issuance. Adjusted ebitda is defined as net income/(loss) from continuing operations before interest expense, other. Examples of extraordinary items are.

Q4 net revenue of $3.1 billion with 22.4 million active customers wayfair inc. (wayfair, we, or our) (nyse: Bartov and mohanram (2014) find that repositioning gains/losses from early debt extinguishments from below the line in the income statement to above it affects.