Neat Tips About Formula For Free Cash Flow

Calculate fcf from sales revenue

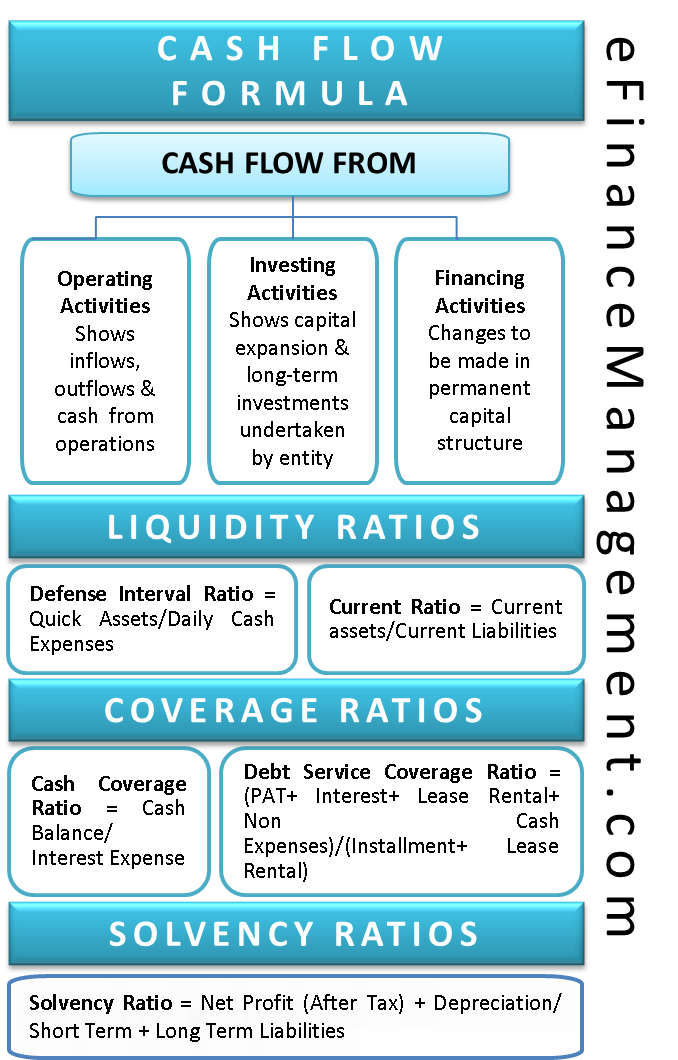

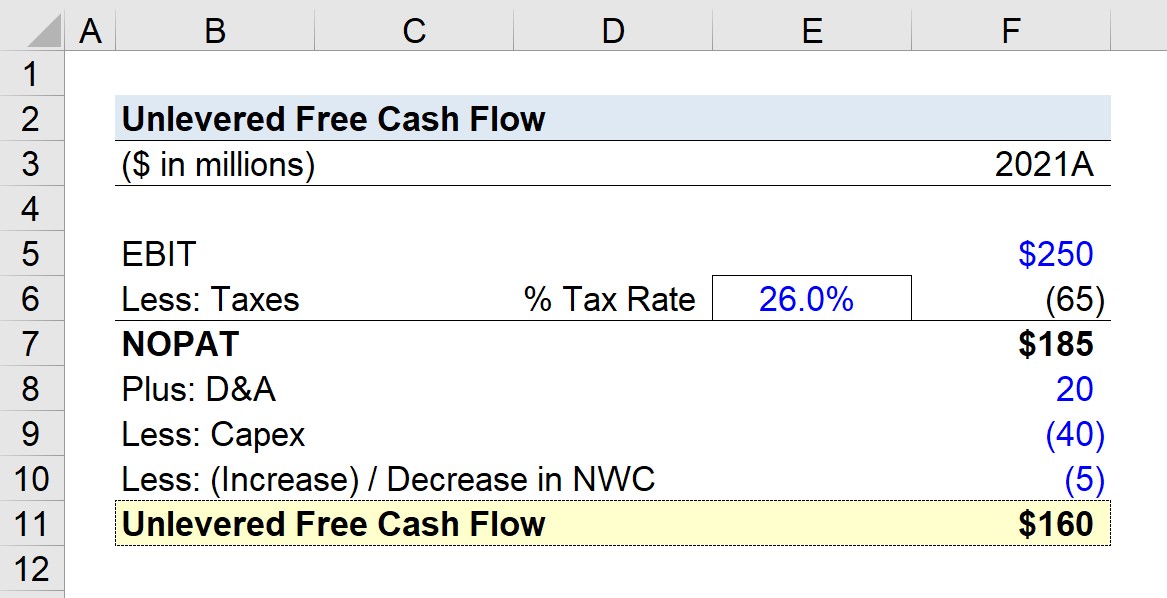

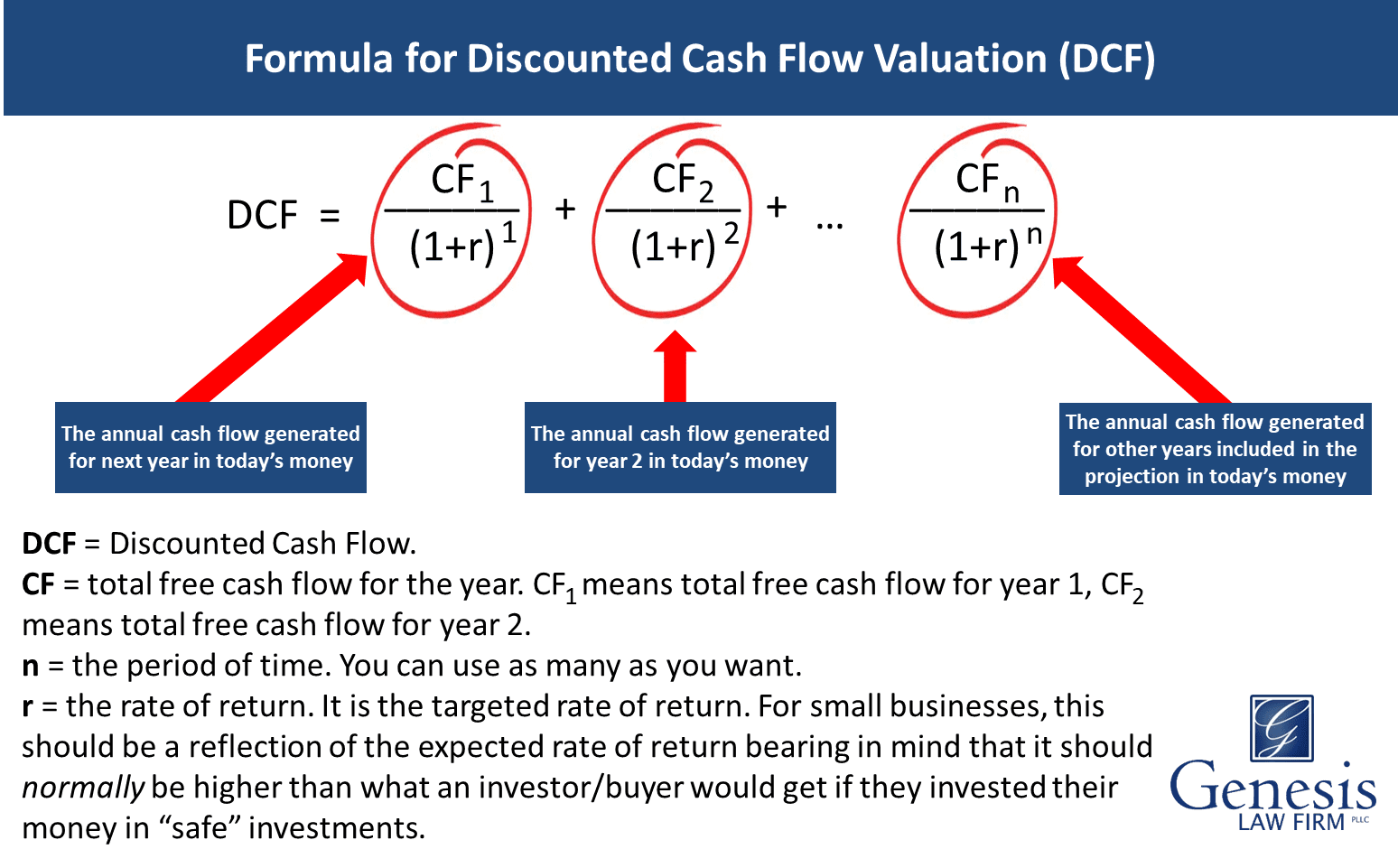

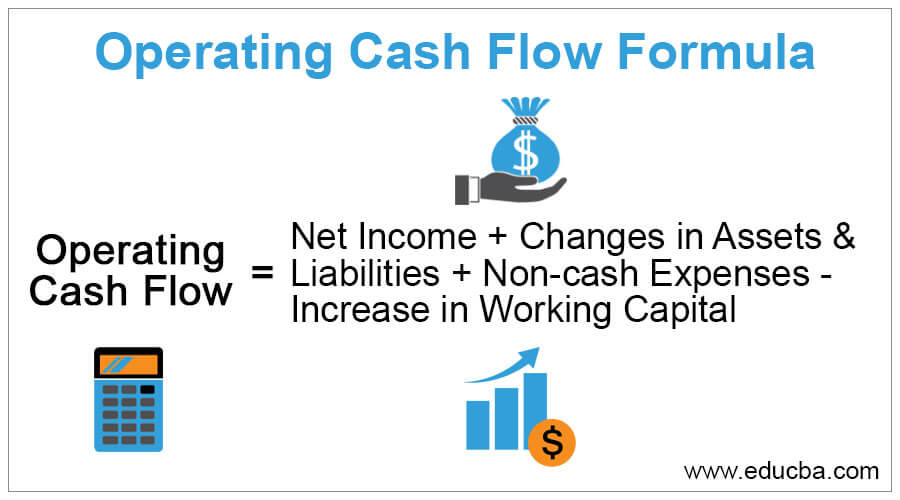

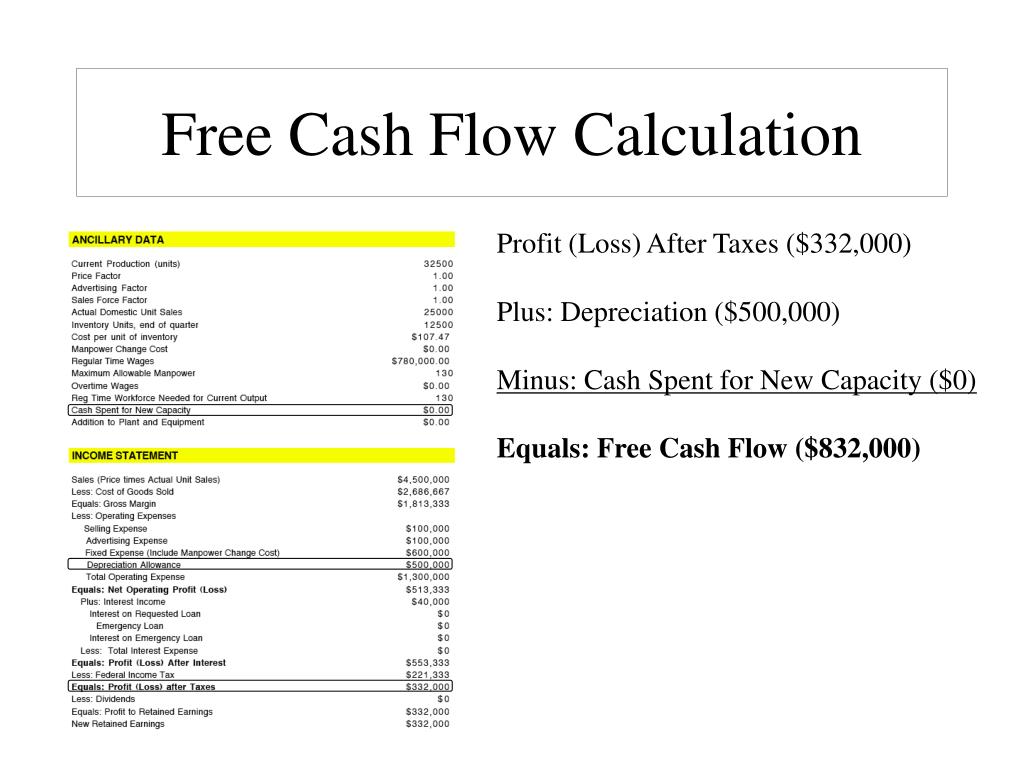

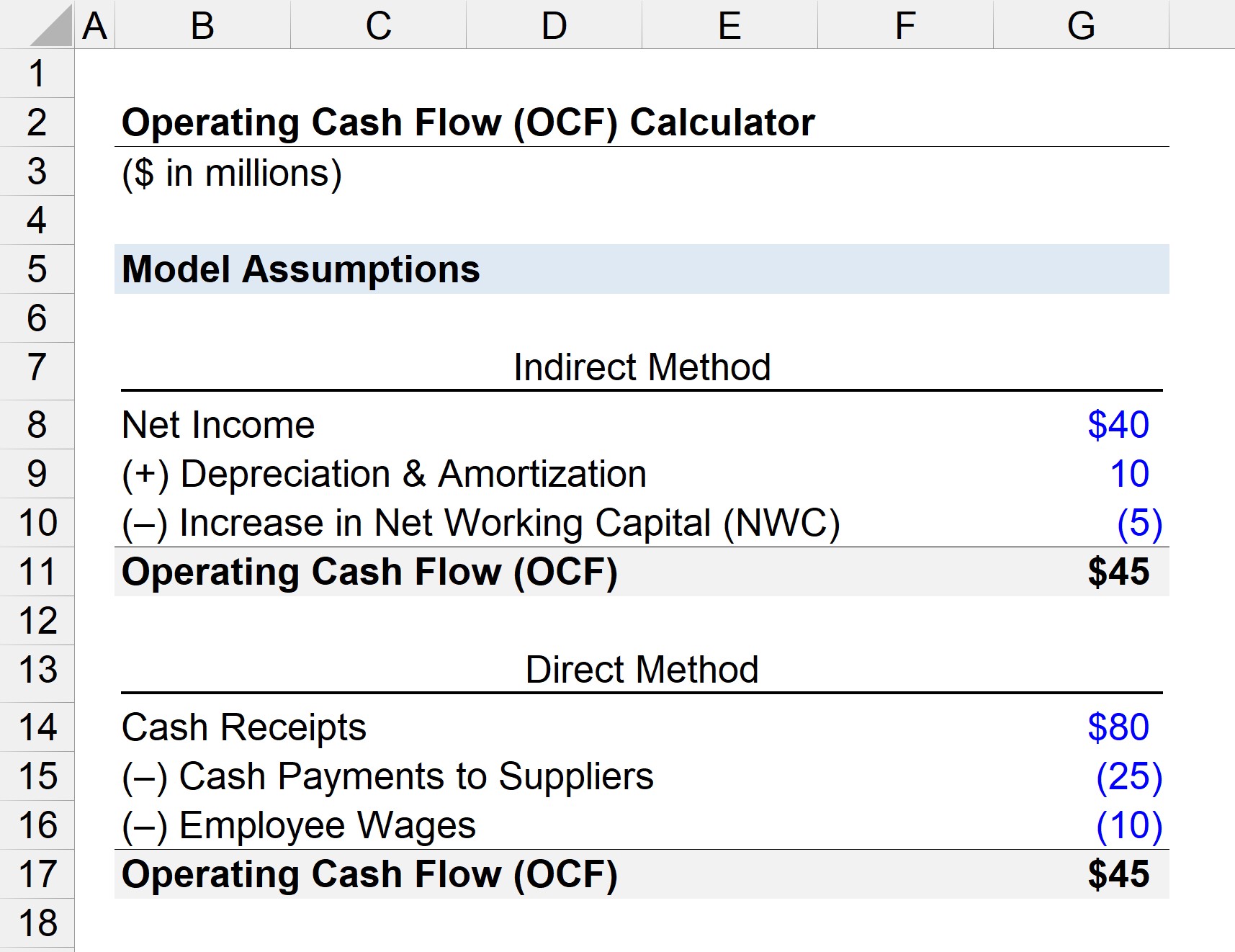

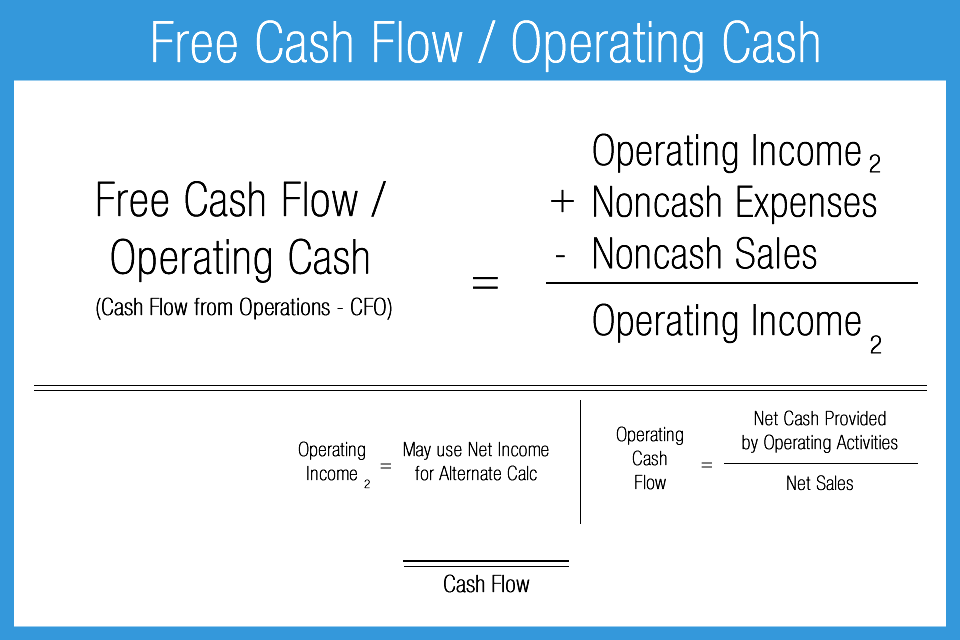

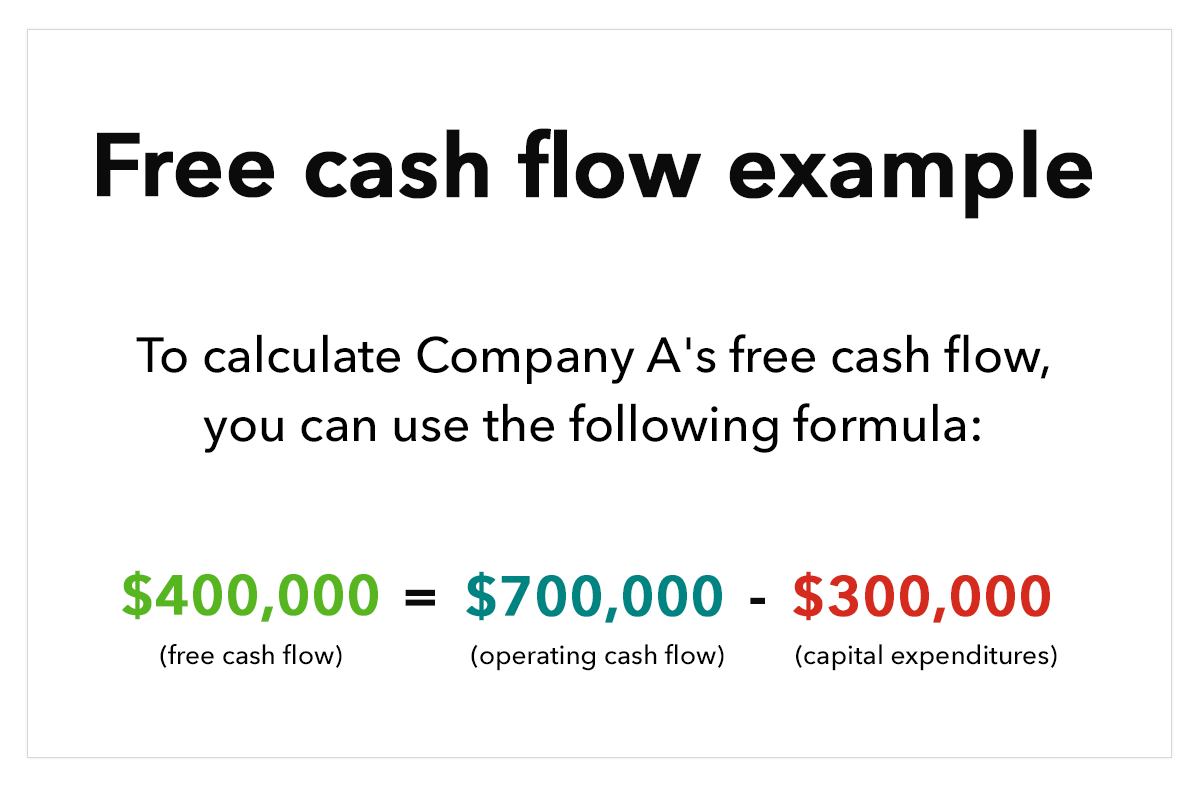

Formula for free cash flow. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates than it uses to run and expand the business by subtracting the capital expenditures from the operating cash flow. Free cash flow = sales revenue − (operating costs + taxes) − required investments in operating capital where: Free cash flow (fcf) = operating cash flow.

Alternatively, you can use a shorter and easier formula for free cash flow: Required investments in operating capital = year one total net operating capital. Free cash flow is how much is left over from operating cash flow after capital expenditures.

Key takeaways free cash flow (fcf) is a company's available cash repaid to creditors and as dividends and interest to investors. Free cash flow to the firm (fcff) represents the amount of. Calculate the fcf formula.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)