Marvelous Tips About Deferred Tax In Balance Sheet

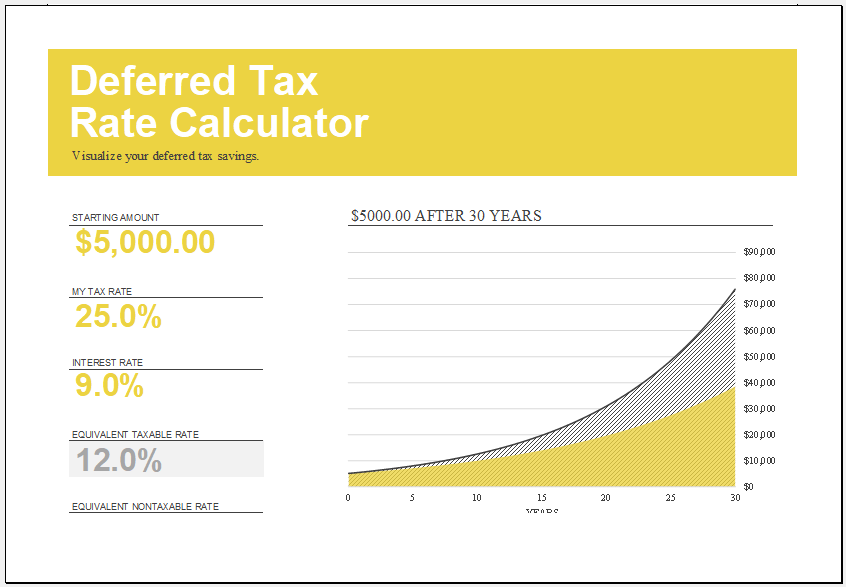

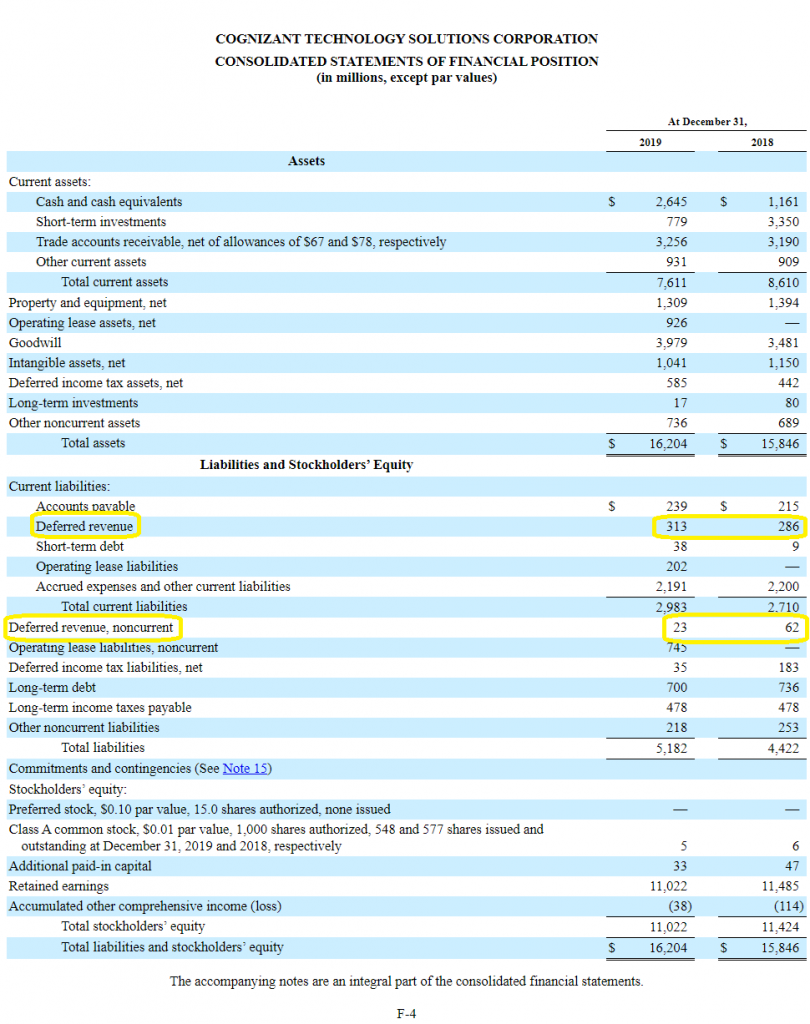

This asset and liability method, required by asc 740, measures the deferred tax liability or asset that is implicit in the balance sheet;

Deferred tax in balance sheet. It is assumed that assets will be realized, and. Deferred tax is recognised on. It is important for financial.

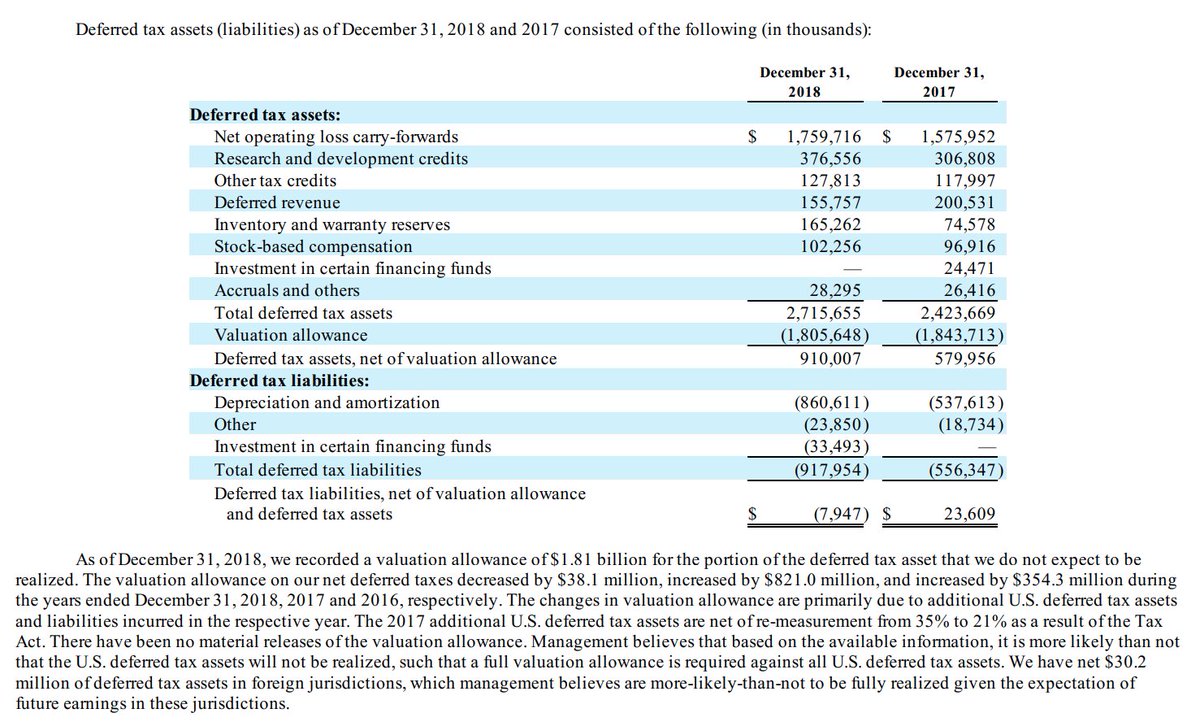

A deferred tax liability is a line item on a balance sheet that indicates that taxes in a certain amount have not been paid but are due in the future. A deferred tax asset is an item on a company's balance sheet that reduces its taxable income in the future. Deferred tax accounting is the recognition of the current and future tax consequences of book income or loss within the same reporting period.

Deferred tax assets (dtas) are an item recorded on a company’s balance sheet and can result from timing differences between tax and accounting treatment of certain. Therefore, the overpayment becomes an. Here’s how it is classified and claimed.

This money will eventually be returned to the business in the form of tax relief. Going off the prior depreciation example, the deferred tax liability (dtl) recorded on the. Deferred tax asset = unused tax loss or unused tax credits x tax rate tax bases the tax base of an item is crucial in determining the amount of any temporary.

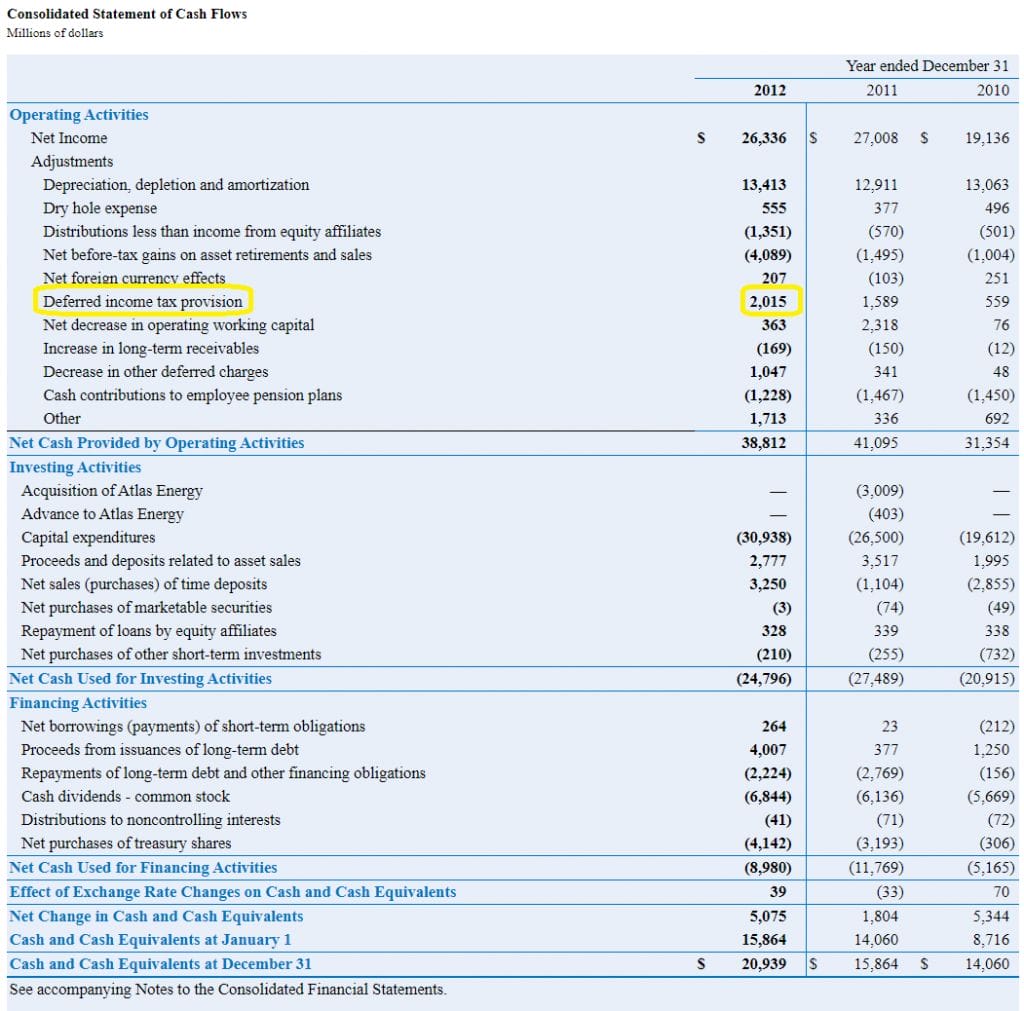

Pajak tangguhan (deferred tax) pajak tangguhan adalah beban pajak (deferred tax expense) atau manfaat pajak (deferred tax income) yang akan. On the balance sheet, an increase in deferred tax liabilities or a decrease in deferred tax assets would reduce net assets, all else equal. The balance sheet, the income statement, and the cash flow statement.

Here positive results will mean creation of deferred tax liability and negative results will mean. Firstly, we will be discussing items of assets side of balance sheet. A deferred tax asset represents a reduction in future tax liability and is reported on the balance sheet.

Deferred tax (dt) the tax effect due to the timing differences is termed as deferred tax which literally refers to the taxes postponed. A deferred tax asset is an item in a company balance sheet that can get reduced as taxable income in the future. Deferred tax asset in balance sheet.

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)