Underrated Ideas Of Info About Accounts Receivable Debit Or Credit On Trial Balance

The unpaid balances represent customer debt and are recognized as an asset for the business.

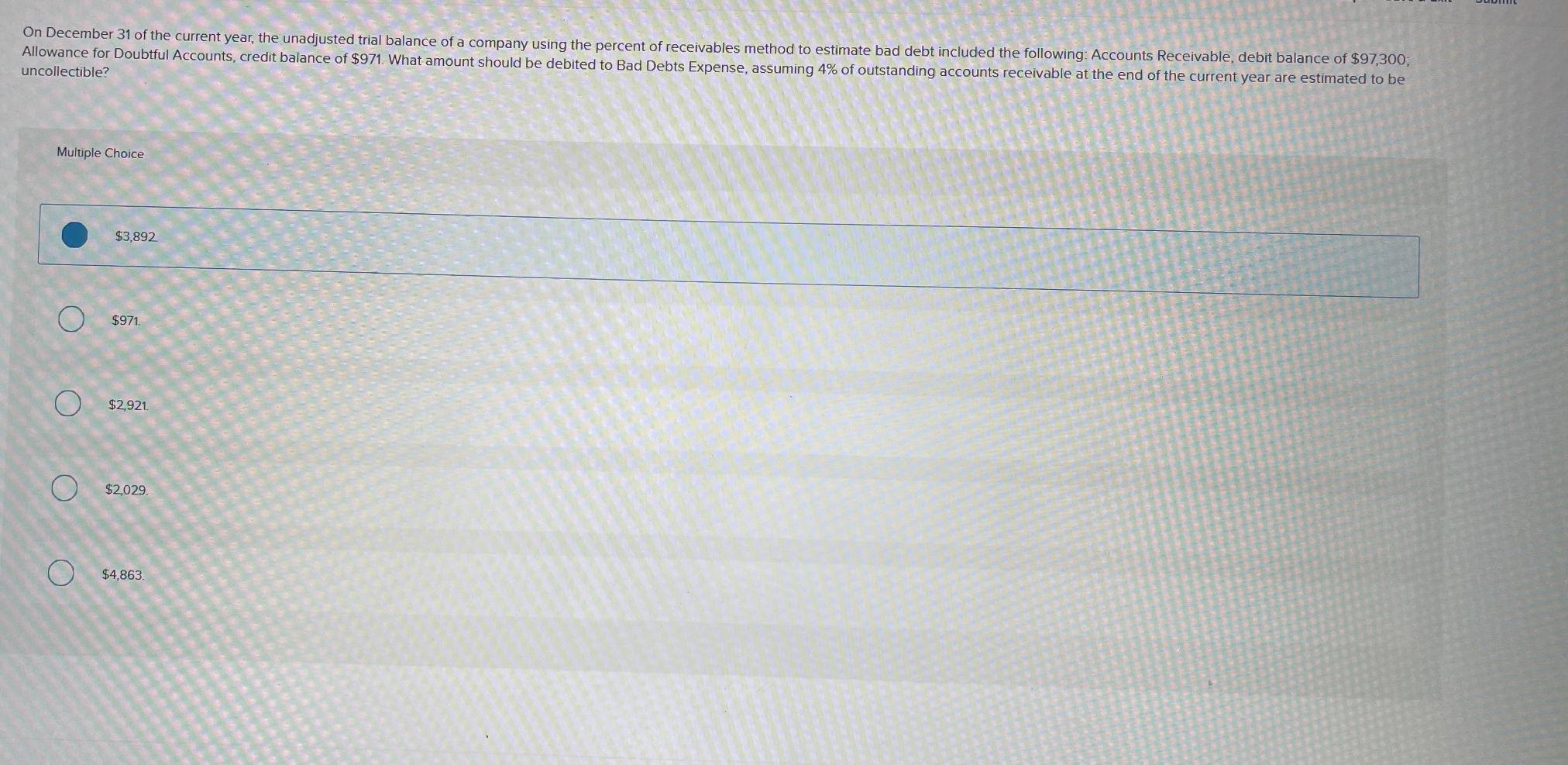

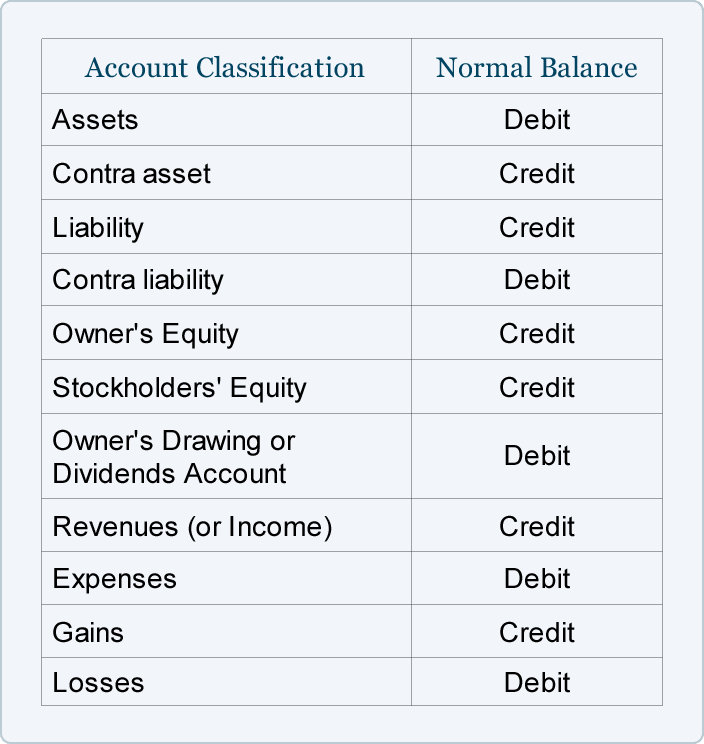

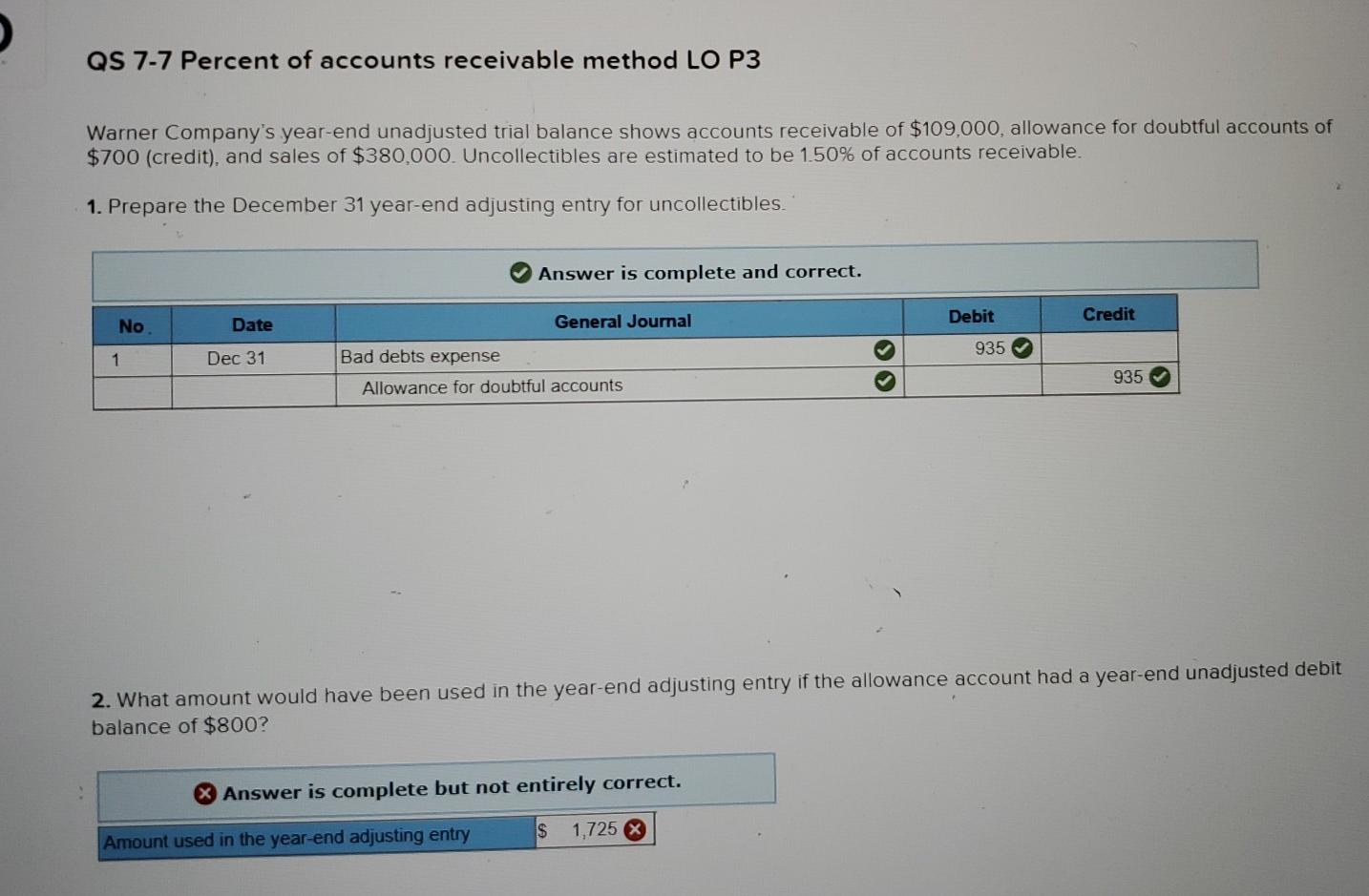

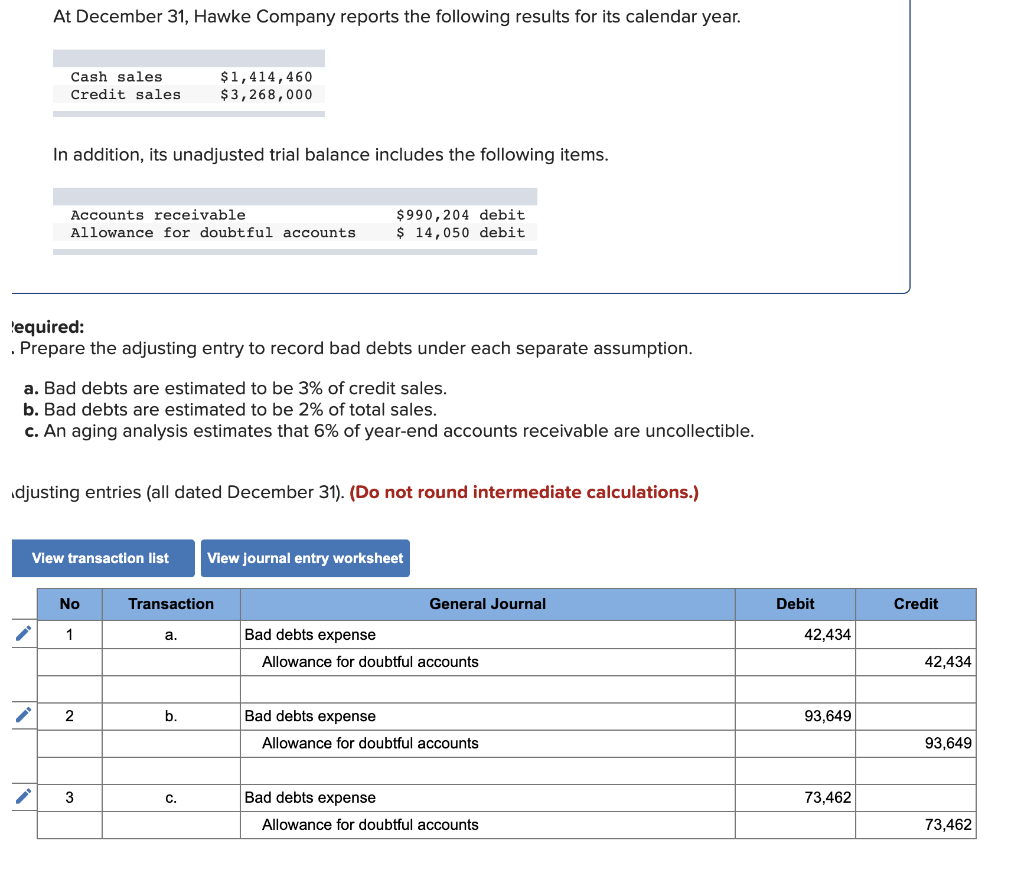

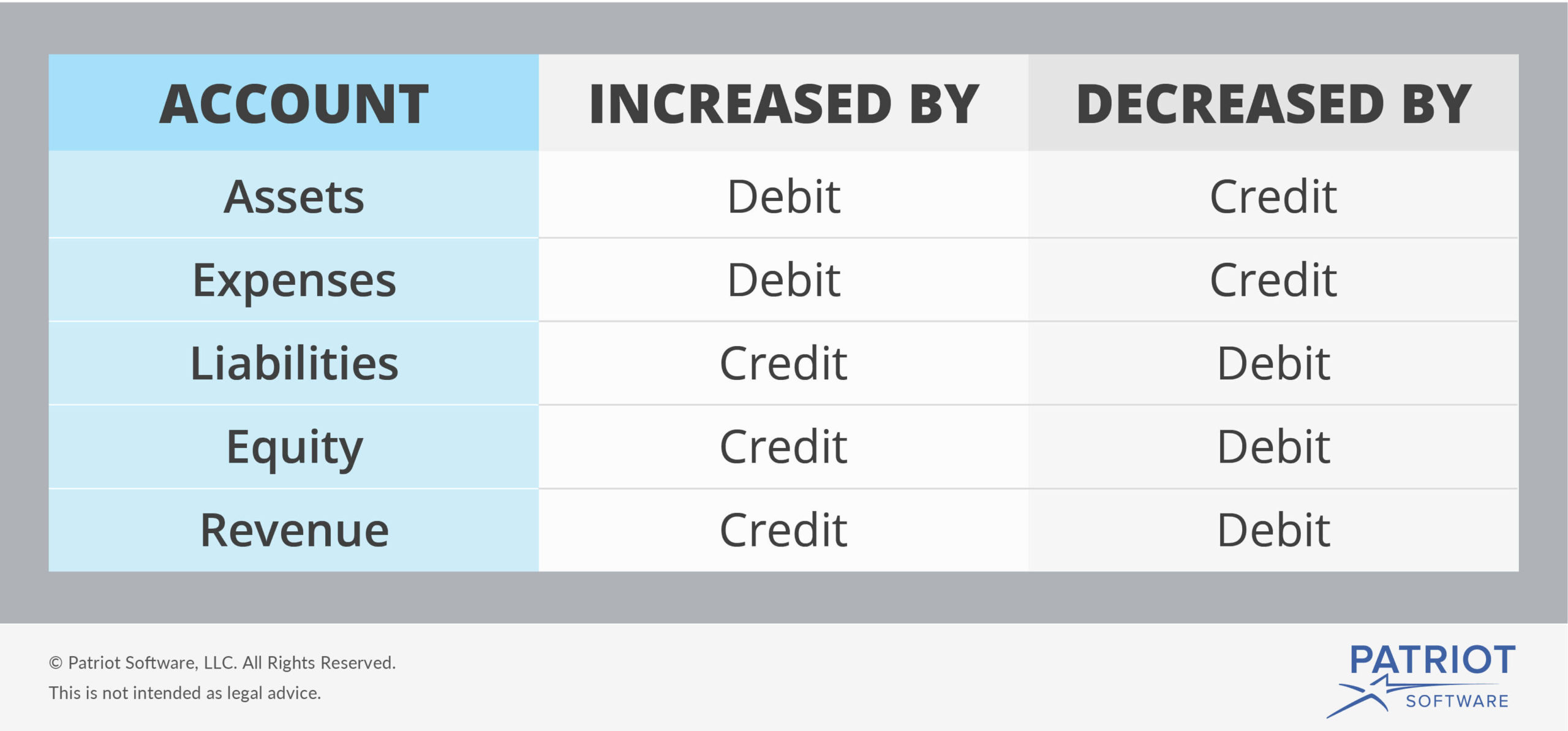

Accounts receivable debit or credit on trial balance. Once the customer has paid, you’ll credit accounts receivable and debit your cash account, since the money is now in your bank and no longer owed to you. Debits refer to an increase or addition of assets or expenses, while credits refer to a decrease or subtraction of liabilities, assets, or income. The normal balance of any account is the balance (debit or credit) which you would expect the account have, and is governed by the accounting equation.

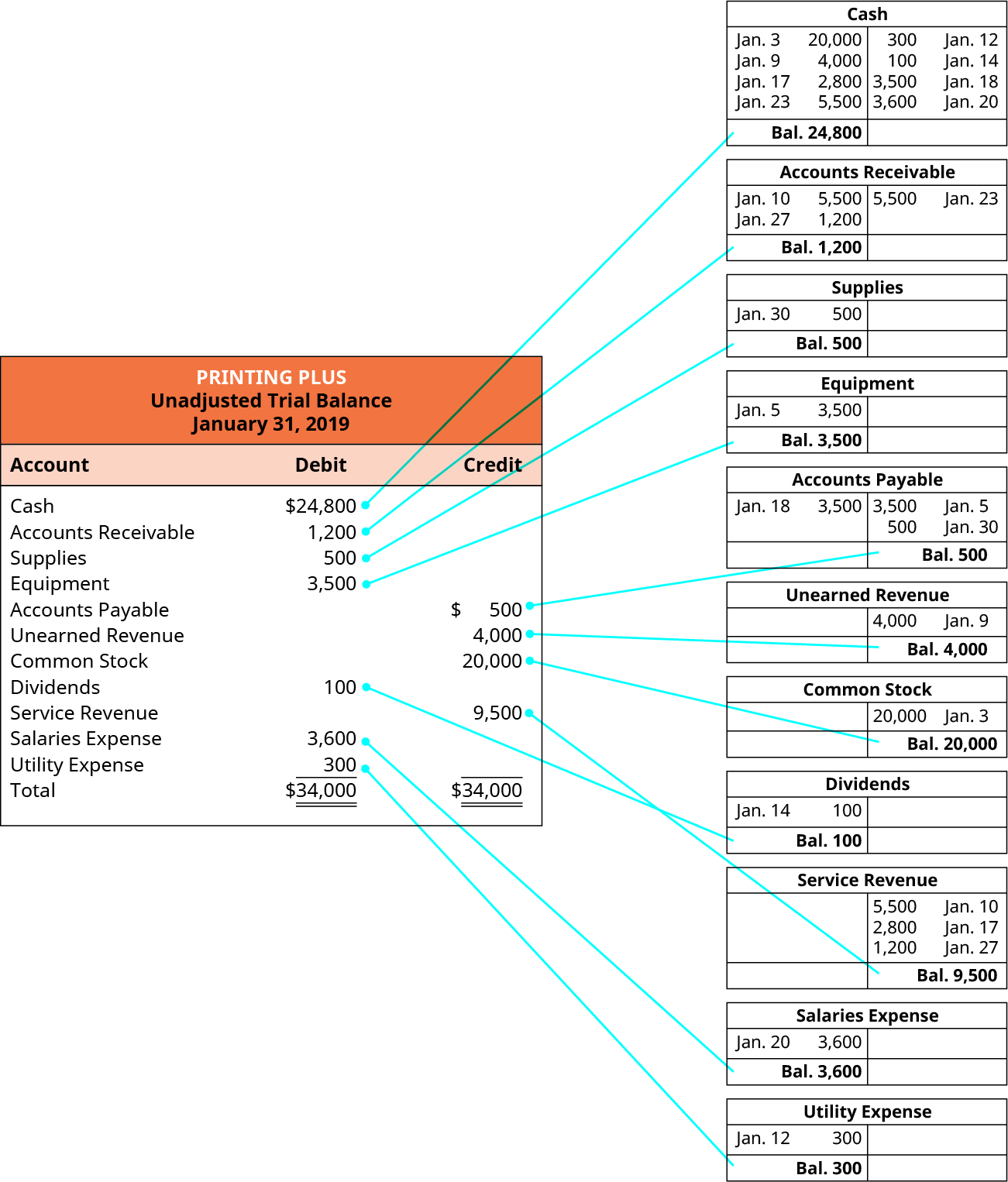

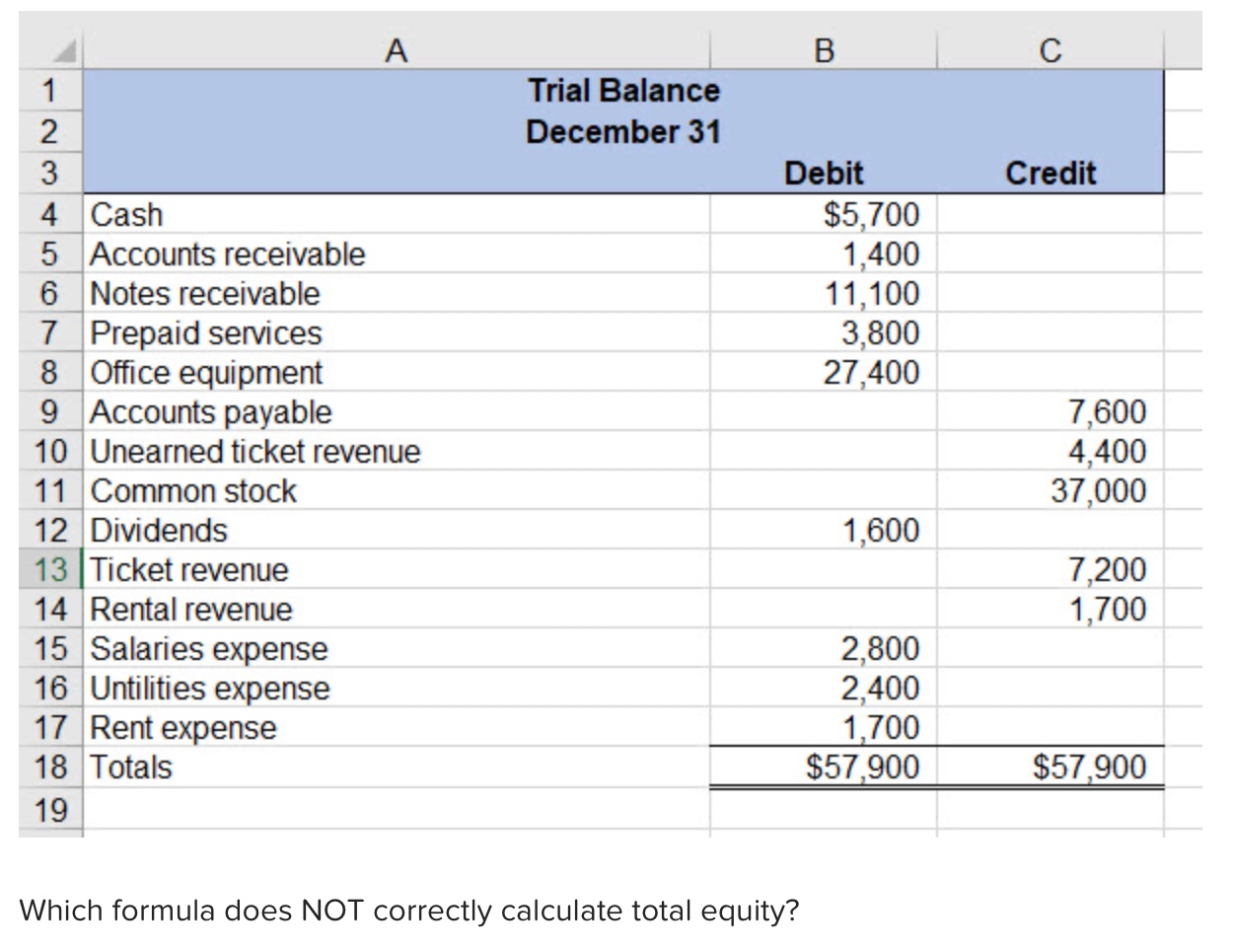

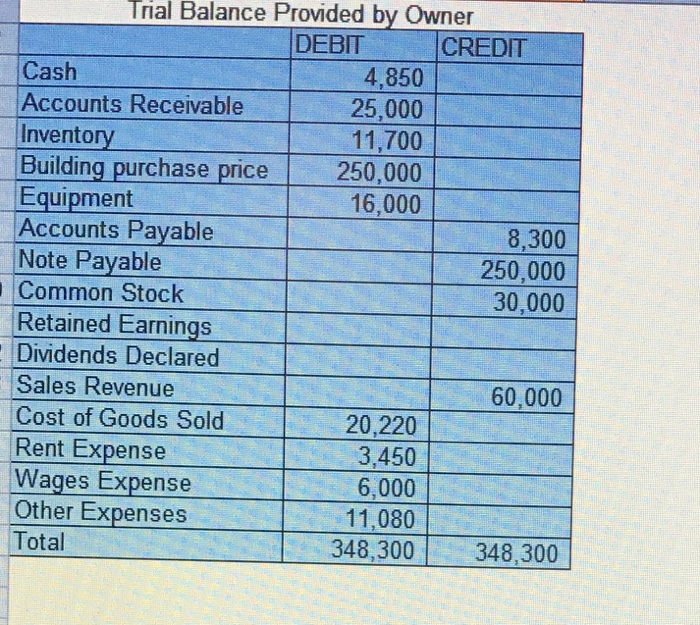

Accounts receivable as a debit. Since assets are on the left side of the accounting equation, the asset account accounts receivable is expected to have a debit balance. Each of the accounts in a trial balance extracted from the bookkeeping ledgers will either show a debit or a credit balance.

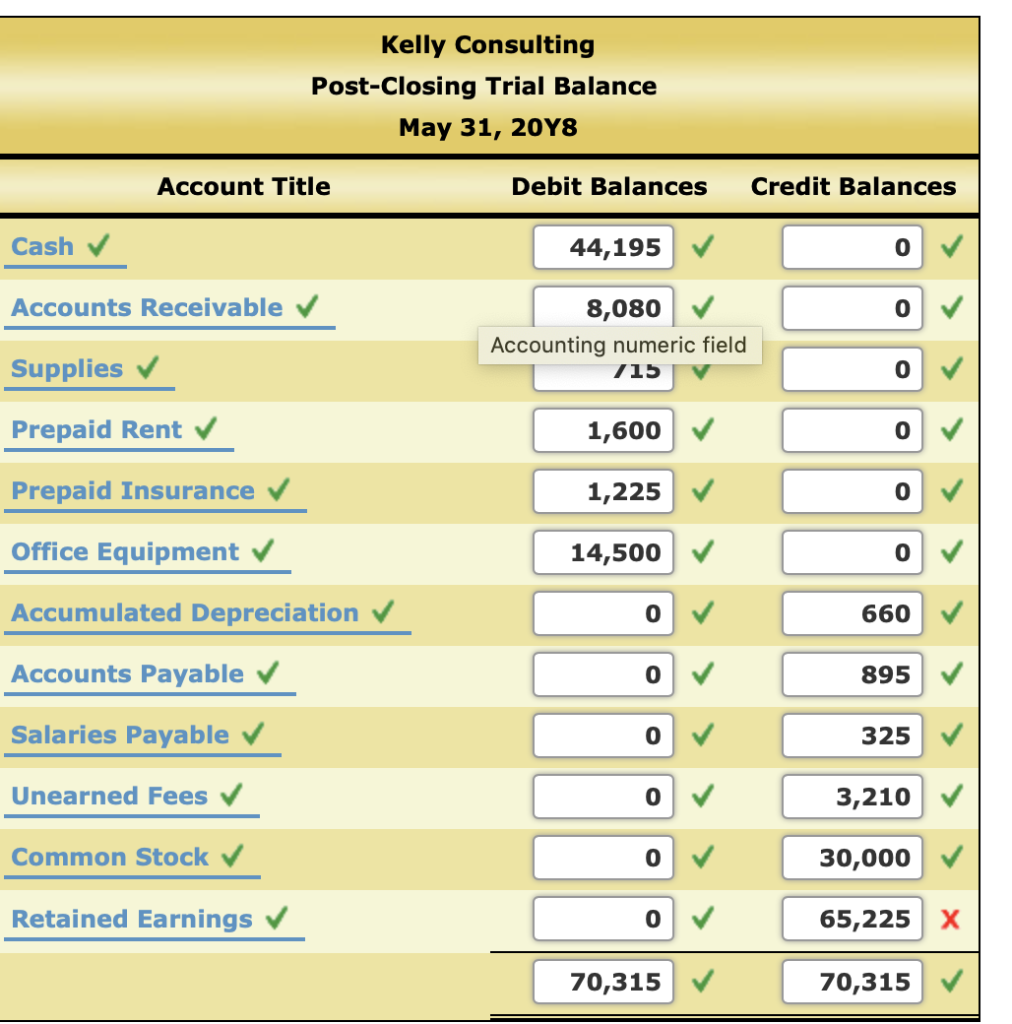

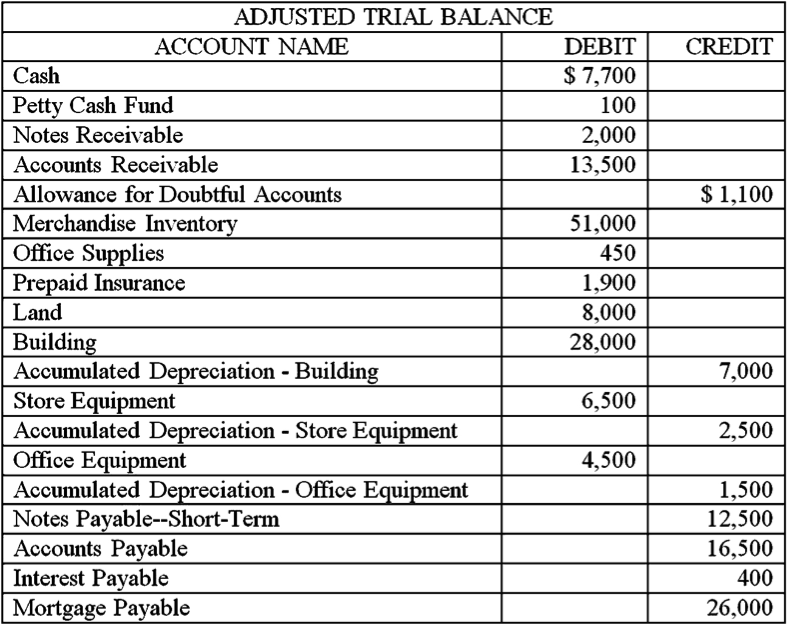

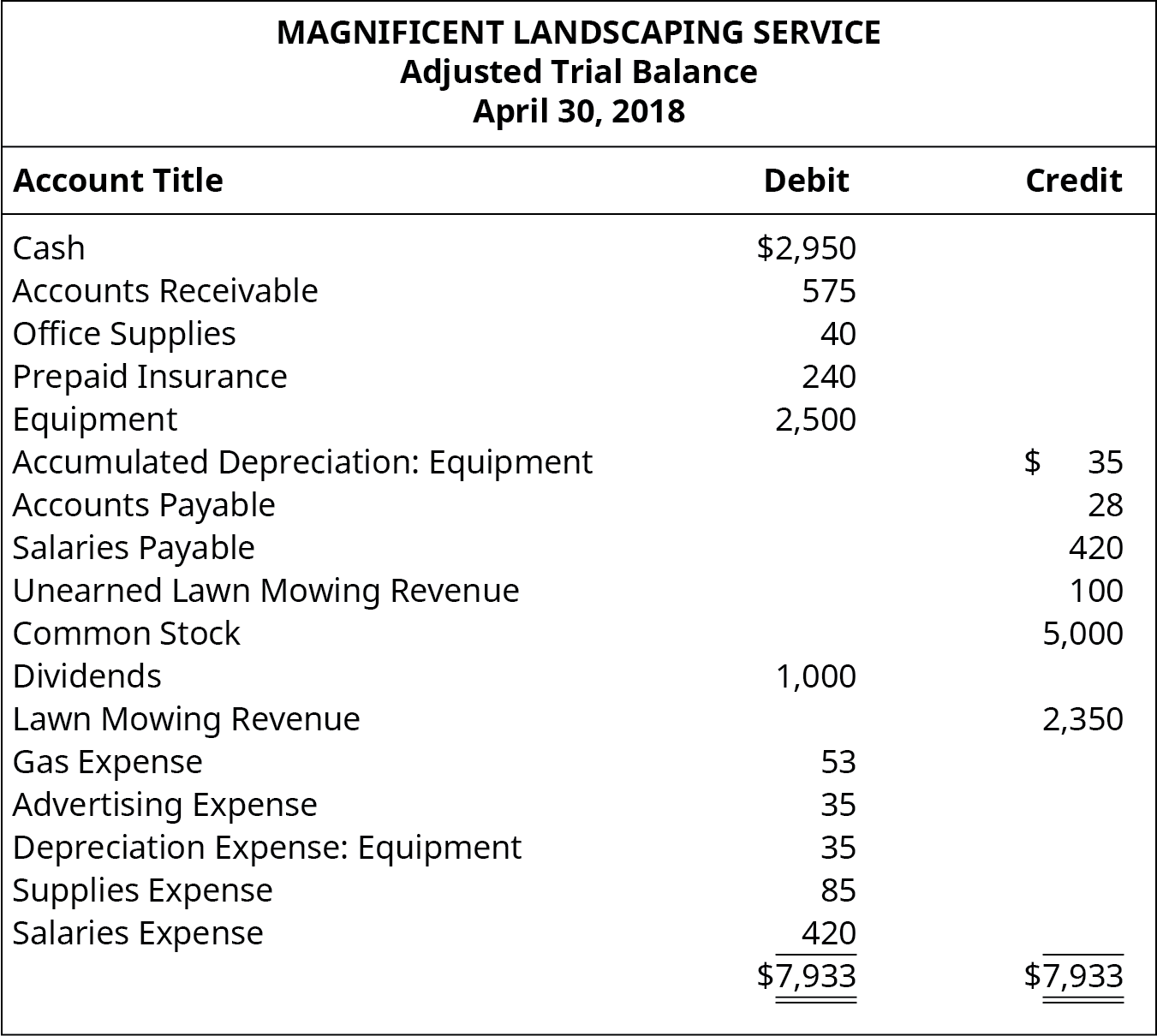

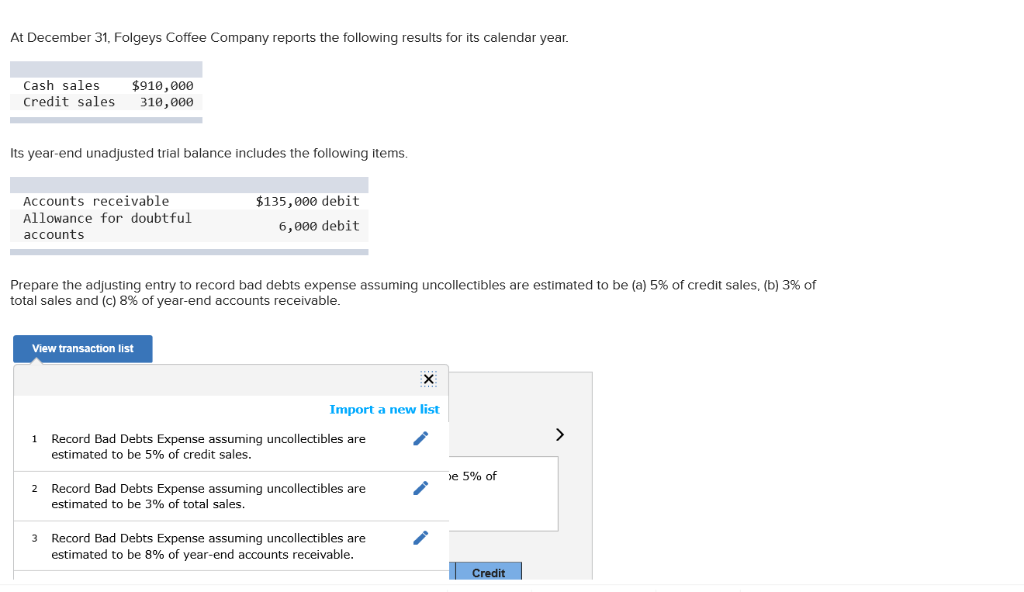

The debit balance in accounts receivable is increased with a debit to accounts receivable for $2,000. For example, cash and accounts receivable, net of the allowance for doubtful accounts, typically have a debit balance, and the accounts payable account typically has a credit balance. Refresh the general ledger tab to ensure proper posting of jes.

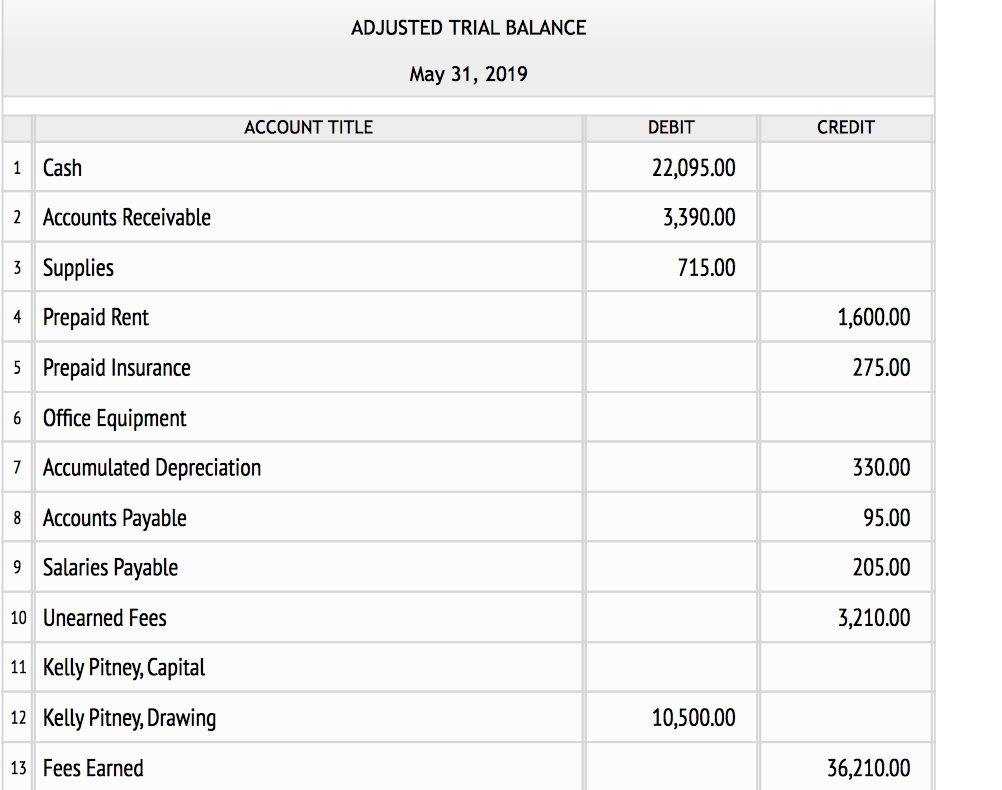

On a trial balance, accounts receivable is a debit until the customer pays. Accounts receivable is a debit.answer:accounts receivable is an asset and therefore maintains a debit balance. Although accounts receivable, net of the allowance for doubtful accounts has a debit balance, the accounts receivable balance sheet account.

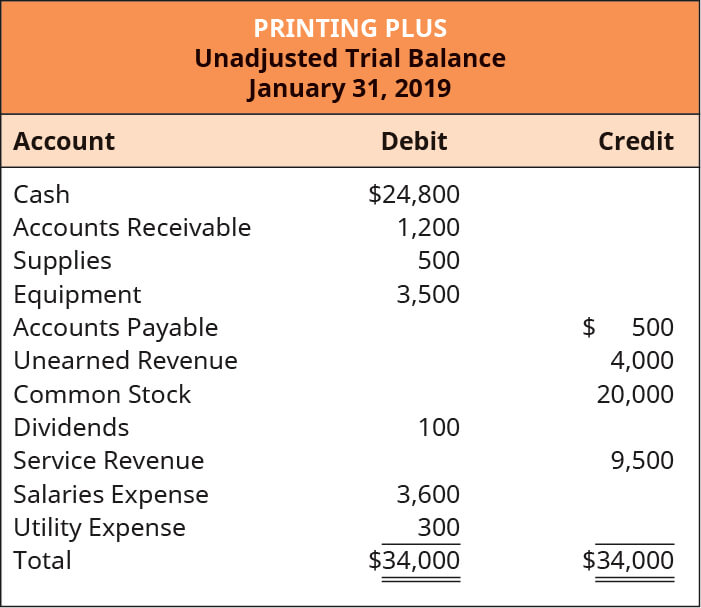

Therefore, it is a debit balance because its money due will be received soon and benefit from when it arrives. However, there are times when credit balances occur in accounts receivable, such that your ar account has more money than it should. A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct.

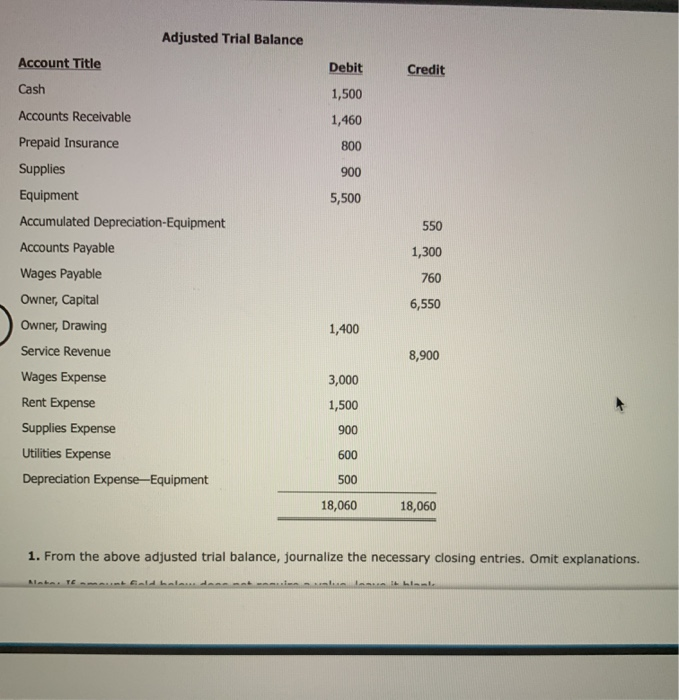

The other part of the entry involves the owner's capital account, which is part of the owner's equity. This can happen for a variety of reasons, including: Credit (cr) → revenue account:

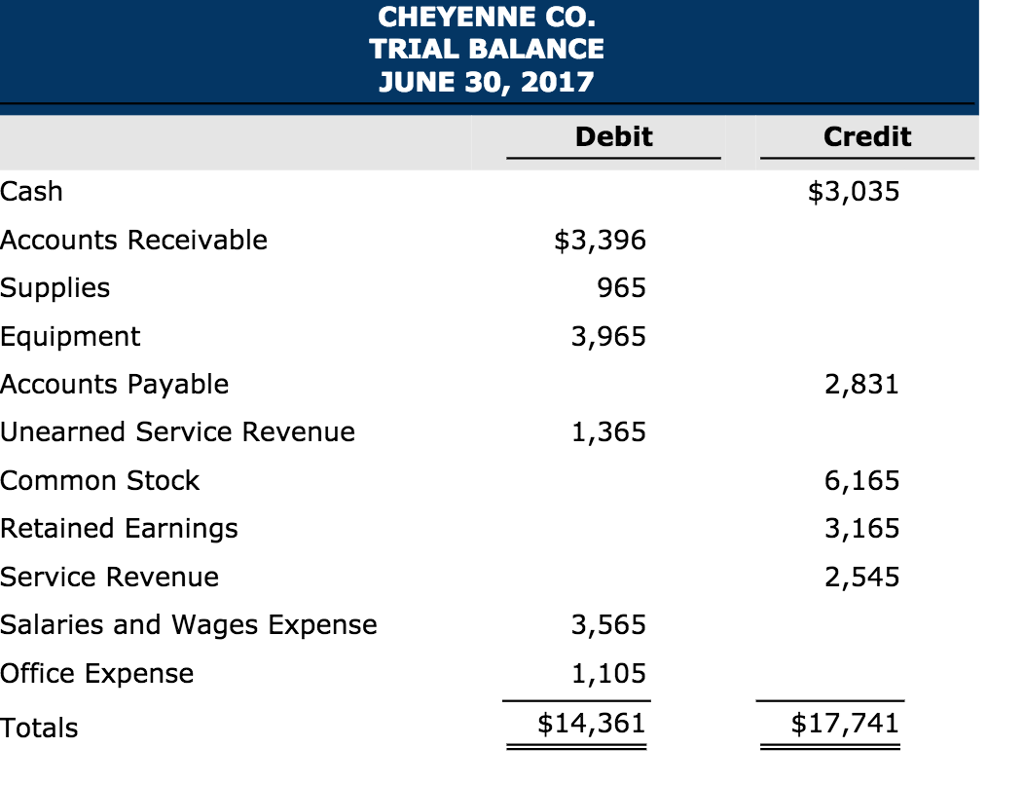

For example, a ltd sold goods to b ltd. Accounts receivable carries a debit status on the trial balance sheet. It is a statement prepared at a certain period to check the arithmetic accuracy of the accounts (i.e., whether they are mathematically correct and balanced).

By maintaining a precise record, businesses can effectively manage cash flow. The debits and credits include all. In other words, a debit is an entry on the left side of your accounting ledger, and a credit is on the right.

As we now know, accounts receivables are debits, so typically your ar account will indicate money owed to you. The term trial balance refers to the total of all the general ledger balances. In other words, a trial balance shows a summary of how much cash, accounts receivable, supplies, and all other accounts the company has after the posting process.

The company's accountant records the invoice amount—$1,000—as a debit, or dr, in the accounts receivables section of the balance sheet, because that is an asset account. Are accounts receivable a debit or credit? The journal entry reflects that the supplier recognized the transaction as revenue because the product was delivered, but is waiting to receive the cash payment.