Have A Info About Unrealized Gains On Income Statement

You are free to use this image o your.

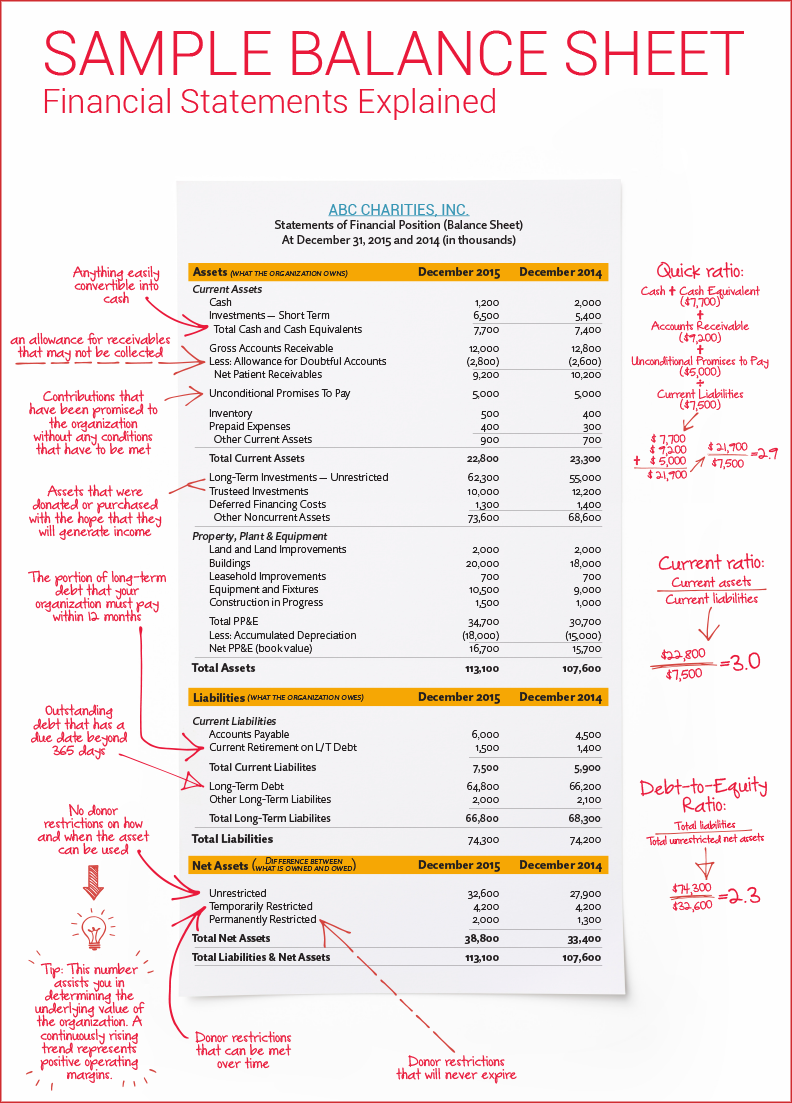

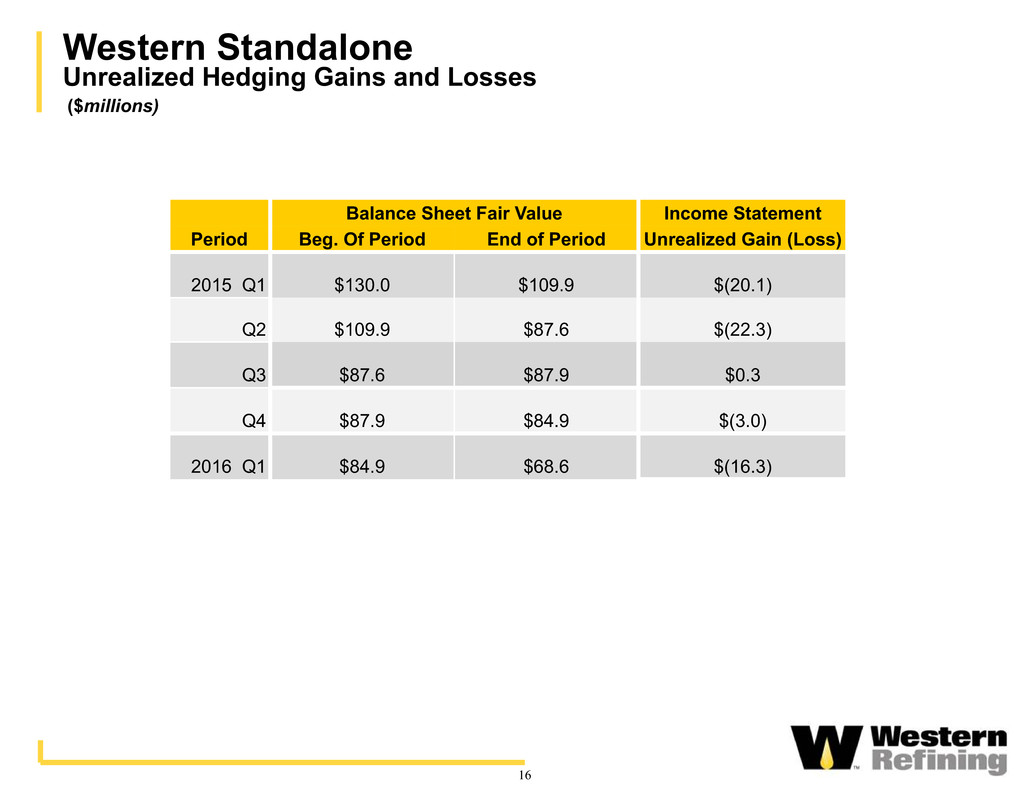

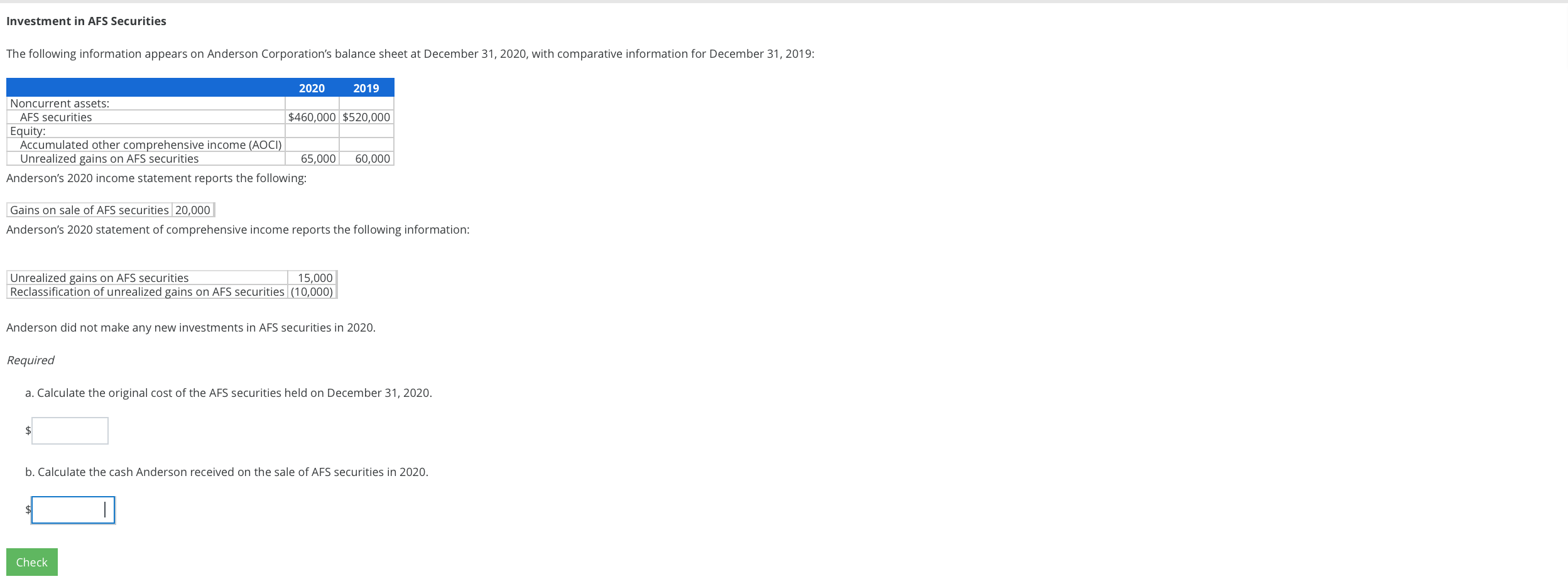

Unrealized gains on income statement. An unrealized loss is a paper loss that results from holding an asset that has decreased in price, but not yet selling it. It is the increase or decrease in the value of. Unlike realized gains and losses that are reported on the income statement, unrealized transactions are usually reported in the statement of.

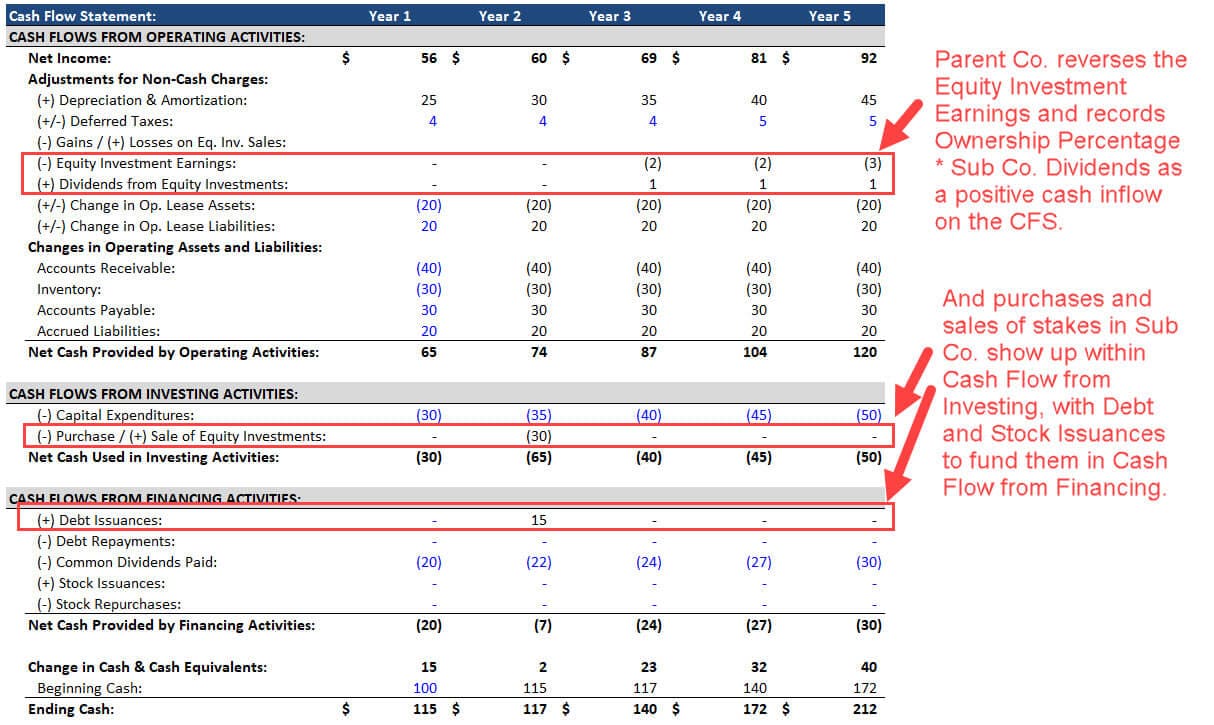

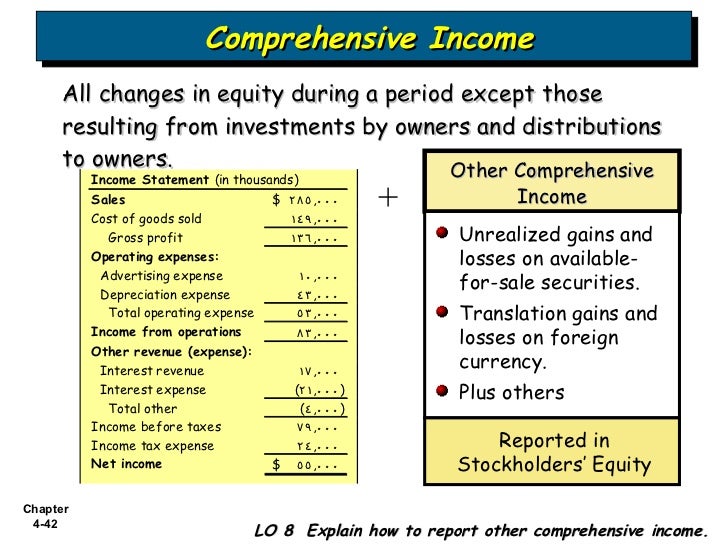

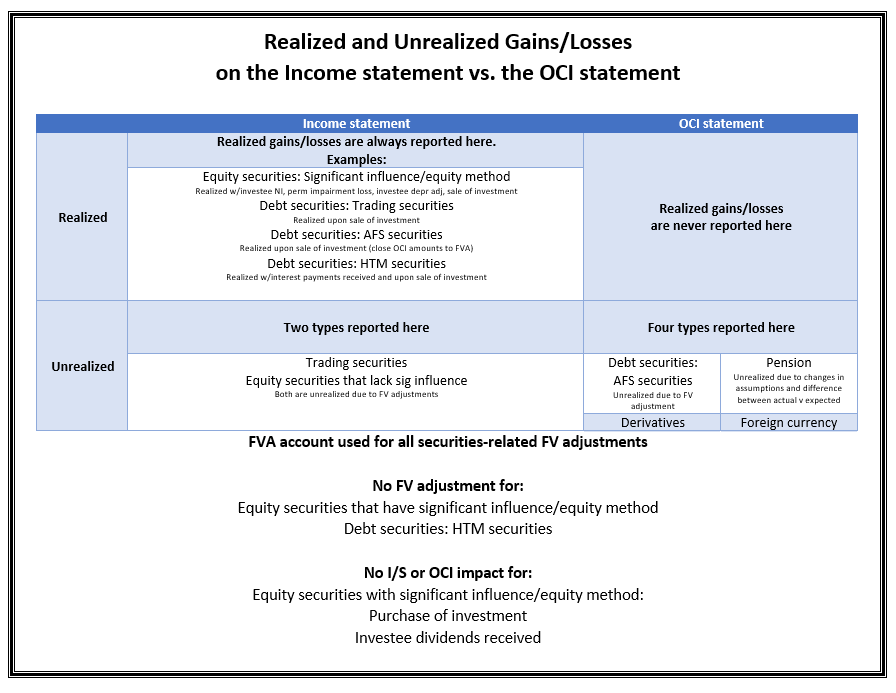

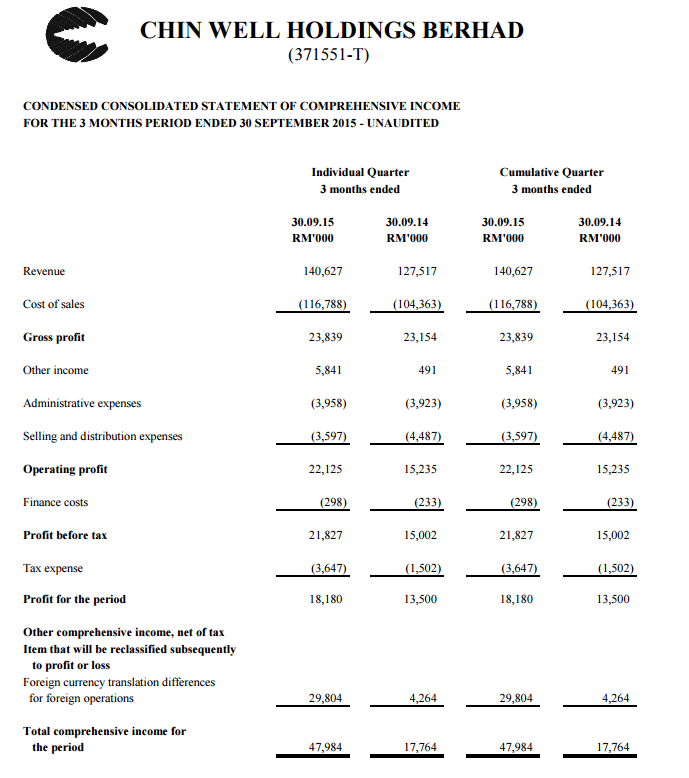

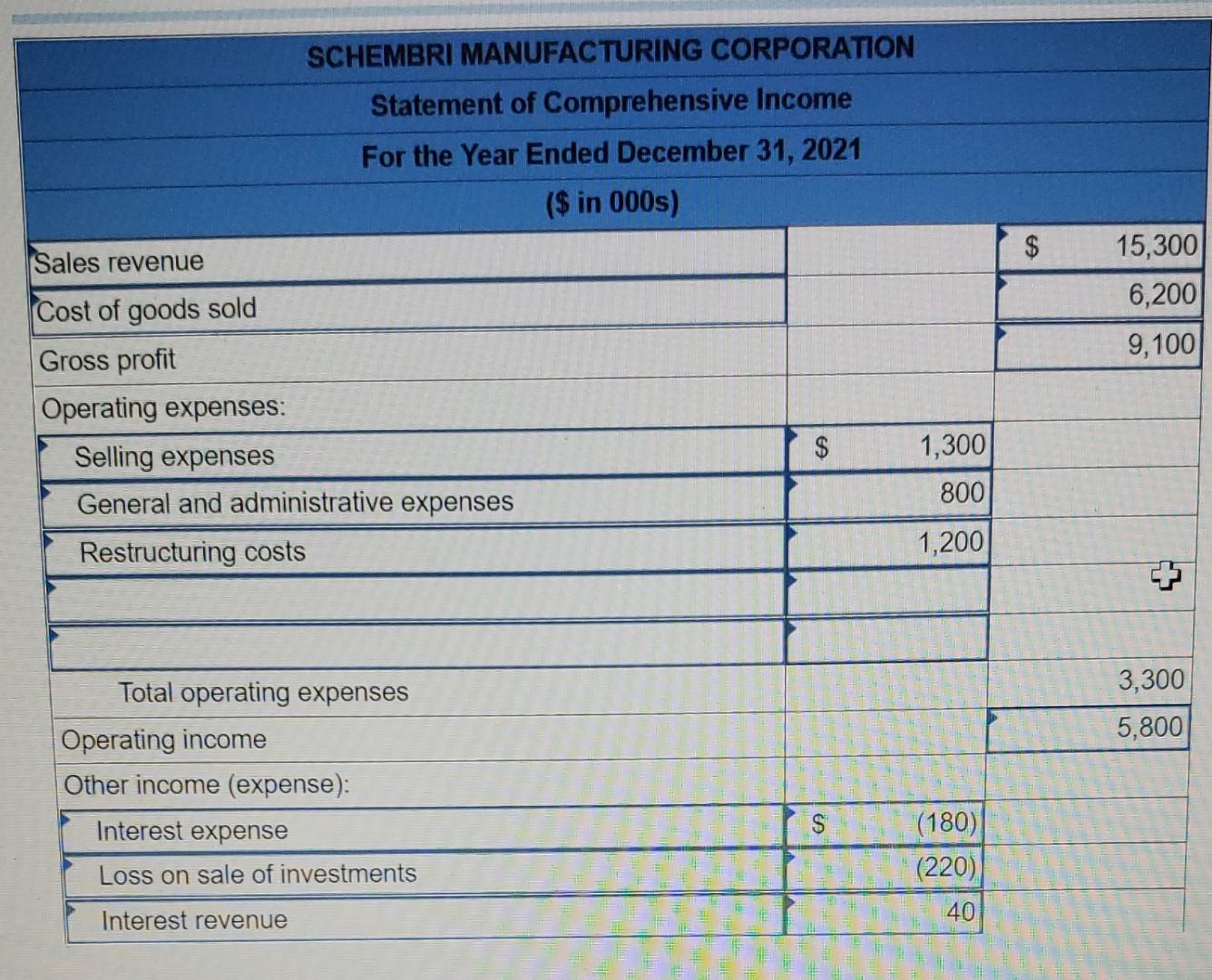

Gains and losses are reported on the income statement. Including unrealized gains in net income could potentially lead to misleading financial statements, as it would inflate a company’s profitability without any. The statement of comprehensive income is a financial statement that summarizes both standard net income and other comprehensive income (oci).

January 30, 2021 what we’ll cover: Although there are no measurement issues related to recording unrealized gains and losses in comprehensive net income, some analysts and investors wonder if. Unrealized gain is an income statement category reserved for investment income that a company expects to receive in the future.

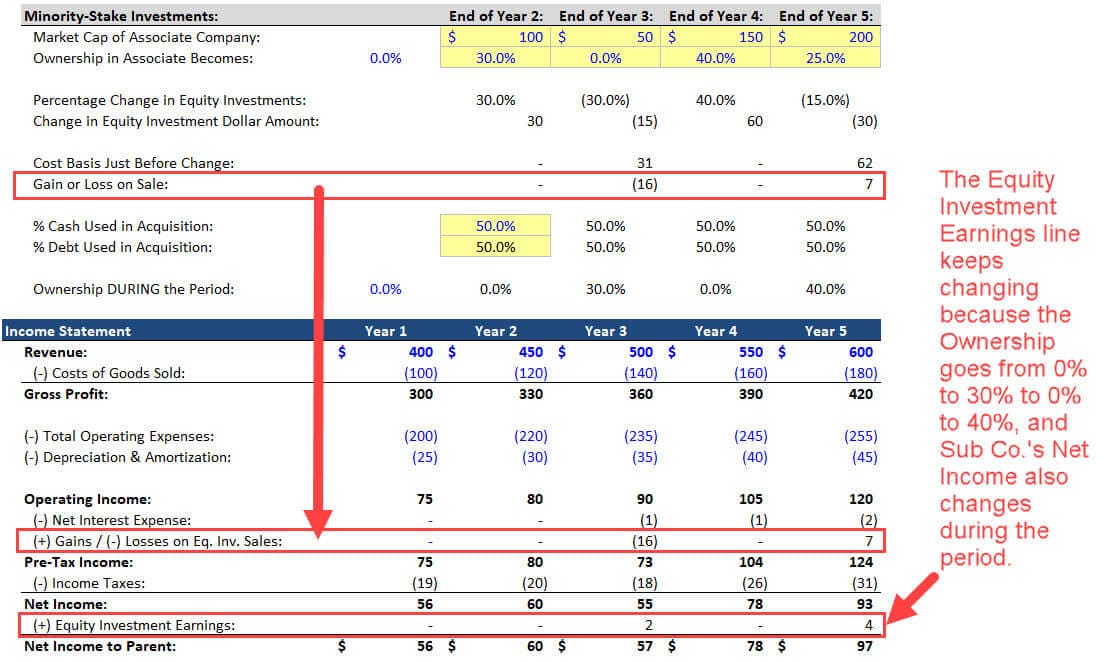

In this journal entry, the unrealized gain of $20,000 will be recorded to the income statement as other revenues as this unrealized gain comes from the trading securities. What is an unrealized gain in an income statement? The net income is the.

Unrealized gains occur when the market value of a security increases but has not yet been sold. Instead of affecting operating income, unrealized gains and losses are recorded in the other comprehensive income account. However, since they are not transactions that normally occur in.

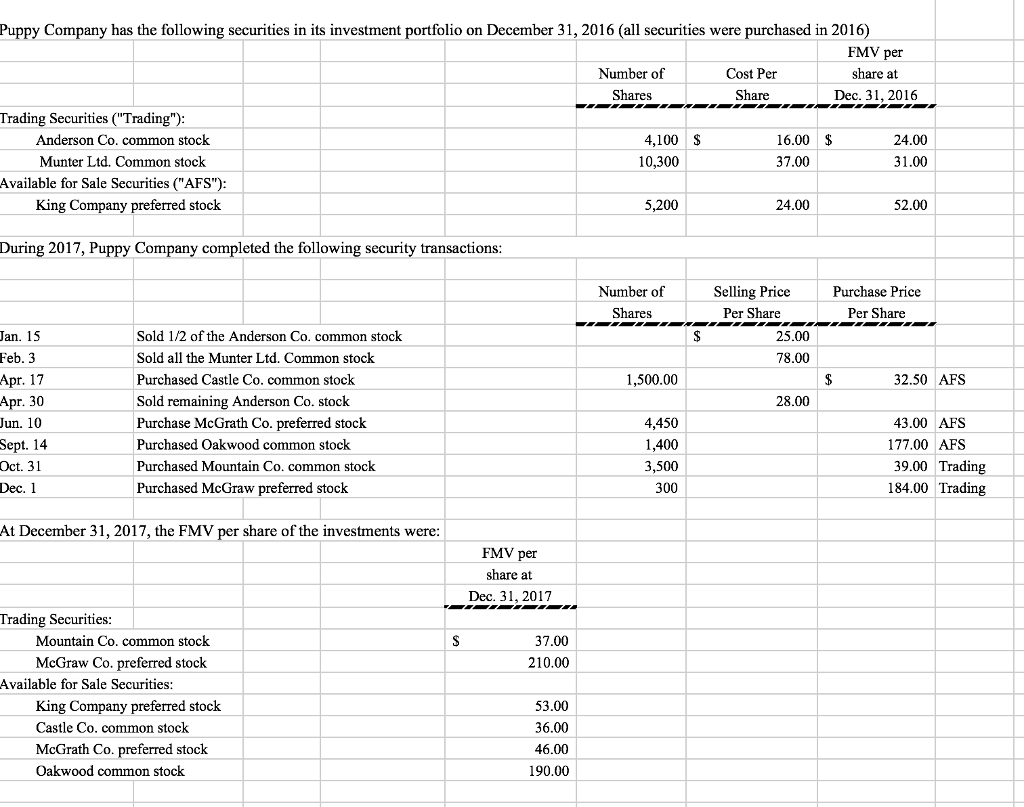

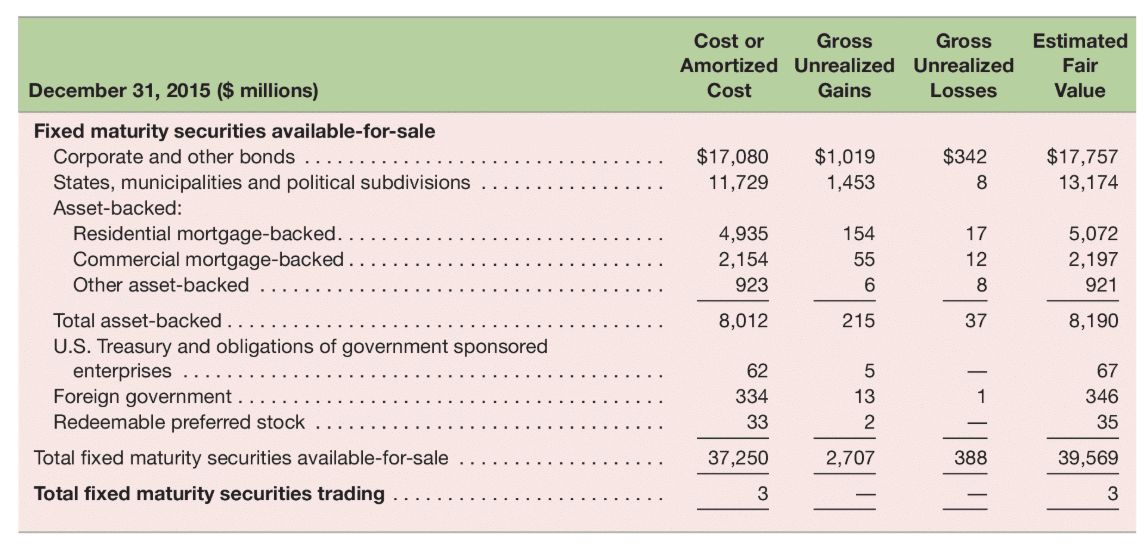

The accounting treatment depends on whether the securities are classified into three types, which are given below. The gains and losses you see in your portfolio are. An unrealized (paper) gain, on the other hand, is one that has not been realized yet.

An unrealized gain or loss is a capability of a business to have profit or loss on paper, which results from an investment. If you have an unrealized gain or loss from an investment, you record the. Investing realized vs.

For example, unrealized holding gains and losses on equity securities, trading securities, and securities for which the fair value option has been elected are typically classified as. For example, if company x determines that its. Net income attributable to uber technologies, inc.

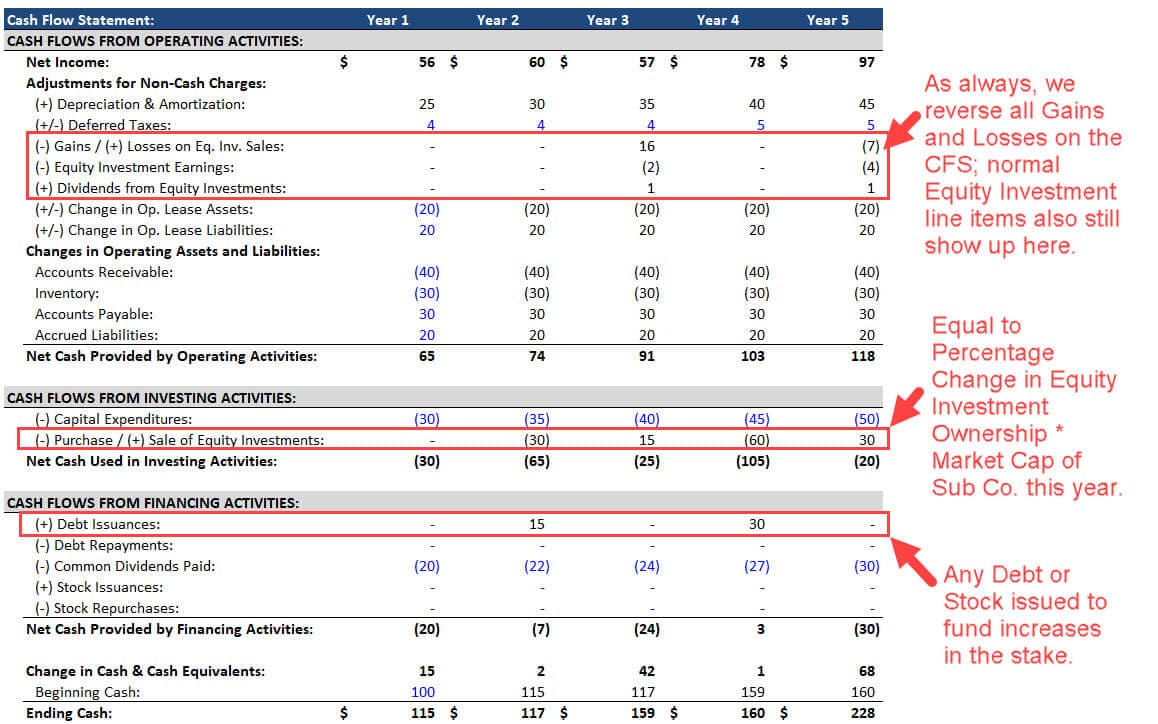

Analysis applies this standard definition of effective tax. Income statement net income (section vii) $ 309 $ 221 $ 723 $ 159 adjustments to reconcile net income to income available. Unrealized income can be unrealized gains or losses on, for example, hedge/derivative financial instruments and foreign currency transaction gains or losses.

These unrealized gains are not recognized in the income. Once they are sold the gain or loss. Chip stapleton what is an unrealized loss?

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

![Held for Trading HFT/AFS Securities Company Investment Portfolios [Guide]](https://eor7ztmv4pb.exactdn.com/wp-content/uploads/2020/12/table-description-automatically-generated-9.png?strip=all&lossy=1&ssl=1)