Wonderful Info About Treatment Of Unrealised Profit

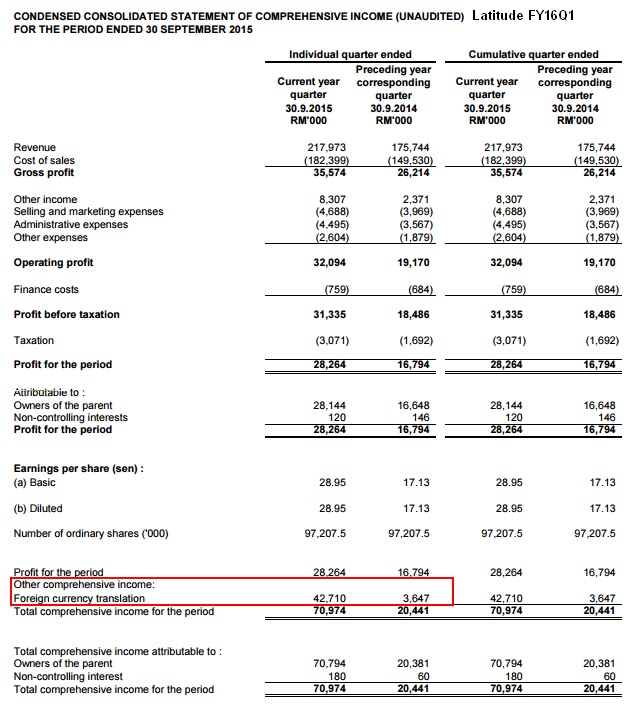

Unrealised gains are therefore not part of the ecb’s result for the year, and consequently also not part of the distributable profit.

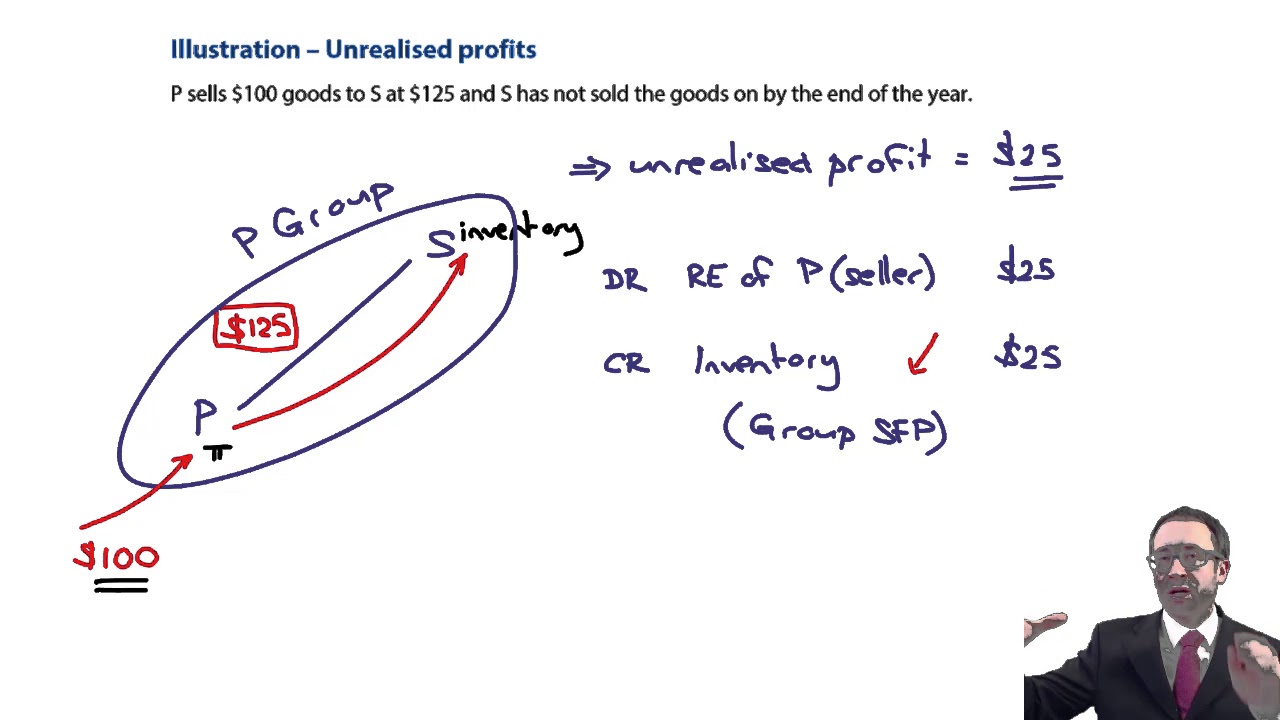

Treatment of unrealised profit. The idea of what we need to do. Inventories 2,880 to recognise cost of goods sold to customers. S sells 4/5 of them to 3rd parties.

S sells 4/5 of them to 3rd parties. The unrealised profit is: Unrealised gains and losses on revaluation of assets;

Zero) which will be carried forward on the ecb’s. How do we then deal with unrealised profit if p buys goods for 100 and sells. The exposure draft proposes to clarify when unrealised profits and losses on transactions between an investor and an associate should be fully recognised:

Unrealized gains are recorded on. The accounting adjusting entries for nci require for those transactions which have the following. It is a consolidation adjustment arising when when.

Calculating unrealised profit on inventory is a consolidation adjustment. Clearly you accept the necessity of eliminating the group’s share of any unrealised profit arising from a transaction between a group company and an. Thereby making a profit of 50 by selling to another group company.

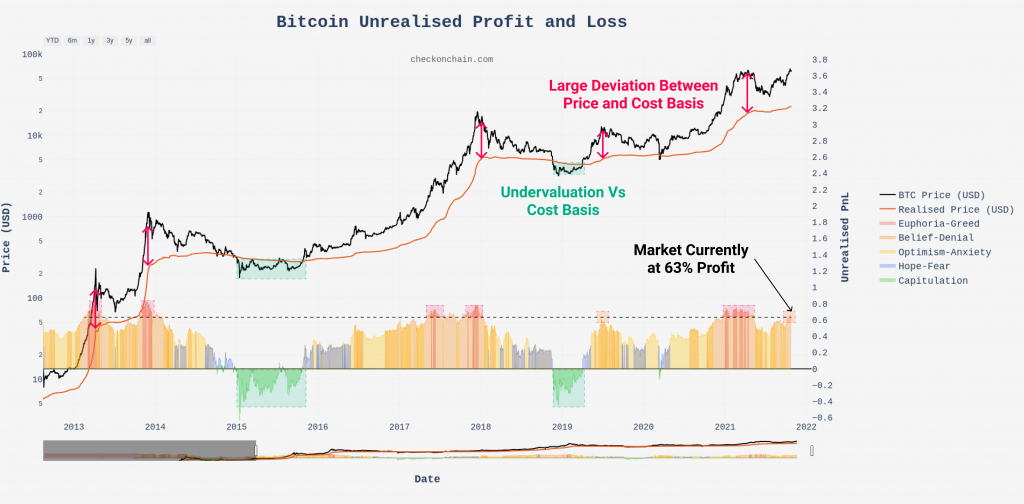

The profit for the year is, of course, the figure in the profit and loss. It is the difference between the market value of an investment and the cost to acquire it. An unrealized gain is an increase in the value of an asset or investment that an investor has not sold, such as an open stock position.

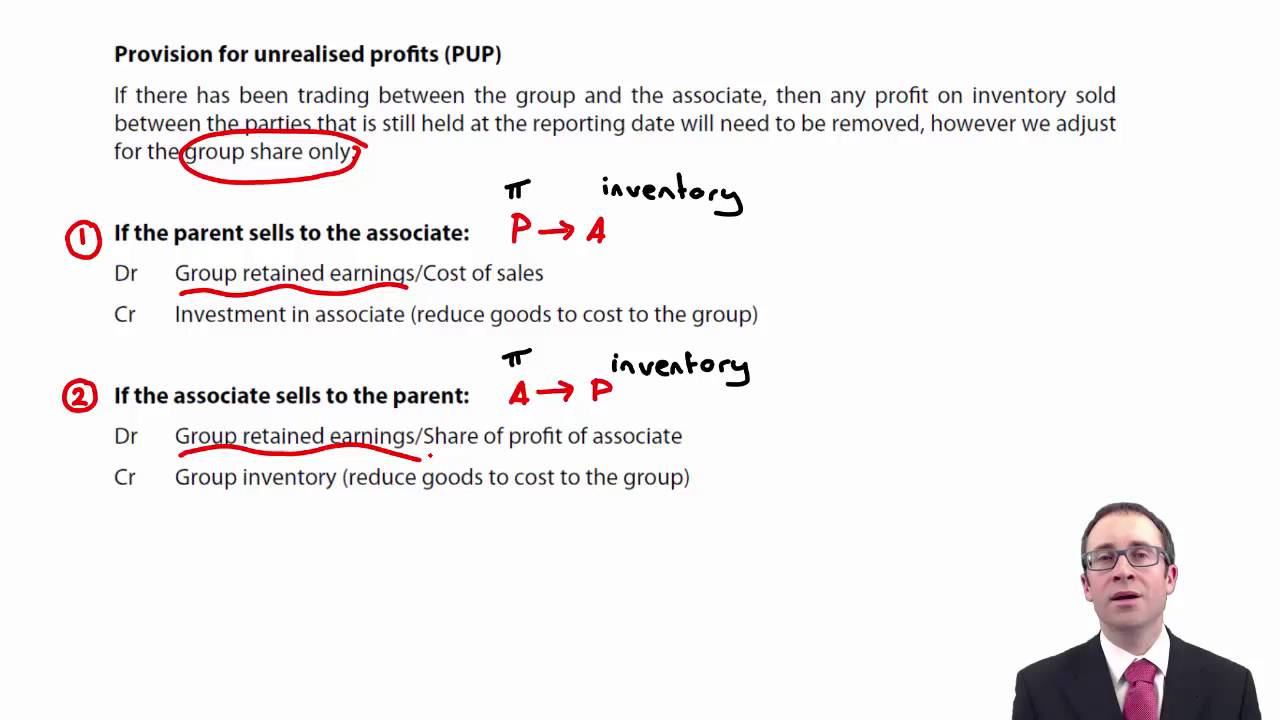

The net approach says that, whereas the parent has recognised the unrealised profit of $8,000, as each of the four years go by, an appropriate proportion. The european central bank’s (ecb’s) audited financial statements for 2023 show a loss of €1,266 million (2022: Adjustments for unrealised profits another common adjustment that you could be asked to deal with is the removal of unrealised profit.

The private power producer made a profit of tk 221 crore in the year. Meaning 2.8f distributions in kind: Profit between group companies 50 x 3/5 (what remains in stock) = 30.

An unrealized, or paper gain or loss is a theoretical profit or deficit that exists on balance, resulting from an investment that has not yet been sold for cash. The idea of what we need to do. An unrealized loss is a.

Provision for unrealised profit as far as consolidation of financial statements is concerned is explained. Thereby making a profit of 50 by selling to another group company. An unrealized gain is a theoretical profit that exists on paper, resulting from an investment that has not yet been sold for cash.