Awesome Info About Purchase Of Equipment Cash Flow

Property, plant, and equipment (pp&e) refers to a company’s tangible fixed assets that are expected to provide positive economic benefits over the long term (> 12 months).

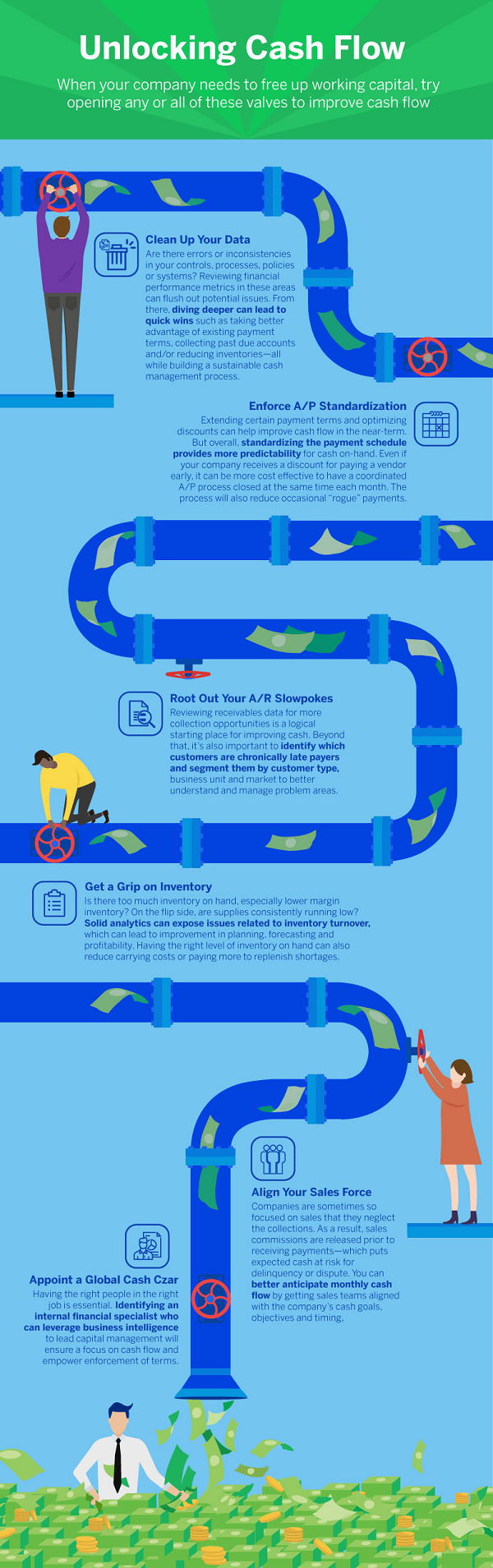

Purchase of equipment cash flow. There were no other transactions in may. Cash flow from financing activities is cash earned or spent in the course of financing your company with loans, lines of credit, or owner’s equity. Cash flow from investing activities is cash earned or spent from investments your company makes, such as purchasing equipment or investing in other companies.

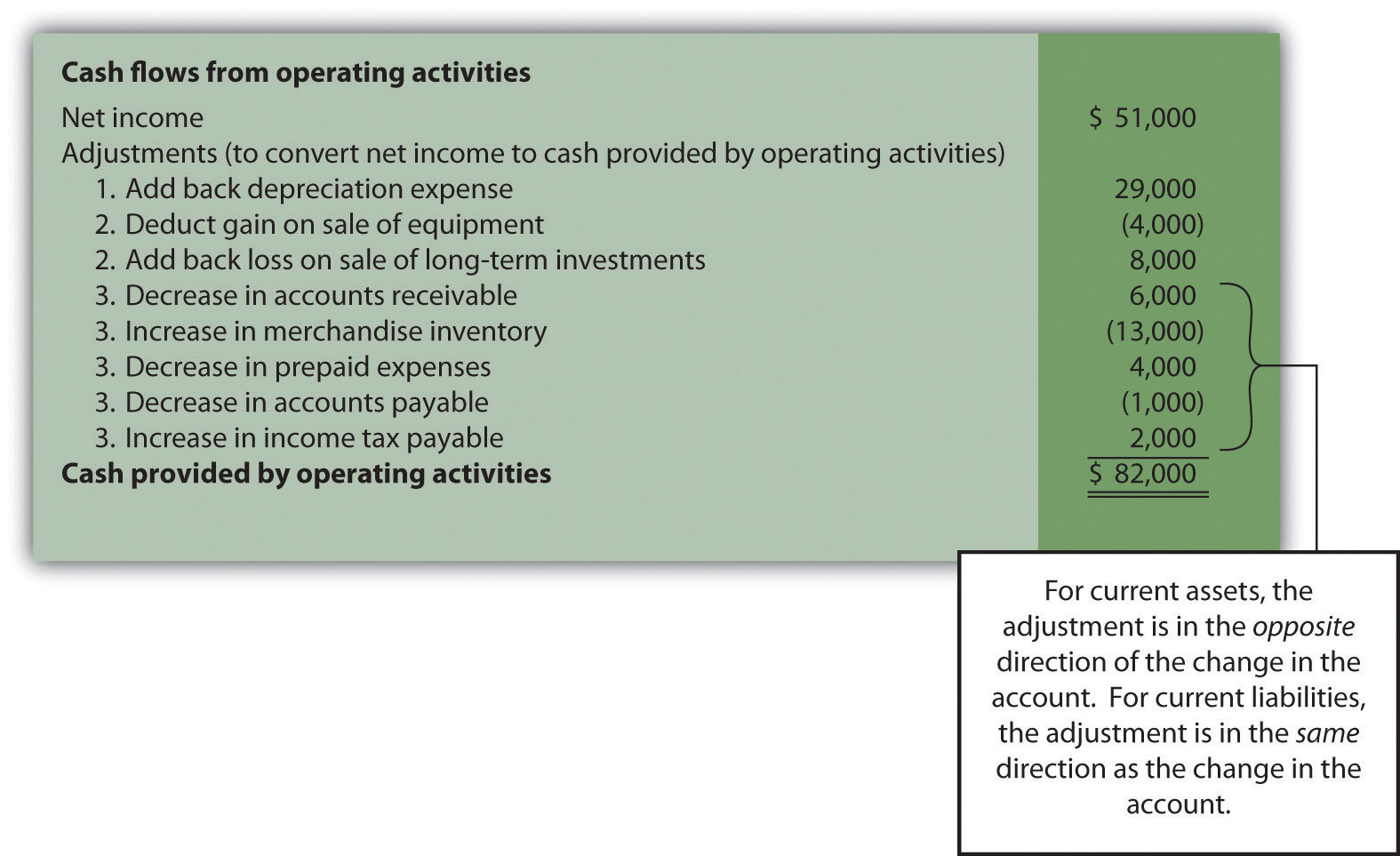

Begin with net income from the income statement. Add back noncash expenses, such as depreciation, amortization, and depletion. On may 30 good deal pays its accounts payable of $150.

It is typically listed under a line item such as “purchase of property, plant, and equipment” or. On may 31 good deal purchases office equipment (a new computer and printer) that will be used exclusively in the business. In this section of the cash flow statement, there can be a wide range of items listed and included, so it’s important to know how investing activities are handled in accounting.

The purchase will also be included in the company's capital expenditures that are reported on the statement of cash flows in the section entitled cash flows from. Proceeds from the sale of pp&e Once completed, these activities are then reported on a company’s cash flow statement.

Instead, record an asset purchase entry on your business balance sheet and cash flow statement. A large corporation often has 10 or more adjustments to convert the amount of net income to the amount of cash. The statement of cash flows is prepared by following these steps:

Cash flow from investing activities refers to cash inflow and outflow of cash from investing in assets (including intangibles), purchasing of assets like property, plant and equipment, shares, debt, and from sale proceeds of assets or disposal of shares/debt or redemption of investments like a collection from loans advanced or debt issued. Purchase of a fixed asset: The purchase of equipment is reported as a negative amount (cash outflow) in the investing activities section of the statement of cash flows.

Common cash flow calculations include the tax paid, which is an operating activity cash out flow, the payment to buy property plant and equipment (ppe) which is an investing activity cash out flow and dividends paid, which is a financing activity cash out flow. In the case of example corporation, the section cash flows from operating income begins with the company's net income for the year: This can include the purchase of a building, the sale of equipment, or investing in stocks.

The cash paid for the purchase of equipment during the year is $27,000, and the proceeds from the sale of equipment during the year are $16,750 (= $9,500 cost +. The cost of the office equipment is $1,100 and is paid in cash. The purchase of equipment appears as a cash outflow under cash flow from investing activities.

Also called capital expenditures or cash equivalent, this cash outflow includes the purchase of any property, plant, or equipment your company makes (and the sale of these items would be a cash inflow). The input that will cause this change to be reflected in a three statement model will most likely be located on the pp&e schedule under “capital expenditures.”. Common cash flow calculations include the tax paid (which is an operating activity cash outflow), the payment to buy property, plant and equipment (ppe) (which is an investing activity cash outflow), and dividends paid (which is a financing activity cash outflow).

Payments for acquisition of property, plant, and equipment payments for purchase of debt instruments of other entities payments for purchase of equity instruments of other entities sales/. Purchase of property plant, and equipment (pp&e), also known as capital expenditures; Determine net cash flows from operating activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)